Do you want to know how to work remotely from Spain? This guide is your passport to making that dream into a sun-soaked reality! We’ll cover remote workers with employers or clients in the USA, UK, and Europe. The guide covers everything from navigating immigration laws to understanding tax implications. Whether you’re a digital nomad or a professional yearning for a change, working remotely from Spain will feel as seamless as a Mediterranean sunset. Dive in, and let’s explore how you can make Spain’s vibrant streets and serene beaches your new office!

7 Aspects to Explore for Remote Workers Moving to Spain

- Remote Work Visa and Residency Requirements

- Tax Implications for Remote Workers in Spain

- Healthcare and Insurance Requirements

- Cost of Living vs Salary and How to Budget

- Banking and Finances

- The Best Places in Spain for Remote Workers

- Timezones and Work Habits

Best Remote Work Visa For Spain

Spanish Digital Nomad Visa for Remote Workers

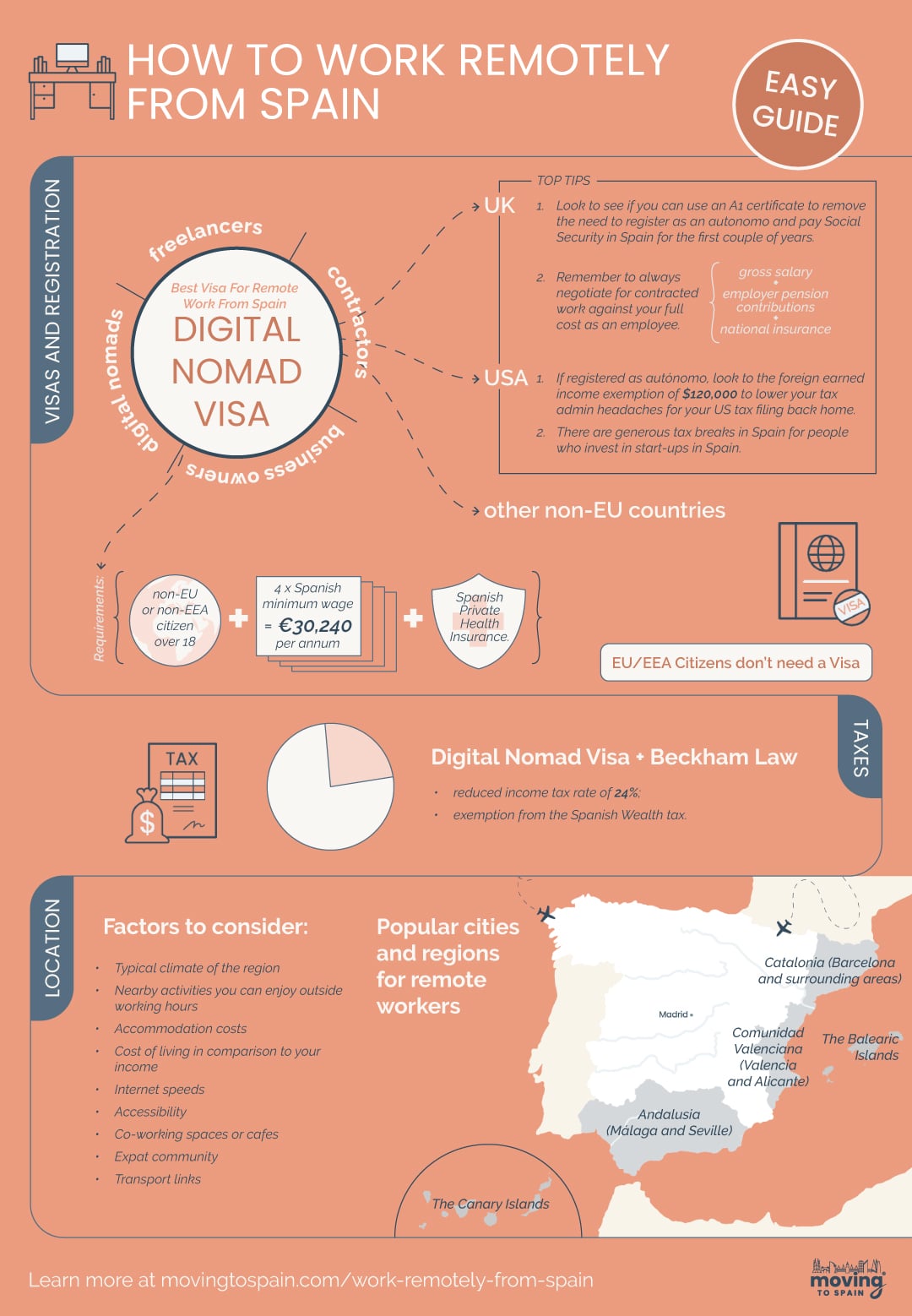

The excellent Spanish Digital Nomad Visa is the best visa for working remotely in Spain. It’s open to digital nomads, self-employed business owners, remote workers employed by non-Spanish companies, and freelancers earning 80% of their income outside Spain. Any non-European Union or non-EEA citizen over 18 is able to apply.

The 2024 income requirement for the visa is based on 400% x Spanish minimum wage, so you’ll need to earn more than €31,752 per annum to qualify. You’ll also need to have Spanish Private Health Insurance.

Important: If you work for a US company, you must be on a contract, not a direct employee, to use this visa type. Direct employees of US companies will need to work for a Spanish entity of their US company. For more details see Working Remotely in Spain for a US Company: Your Complete Guide 2025.

Tax savings: If you work in Spain on a Digital Nomad visa, you could get an awesome tax break. You may be eligible to apply for special tax rates under the Beckham Law in Spain.

You can also use a different Spanish work visa, depending on your employment situation, and you can move to Spain without a visa if you are an EU citizen.

Note: You can enter Spain on a tourist visa and then apply for the Digital Nomad / Remote Work visa once you are in the country.

The Non-Lucrative Visa

The Spanish Non-Lucrative Visa specifically excludes working in Spain. Remote work and freelancing are included in this restriction. The requirements for the visa are passive income (investments, pensions, annuities, etc) and not income earned from work. Some people work remotely in Spain using non-lucrative immigration status, but they are breaking the law. You’ll risk having your visa canceled if you are discovered working in Spain.

Residency in Spain for Remote Workers

Once you move to Spain, you must register as a resident. The exact process depends on your nationality, immigration status, and where you live in Spain. See our guide to sort out your NIE, TIE, and padrón to finalize your Spanish residency.

Tax Implications for Remote Workers in Spain

Expat taxation in Spain can be complicated. The first step is to establish your financial residence. Generally, if you live in Spain for more than 183 days per year, you’ll be a tax resident of Spain. If you are a contractor or freelancer, you’ll most likely establish a legal entity as an autónomo. As an autónomo, you’ll be responsible for paying your taxes and social security in Spain.

You can work in Spain as a direct employee if you are employed by a company registered in the EU, EEA, UK, or Russia. You’ll need to get an A1 or S1 certificate that shows you are paying social security (or national insurance in the UK), and so are exempt from these payments in Spain. The simplest taxation path is to apply for a “no tax” tax code so your employer does not withhold tax. But remember, you are responsible for declaring all your income and paying Spanish income tax. The alternative is to offset any tax your employee withholds in your Spanish tax return – double taxation treaties mean you won’t pay tax twice on the same income.

You may be taxed as a non-resident with a Digital Nomad Visa or as a direct employee of a Spanish entity. This means you may pay a reduced income tax rate of 24% and are exempt from the Spanish Wealth tax. Expanding the Beckham Law to include remote workers means they are taxed at non-resident income tax rates (IRNR). This income tax rate is much lower than the progressive rates for most people earning sufficient to qualify for the visa.

Note: Our Spanish cross-border taxation specialist partner can assist with setting up your autónomo and planning the most effective tax strategy. They’ll also help with preparing and submitting your Spanish tax return.

Another factor to consider is Spain’s wealth tax levied on your global assets.

Warning: You may need to pay social security and income tax in Spain. The amount you pay depends on how much you earn. It does add up, but you get a lot of benefits you’ll use in your daily life in return.

Banking

As a remote worker in Spain, you may need multi-currency accounts and receive payments in non-euro currency. Setting up accounts to keep costs low can make a big difference to your take-home pay at the end of the month. And you’ll want to avoid bank fees in your home country, so we recommend opening a Spanish bank account. Find the best banks in Spain for Expats and explore how to open a bank account in Spain.

Also, see our guide to the best international money transfer services to avoid fees and get the best exchange rates when moving money.

Health Insurance for Remote Workers in Spain

Remote workers planning to live in Spain will need health insurance, either public or private. The type of cover you can get will depend on your nationality, immigration status, and employment status.

Private Health Insurance

Most Expats in Spain have some form of private health insurance. For most, it is a requirement for their visa and residency. For others, it offers greater choice and access to care in your language.

See our guide to Private Health Insurance in Spain for more details.

Important: The Spanish immigration service has very specific requirements for qualifying medical insurance. Your cover must be fully comprehensive without co-payments, the policy must be immediate, and it must include any pre-existing conditions. You can use our easy tool to get three qualifying healthcare quotes from excellent companies.

Public Healthcare

You’ll be eligible for public healthcare if you pay social security in Spain (or have an equivalence certificate). The Spanish public healthcare system is excellent, and even Expats with private coverage often use selected public services.

Working Remotely In Spain For A UK company

Working remotely for a UK company while living in Spain provides the best of both worlds. You get to work a high-paying job (wages in the UK are typically higher than in Spain) while also benefiting from the better weather, more laid-back lifestyle, and lower cost of living in Spain.

Top tax tips for Brits working remotely in Spain.

We asked our Taxation Specialist partner, Louis, for his top two tips:

1. If you are under a UK employment contract, look to see if you can use an A1 certificate to remove the need to register as an autonomo and pay Social Security in Spain for the first couple of years.

2. Remember to always negotiate for contracted work against your total cost as an employee. For example, your employer paid a gross salary of £50,000 GBP, £2,500 GBP in employer pension contributions, and £5,851 in National Insurance; the total is your package. Negotiate around the full cost of your employment of £58,351 a year.

What Is It Really Like Working Remotely for a UK Company? We Asked A Friend.

James, 46 years old. British Citizen.

James has worked for the same employer for 16 years. He was based in London and works for a company that does market research for UK real estate companies. His company has around 50 employees, mostly based in London. Around 80% of staff work from home at least some of the time.

James moved to Spain in 2019; he is living in Spain as the spouse of an EU citizen (as his Irish wife will happily remind anyone who asks).

- Why did you move to Spain? “With two young kids, London was very expensive and quite hectic. The things we loved about living in London before kids became a challenge. We wanted a change of pace and a more relaxed lifestyle.”

- How did you land a remote job? “I’ve been at the same company for many years, and so the conversion happened over some months. I told my boss we were thinking of a move, and they wanted me to stay with the company, so we made a plan. We agreed to a 6-month trial period which went really well. Then COVID hit, and everyone was working from home – but it made it impossible to get back to the UK for the visits we’d agreed in the plan!”

- Does it work? “Yes, it does work for me and for the company. There have been issues and frustrations (probably for both sides!), but open dialogue works wonders. I did have to think differently and be a more effective planner. Post-pandemic, being able to fly to the UK every couple of weeks cheaply also helps (thanks, Mum, for the room!). Timezones are easy, and the pandemic forced us to change ways of working in the company at a really good time for me.”

- Main Challenges: “I miss the informal chats in the office and the pub. When I do go into the office, there’s normally a list to work through and a deadline for my flight back home. We also agreed that I’d work on the UK public holiday calendar – not the Spanish one. It means I occasionally use up some annual leave days to have Spanish holidays with the kids.”

- Would You Recommend Working Remotely From Spain? “Yes, for the right person and the right employer. I can see where it could go horribly wrong if both parties aren’t doing their best to make it work. Our family life in Spain is wonderful – heading to the beach in the evenings with the kids is hard to beat! We did miss friends and family when we moved, but we soon settled into a great social scene with the kids at the center of it all.”

- Employment Status and Tax Residence: I’m a direct employee of a UK company and a tax resident in Spain. My UK payroll has “no tax” status, so I have to put aside money to cover my income tax and manage my tax return in Spain.

Your Spain Move Planning Package

No guesswork. Just expert guidance tailored to your situation. Our packages include one-on-one consultations with immigration, tax, and finance specialists—plus access to essential moving tools and direct support from Alastair and Alison.

Working Remotely In Spain For An American Company

The same goes for working remotely for an American company. If you have the correct visa, you can live anywhere in Spain while working for a US-based company. You should have an open, honest discussion with your employer as there are legal and tax considerations to understand. Because of this, some employers are hesitant to take on overseas remote workers – you may have to do some persuading.

Note: To use a Spanish Digital Nomad Visa to work remotely for an American company in Spain, you need to be a contract worker for a US company, not a direct employee—so this rules out any US W2 employees. If your US employer has a Spanish entity, you can work directly for them.

Top tax tips for Americans working remotely in Spain.

We asked our Spain/USA Taxation Specialist partner, Louis, for his top two tips:

1. If registered as autonomo, consider the foreign earned income exemption of $120,000 to lower your tax admin headaches for your US tax filing back home.

2. Deductions are nowhere near as generous as back in the US; however, there are generous tax breaks in Spain for people who invest in start-ups in Spain, with a 50% deduction from your tax bill for every € invested in Spain.

What Is It Really Like Working Remotely for a US Company? We Asked A Friend.

Jürgen, 55 years old. German Citizen.

Jürgen works for an American company headquartered in New York and lives outside Barcelona.

He works as a senior IT integration architect for a global consultancy, and has EU citizen residency in Spain. He was hired into the remote role after working on a client project with a team from his new company.

The hours suit him. He does intense, focused work from mid-morning. He then has a break for gym sessions, chores, etc., in the early afternoon. He’s then back online for a few hours for calls, meetings, and interaction with the New Yorkers. Some days, he will do calls late into the night / early morning if projects are hitting deadlines! This is an excellent match for this late riser / late bedtime person.

He is employed as a consultant, although his role would be as a standard full-time employee if he lived in the USA. His role includes lots of international travel to client sites, where he often meets fellow team members. He travels to the USA once per quarter for face-to-face catchups.

EU Citizens Working Remotely From Spain

Citizens from European Union (EU) or European Economic Area (EEA) countries don’t need a visa to work in Spain. This includes working for a non-Spanish employer in their home country or in a 3rd-party country. This means that EU and EEA citizens only need to follow the standard registration of residency process. Non-EU countries now include the UK after BREXIT.

Note: If you want an EU Passport, remote work in Spain could be a pathway for you. Many Spanish work permits and the Spain Digital Nomad visas count toward the 5-year Permanent Residency (PR) and 10-year Spanish citizenship qualification period.

Top tax tips for Europeans working remotely in Spain.

We asked our Taxation Specialist partner, Louis, for his top two tips for EU citizens working remotely in Spain.

1. If you are under a European employment contract, check it is better to use an A1 certificate or go for contracted work, as social security in many European countries is very high. For contracts with countries like France, switching to a contractor in negotiation with your employer is often better.

2. Less of a tax tip, more of a labor rights one. Remember, your job security under many European contracts may include the right for the employer to request your return to Europe; as such, your job security may be much reduced compared to previously.

What Is It Really Like Working Remotely for an EU Company? We Asked A Friend.

Séamas, 42 years old. Irish Citizen.

Séamas works for a company in Dublin and lives outside Barcelona.

He is the CFO of an Irish company (85 employees) based in Dublin and has EU citizen residency in Spain. He lives outside Barcelona with his wife and two young children.

How did you land a remote job? My old employer shut down over COVID-19, and I was offered this role. With the shutdowns, I think everyone was open to remote work, and Spain isn’t very far from Dublin. I had worked with a long-time employee at the company in a previous role, so I had a first-hand referral, which is always handy.

Does this work for you and your company? I love the few quiet hours that I get before Dublin comes online. I get to do “thinking work” and feel like I have a jump start every day. Sometimes, I work late to synch with the Irish folk, but most understand my timetable. I visit the Dublin office around once a quarter; flights are quick and cheap. With two youngsters, I like having the afternoons free to help out and spend time with them, so I’ll often do an hour or so of emails after they go down for the night.

Immigration and Healthcare? I’m an EU citizen, which means I can live and work in Spain without a visa. I can access public healthcare, but my family has a private health insurance policy, so we use mainly private doctors.

Popular Cities And Regions For Remote Workers In Spain

Spain is incredibly diverse, comprising cities, mountainous areas, vacation resorts, the rural countryside, and more. The cost of living in Spain is lower than in most Western Europe, so your foreign income will go further. Working remotely normally means working from home or a co-working space. So, where you live, and your quality of life will be critical.

Finding the Right Place to Live Tip: Before you decide where you’ll live, I recommend visiting a few cities or regions first on a scouting trip to get a feel for them. It’s much different seeing somewhere in person than reading about it online.

Some of the most popular choices for remote workers include:

● The Canary Islands

● Catalonia (Barcelona and surrounding areas)

● Comunidad Valenciana (Valencia and Alicante)

● Andalusia (Málaga and Seville)

My advice: If you want to live in a big city like Barcelona, look in the immediate surrounding areas instead. The accommodation and living costs will be a fraction of the price compared to the center, and you’ll still be able to zip into the center whenever you like using public transport.

Factors to consider when choosing your Spanish Remote Working Base

When choosing where to live, keep the following things in mind:

- Typical climate of the region

- Nearby activities you can enjoy outside working hours

- Accommodation costs

- Cost of living in comparison to your income

- Internet speeds

- Accessibility

- Co-working spaces or cafes

- Expat community

- Transport links

- Time Zone differences to your company’s offices.

- Travel distances and costs to your company’s offices.

Based on critical factors, a recent study found Spain to be the 4th best European country for remote workers.

Tips for finding suitable accommodation: First, you must decide whether you want to rent an entire apartment, a shared apartment, or a room in a co-living space. Airbnb is a great place to find all these options, but it can get pricey if you stay longer than a few weeks. Search for accommodation on Spanish websites, such as Idealista.com, or local Facebook groups advertising housing for rent.

Our Spanish Short-Term Rental Guide has more information.

Could You Do Your Job From Spain?

The global shift to remote work has thrown up some challenges, but there is so much upside. Fears around employee productivity, isolation, and ways of working have proved to have some basis in fact. But the advantages far outweigh those challenges for many.

Remote work from another country adds to those challenges. But it can add so much value. A big pay boost through lower cost of living and lower taxes is just the start. The excitement of a new country and the quality of life in Spain are incentives for many Expats. The Spanish government’s recognition that remote working Expats add value is late but welcome. Now that you know how to work remotely from Spain, will you take advantage?

FAQ – How To Work Remotely From Spain

Is it legal to work remotely from Spain?

Yes, it is legal to work remotely from Spain, but non-EEA citizens require immigration permission to live and work in Spain. For remote work for a foreign company, the best immigration option is the Spain Digital Nomad Visa.

Can I work remotely for a UK company while living in Spain?

You can work remotely for a UK company while living in Spain. All non-EU citizens (including British citizens) must apply for immigration permission to work remotely in Spain legally. The new Spain Digital Nomad Visa is a great option.

Can I work remotely for a USA company while living in Spain?

You can work remotely for a USA company while living in Spain. All non-EU citizens (including American citizens) must apply for immigration permission to work remotely in Spain legally. US citizens can use the Spanish Digital Nomad Visa to work remotely from Spain if they are contractors for a US company.

How long can you work remotely in Spain without paying taxes?

You can work in Spain for up to 183 days in a single calendar year without becoming a tax resident in Spain. After you spend 184 days in Spain in the same calendar year, you may be responsible for paying Spanish tax on your global income — even if you work remotely.

Warning: If you are considered a tax resident in Spain, you may also be a tax resident in another country, depending on their laws. In this scenario, you need to find out if there’s a double tax treaty between both countries to avoid paying double taxation.

What is the new law for remote workers in Spain?

The law that impacts non-EU citizens’ remote work for foreign companies is the Spain Startup Act. Law 28/2022, December 21, 2023, is formally called “on the promotion of the startup ecosystem.” This law includes provisions for the Digital Nomad Visa and Beckham Law Tax program extensions.

What is the Digital Nomad Visa in Spain?

The Digital Nomad Visa in Spain is a special permit that allows individuals to live and work remotely in Spain without being employed by a Spanish company. This visa caters specifically to digital professionals, remote workers, and freelancers.

Is Spain a good destination for European digital nomads?

Absolutely! Due to the ease of travel and fewer visa requirements, Spain offers a rich cultural experience, a favorable climate, and a supportive environment for digital nomads, especially those from European countries. The low cost of living in Spain vs other European countries also appeals.

Can I be self-employed and work remotely in Spain?

Yes, you can be self-employed and work remotely from Spain. However, you must register as “autónomo” (self-employed) and comply with the Spanish tax and social security regulations.

Can you get the 24% flat tax rate if you are a freelancer with less than 20% clients, from an EU country?

Hi Maxime – the new Start-Up Law extended the Beckham Law (https://movingtospain.com/beckham-law-spain/) to holders of the Digital Nomad Visa. As an EU citizen, you can’t apply for this visa. However, EU citizens are still eligible for SETR in some specific cases. Our Spanish taxation expert, Louis, will be able to assess your circumstances to see if there is a possibility of you qualifying. All the best, Alastair

Hi, can you work remotely from August until end May without paying taxes?

Hi Ignasi. In general, you’ll be resident in Spain for taxation if you live more than 183 days in Spain. However, you must assess your situation with a Spanish tax professional as your current tax residence and many other factors must be considered. All the best, Alastair

Thanks. Can u also give information about how to apply and where to do it the digital nomad from Spain (we are american but actually in Spain with an ESTA autorization)

Hi Alastair,

I’ve lived and worked in Ireland since 2006, however, I have a UK passport.

Would I still be eligible to meet the 183 day tourist visa criteria, then apply for a digital nomad visa or equivalent after this period?

Thanks

Gavin

Hi Gavin. As you are a resident of Ireland, I assume you can travel to Spain within your 183 days – and yes, you can apply for a Spanish Digital Nomad visa after arriving in Spain on a tourist visa. Your situation is unusual, so you may want to clarify with our Spanish Immigration Law Partner. All the best, Alastair

Hi there, I am from EU country and live in Spain. I work remotely for a UK company and I used to live and work in UK some time ago. Would I be able to pay taxes only in Spain? Would I need to be paid in a Spanish bank account or that doesn’t matter?

Hi Milena. You’ll pay tax in the country where you are a tax resident, not where your employer is. So, if you are a tax resident in Spain (and you generally are if you live here more than 183 days per year), you’ll pay tax in Spain. You don’t need to be paid into a Spanish bank account; you should declare all your income in your tax return. See more about taxes in Spain here. All the best, Alastair

Hi if i am not yet a resident but will be as a family member of an EU citizen living in Spain. If I am working remotely for my home country will the tax benefits still apply or am I stuck paying 45% due to being married as either way I may be considered a tax resident.

Hi Javier – your situation is complex, so I’d recommend chatting with a qualified professional – however, as a general rule, you get to select the immigration option you use. You may qualify for a digital nomad visa despite your EU spouse, which may entitle you to reduced tax rates under the Startup Law. All the best, Alastair

Hi, I work for a US Company and want to work remotely in Spain for a total of just 2-4 weeks over the course of the next 12 months. Can I do that on a visitors visa or do I have to apply for the Digital Nomad Residency visa. If I have to go the residency route do I have to stay for ove 183 days to be able to renew for additional years? Thank you, Theresa

Hi Theresa – You have 90 days under a standard tourist visa, and if your working here is incidental to the visit, then it shouldn’t be a problem – your stay should be primarily for tourism, which is the assumption that immigration officials will make in this sort of case. You’ll need to show you can support yourself for your stay in Europe. The 183-day stay requirement doesn’t apply to all residence classes, so it would depend on the immigration option you select. However, in your case of a stay of under a month, I’d suggest that the standard tourist visa and a focus on the tourism aspect, if questioned, will be sufficient. All the best. Alastair

Great and insightful article. Thank you for the content. If I am an EU citizen, currently working in Malta for a Maltese company and I will be moving to Spain in August 2024 working remotely from Spain for the same company, will I be considered a tax resident in Malta for the year 2024? Will that mean that I will pay my income taxes in Malta for 2024? And won’t be charged taxes in Spain? Will I be charged income taxes in Spain starting with year 2025? Thanks

Hi Stephanie. I can’t give you specific advice, just the general guideline. Most people only submit a Spanish tax return in the year that they become a Spanish tax resident. So, someone in Spain for under 183 days in 2024 will most likely still be a resident for tax in the old country and start paying tax in Spain in 2025. Please consult a good Spanish tax expert before you move to ensure you get the best outcome. All the best, Alastair

Hi Alistair – do you have an official reference I can cite to my employer who is refusing to give permission to work during a short tourist visit?

Thanks

Hi Andrew. No official reference will show permission to work during a tourist visit. However, as discussed, the understanding is that most people will do some work (even if it is just checking emails or being on emergancy call) while on vacation, so carrying a laptop, etc., is acceptable. I suggest trying to find out what the key concerns of your employer are – why are they so resistant that you need an official reference to work while on vacation? All the best, Alastair

Hi I have a question, if I am a legal resident (married) in Spain, and I am offered a remote job by an American company, do I need to register as autónomo? It’s a standard contract position, so I’d rather avoid the autónomo taxes if possible, but how would I file?

Hi George. I checked with our taxation expert partners, and this was their response: “You have to register as autónomo because your work is remote and the contract is not based in Spain. Therefore, you can’t be subject to the company’s payroll. To receive payments from the American company, you must issue invoices and the only way to legalize this income is by registering with the Social Security and the tax agency. There is no way to avoid paying these taxes.” – you can discuss this more with Louis and his team, as they have some good ideas around tax minimization in these cases. All the best, Alastair

Yo soy Española y voy a volver a España en breve, pero trabajo para una empresa americana, continuaré trabajando para ellos de manera remota, necesito ser autónoma en España? O como funciona, o puedo seguir trabajando bajo mi contrato normal? Ayuda por favor, estoy bastante perdida.

Hola Mariana. Puede haber cierta complejidad con los residentes españoles empleados por empresas estadounidenses. Recomendaría charlar con un experto en impuestos español/estadounidense para acordar la forma más eficiente de trabajar. Buena suerte, Alastair.

Hello, What does a Uk company have to do to be able to pay my taxes in Spain, if I am living there longer than the 183 days and working for the uk company remotely?

Hi Calina. I’d suggest meeting with our Expat in Spain taxation experts, who will be able to explain the entire process and help you approach it most cost-effectively. Alternatively, explore the subject in our Spain taxation guide. All the best, Alastair

Just need a bit of clarification. A Digital Nomad can work remotely in Spain and not be eligible to pay Tax the first 183 days, correct? So if you work there for 200 days do you only get taxed on earnings for 17 days (days after the initial 183 days ) or are you then taxed for the full 200 days earnings?

Hi Sonja – I clarified this with Loius, our Spanish taxation specialist. His comment is, “If you are over 183 days in any calendar year (so tax resident in Spain) you are taxable for the full year 365 days, not just 17 days or 200 days. With tax deductibility under dual tax relief for the remaining 200 days so you won’t pay tax on this income in your previous tax residence country.” There is an exception: if you have Beckham Law tax status (for example, under the Digital Nomad Visa), your year will be split as you are effectively taxed as a non-resident. You can book a consultation with Louis here for more Spanish tax guidence. All the best, Alastair

Hello!

Hopefully you can clarify my situation and options.

I have lived in Spain since 2015 and am Visa exempt due to the ‘pacto’ that was created during Brexit negotiations for people already registered and working in Spain beforehand. I am currently an autonomo English Teacher and hate being autonomo to be honest. I am looking at getting a fully remote UK contract but don’t want to declare tax here (expensive and a pain) and would much rather pay my tax in the UK as my girlfriend and I will likely move to the UK in the next 3-5 years.

Basically, am I able to live here in Spain with a remote UK contract and pay my taxes in the UK? Is there a rule for minimum amount of time you must spend in the UK each year, I have heard different things and in place of social security I could just pay for private insurance here.

I would really appreciate any help and advice you could give me.

Many thanks,

James

Hi James. Where you pay tax depends on where you are resident for taxation, not the location of your employer. So, as long as you live in Spain (check out our Taxation in Spain Guide for more details of this definition), you’ll be liable to Spanish taxation. If you move to the UK and become a tax resident there, you’ll start paying tax in the UK. All the best, Alastair

Thank you for the all the wonderful posts on this page.

One thing that no resource online has been able to verify is this: Is social security contribution obligation for the autonomous connected to that 183 day period with general tax? Or do you have to start contributing to the local social security even on a shorter stay. Bit more context: entrepreneur from another EU country working remotely from Spain for three month period. Pays social security and pension to that EU country already.

Hi Tee. You’ll need an A1 form as proof that you pay social security in a qualifying EU country once you become a tax resident in Spain. You should still have tax residence and social security responsibilities only in your home country for a three-month visit. Our tax specialists will be able to answer this in more detail. All the best, Alastair

Hi I work for a US company and am both US and Spanish citizen. I plan on paying taxes in the US even after I retire. Is there any visa or consideration if I am legally allowed to work in Spain as a citizen remotely?

Hi Martha. As a Spanish citizen, you can live and work in Spain without a visa. If you live in Spain for more than 183 days, you may be considered a Spanish resident for taxation, and then you’ll need to pay tax in Spain. To decide on the best path, I’d suggest a consultation with our Spanish cross-border taxation specialists to determine your best options. All the best, Alastair

Hi, I’m an Irish citizen and currently work and live in Ireland, I’m looking to relocated to Spain(Lanzarote). My company don’t have a Spanish entity , contracting isn’t an option in my current role, was looking at the possibility of collecting my wage in Ireland while living in Spain , and offsetting the tax I pay in Ireland against any tax due in Spain through the Double Tax Treaty between Ireland and Spain -Obviously I want to be tax compliant in both countries but am just looking for a way to do it . Have you heard of this being done before

Hi Marc – there are ways this can be managed – please with our expert cross-border tax specialists to determine how to get your taxes paid in the correct country and pay the minimum amount. Cheers, Alastair

Hi Alastair, if I’ve worked for over a year in Spain (working for a UK company) and only paid taxes in the UK, does UK return me the taxes paid there in order to pay them in Spain?

Hi Cami – I’d suggest chatting with our expert Spanish cross-border tax specialists to determine how to get your taxes paid in the correct country and pay the minimum amount. As you have been here for a year, you’ll be eligible for tax in Spain, but the UK Spanish double taxation legislation means you should only pay tax once on the same income. All the best, Alastair

I hope you’re well. Great article.

I am an Australian currently in Spain on a Student Visa, can I work for a UK-based company as a permanent employee looking to progress into a Digital Nomad Visa or do I need to be a contractor & set up my own company to work as a freelancer & invoice them?

I prefer to be a permanent employee on their books working remotely from Spain on DNV not a freelancer.

Hi Jessie. You can be a permanent employee of a UK company as long as you have an A1 form that shows you pay UK National Insurance (social security) contributions. Our immigration lawyer partners with many similar cases and would happily assist with your paperwork. All the best, Alastair

Thank you for your prompt reply Alastair. So even as an Australian, working remotely for a UK company in Spain I would still need to pay this on top of the current tax rate? Unique I know ha.

hello, I want to spend 9 weeks in Spain this winter and would like to work at least one day per week but ideally 20 hours per week, working remotely for my UK employer. Can I do that without any tax issues for my employer? I am a UK citizen.

Hi Sue. Officially, your SCHENGEN tourist visit prohibits working in Spain. However, in reality, most people now do at least some work when they take a vacation, even if it is just keeping on top of emails, etc. As you are well within the 90-day limit and will not be at any risk of becoming a resident in Spain for taxation and are not formally moving to Spain for work, there should be no implications for your employer. All the best, Alastair

Is it possible to switch to the Digital Nomad Visa while already living in Spain on a non-Lucrative Visa? I am an American. I am planning to move to Spain in 2024 using a non-lucrative visa. I meet the requirements and am semi-retired and financially secure without employment but I would like to work remotely so I was hoping I could move to Spain on the NLV and if I found a remote position (with an American firm) then I would switch to the Digital Nomad visa. However, when reading the requirements (summarized differently on different websites) I see:

1. I must have been working for the company for at least 3 months prior to applying.

2. That I cannot have been a resident of Spain in the past 5 years.

Are these requirements accurate and/or applicable to all applicants or is there a way for me to switch to the Digital Nomad Visa while already in Spain?

Hi Daniel. I’d suggest chatting with our Spanish immigration lawyer partner – your situation is complex, and they’ll be able to advise you on the best way to handle the move as they work with many Expats in these situations. There are some cases where you can move from a non-lucrative visa to a Digital Nomad Visa (or another work permit) while living in Spain, but as you mentioned, there are restrictions on some residents. All the best, Alastair

Thank you for your prompt reply Alastair. So even as an Australian, working remotely for a UK company in Spain I would still need to pay this on top of the current tax rate? Unique I know ha.

Hi! If an Spanish company who is in process to open their branch in Dubai, hires me initially as freelancer and want me to visit Spain for training and onboarding for 4 months while paperwork in Dubai is done, I’m I required to pay any taxes on my income to Spain? I have this doubt since I received an agreement with my remuneration and mentioned in brackets (base imponible factura) which means is the salary before any tax and retention, but I believe I should not be eligible to be taken any tax from my income in this scenario. I need help to clear this big concern to me. Appreciate the help!

Hi Miriam. I’m not qualified to give you direct advice on your situation, but here are some standard guidelines. Generally, freelancers are only liable for tax in Spain once they are a resident of Spain for taxation. The most common standard is that you live in Spain for 183 days in a year (6 months). A person temporarily visiting Spain for professional purposes for four months may still be a tax resident in their home country and pay tax there. If you’d like the situation clarified by a Spanish tax expert, please chat with our partner here: https://movingtospain.com/services/tax-advice-spain/ All the best, Alastair.

Hello,

I am currently working for a company in the Czech republic (I’m Czech). Is it really possible for me to just move to Spain and work remotely from there?

I asked the HR at my company and they said it’s not possible, therefore I’m confused

Hi Matej. There is no legal impediment to working remotely in Spain; you can do so without a visa as an EU citizen. However, if your company does not allow it, that is their policy decision and may relate to ways of working and the paperwork they need to do to complete the process. You can ask HR why they refuse you the option of moving to Spain. Regards, Alastair

Employment Status and Tax Residence: I’m a direct employee of a UK company, and I’m a tax resident in Spain. I have “no tax” status on my UK payroll, so I have to put aside money to cover my income tax and manage my tax return in Spain.

What do you do about social security payments in Spain in this case?

Hi Tom, For the first couple of years, you can use your company’s NI contributions for an A1 certificate to avoid needing to register as an autonomo and paying social security. Our tax partner in Spain can assist with the paperwork. All the best, Alastair

Hi there, I have a house in Spain and due to long history living in Spain previously – I have a TIE card already however I have not been a tax resident in Spain since 2015 (due to living mostly abroad since then). I am now thinking of moving more permanently to Spain next year, whilst remaining on a UK employment contract and working remotely from Spain. Would this scenario qualify for Beckham law and would the TIE be sufficient?

Hi Iain. Your TIE (your resident card) is only valid for five years. Your NIE (tax number) doesn’t expire but it is not a residence permit. Spanish permenet residency can be cancellled is oyu don;t have continious residence in Spain, and your non-resident tax staus may make that clear. I’d suggest that as your situation is complex and unclear, you’d be best served by talking it through with a qualified immigration lawyer in Spain. All the best, Alastair

Thank you fur all your information. I’m planning to move to Spain in the future. I’m a UK citizen working remotely in the uk for a uk company. I’m planning to get my Irish citizenship and passport which I think will make the move easier. If I want to keep my same job in Spain I don’t think I can use the remote worker visa if an EU citizen. Would it be better to just keep my uk citizenship or is it possible to move and work over there keeping my current UK job with my Irish citizenship?

Hi Emma. The Spain Digital Nomad Visa (like all visas in Spain) is not available to EU/EEA citizens as no visa is required to live in Spain (but remember, although it is easier to move without a visa, EU citizens still need to register their move to Spain). There are some upsides to getting a Digital Nomad Visa as a UK citizen, not least that you may be eligible for the Beckham Law tax dispensation. All the best, Alastair

Hi, I wonder if anyone can help me. I am moving to Tenerife in April and I would like to continue working for my current employer but remotely – does anyone know what the tax implications are – what do I have to do? Would I pay twice – one for UK and one for Spain? Any help greatly appreciated. Claire.

Hi Claire. If you are living in Tenerife for more than 183 days per year, you’ll normally be a tax resident in Spain, so you’ll pay tax in Spain. As Spain and the UK have a dual taxation agreement, you won’t pay tax twice on the same income. You can either declare tax that your company withholds in the UK (as an effective deduction on your Spanish tax return), or you can get a “no tax” code and manage your tax payments in Spain (our Spain/UK tax expert can help you with this). Remember, you may be able to use an A1 certificate to cover your social security payments so you can save on costs and administration.

Hi there,

I am from the UK and currently ‘en tramité’ with my residence VISA here in Spain (it is the 5 year temporary family residency card as I am married to a Spanish man), and I am looking into the possibility of eventually also working remotely for a UK company once this comes through. My question is, once I have my residency, am I still required to also apply for a remote work VISA or will my residency cover my right to work remotely?

Thank you!

Hi Lauren. As the spouse of a Spanish citizen living in Spain, you have the right to work, either in Spain or remotely for a foreign company. So, no additional visa is required. Cheers, Alastair

Hi

I am en EU citizen living and registered as a freelancer in Spain. I am looking at working remotely for a UK or US company.

Do I need a US or UK work visa for this, including if I work as a freelance contractor?

Thanks in advance!

Hi Mel. You don’t need a local work visa for the hiring country to work remotely for a UK or US company. There should be no issues as a contractor in either country. Regards, Alastair

Hi Alastair,

Happy to meet you and reading this article was very helpful!

I would like to clarify a few aspects in regards to my relocation to Spain with my family. I am an UE citizen, I work for a company in US , but my work contract is not on Spain, it is on my natal country in UE.

If I would like to relocate to Spain and work remotely from Spain with my twins and my husband, do I need to shift to any specific work contract on Spain with my company? Or I can just work remotely from Spain with my family and pay the taxes here and in my natal UE country as well as per my work country?

As well, do I receive any deduction for the taxes considering being and expat but not having a work contract for Spain, just paying the taxes there.

Many many thanks 🙂

Have a lovely day ahead!

Cheers,

Marina

Hi Marina. I’d chat with our Spanish cross-border tax expert for a definitive answer, as your situation is complex. A couple of general points: 1) If you are a Spanish tax resident, you’ll pay income tax in Spain, and any tax withheld should be a deduction from your Spanish tax return (where Spain has a tax treaty in place with your employer country – including the US and all EU countries). 2) You don’t need a Spanish employment contract to live in Spain as an EU citizen. If your company has a Spanish entity, changing your employment status to Spain may simplify things, but you’d need to consider benefits, etc., to see if this is worthwhile. All the best, Alastair

Hi,

I am a UK national and resident working remotely for a UK limited company and looking to relocate to Spain under the digital nomad visa. If I submit my p85 to get a ‘no tax’ code and obtain an a1 certificate, would my employee or I be required to do anything else to ensure tax conformity? Providing of course I declared the income in Spain.

Thanks

Hi Si. I can’t give specific tax advice as I am not a qualified tax advisor (you can speak to our Spanish tax expert here). However, Spain and the UK have a reciprocal Social Security arrangement so you can reamin a direct employee of a UK company. If you are resident in Spain for taxation, you can submit all global income in your Spanish tax return. All the best, Alastair

Hi Alastair,

Thanks for all the info you have provided above so far.

I am currently living in Spain under a TIE card as a family member of an EU resident (Dutch wife also a resident in Spain).

My question is around my work situation. I am the sole director of a limited company based in the UK and travel back and forth to undertake projects in the UK as well as some remote projects from time to time. All of my clients are UK-based and will continue to be going forward.

I am aware that I have to pay my personal income tax in Spain for my UK salary, but I have read that the Spanish tax authorities may deem my UK ltd company as a Spanish company if any decision-making relating to the business has taken place on Spanish soil.

Crucially I need to keep my core business as it currently is, registered and operating in the UK as it would lead to a large loss of clientele if it suddenly had to switch to a Spanish Business.

I’m sure I’m not the only person to find themselves in this situation, but the information has been a bit of a minefield online so far around what is the best course of action to approach this.

Any advice would be welcomed.

thanks,

Marcus.

Hi Marcus. This can be a complex subject with the base of operations of a company vs the registration. I’d recommend talking with our UK/Spain tax expert – Louis will help you find the best approach to meet both your UK and Spain obligations. All the best, Alastair

Great article, very insightful!

My question is, I am a UK citizen working for a UK company, remotely.

I also hold Italian citizenship and have an Italian passport since 2023.

I understand that to work more than 30 days abroad might breach my current employment T&Cs, so am wondering if I can spend periods of max 30 days 5-6 times a year from a home or rented apartment in Spain without residency -due to either Italian/EU or UK status.

What pattern would be best to avoid exceeding 182 days or 30 days at a time and would I still need to have a 90 day period without any Spain/EU visit.

Would using my Italian passport to work solve some of above given right to work in Spain?

What other options do I have? Appreciate it!

Thanks, Chris

Hi Chris. As an EU citizen (Yay, Italian passport!), you have the right to live, work, and travel freely with the European Union, so you can come and go as you please. In general, once you intend to stay for more than 90 days, you should register as an EU citizen in Spain. If you spend 183 days in Spain and it is your financial base, then the Spanish tax system may consider you a resident in Spain for taxation – but that is a separate issue to your immigration status. All the best, Alastair

Hi!

I am a UK citizen currently living in London and also hold an Irish passport, but I’m looking to relocate to Spain (for medium-long term). I would like to explore the possibility of working remotely for a UK based company but I’m not sure if there will be any legal issues with this, especially around paying taxes. I’ve heard about the UK-Spain double tax agreement but I’m not sure if this applies to me. Any advice would be great 🙂

Hi Luke – as an Irish passport holder, you can work in Spain for a UK company without a visa (however, you must register your EU citizen residency in Spain). There are several ways to approach tax depending on how flexible your company is, but you are correct; the double taxation agreement ensures you don’t pay taxes on the same income in both Spain and the UK. You can chat to our cross border tax specialist for more detailed advice. All the best, Alastair

Thank you for this article it’s so helpful. I’m a US citizen working remotely for a US company. I want to move to Spain next year. But I’m a W2 employee what I understand is that I’d have to become a 1099 contractor to qualify for the digital nomad visa correct?

Hi Stephanie – That is correct, currently, US W2 employees don’t qualify for the Spanish Digital Nomad visa due to issues with social security. Regards, Alastair

Thank you for this site! It answers so many questions. I have one more, though. Above, the article says “Note: To use a Spanish Digital Nomad Visa to work remotely for an American company in Spain, you need to be a contract worker for a US company, not a direct employee—so this rules out any US W2 employees. If your US employer has a Spanish entity, you can work directly for them.” My husband’s company has a Spanish entity, and we think they would be OK with him working from Spain, but to get a work visa for the Spanish entity, isn’t it required to be one of the “significant employers” and make the visa application on his behalf (incurring costs and time)? We want to make this as simple as possible for his employer.

Thanks for any help!

Hi Debora. I asked our immigration lawyer partner about your case, and there are four main points. If you want to explore this option, then please book a consultation with them >> https://movingtospain.com/services/spain-immigration-lawyer/

If a US employee moves to a Spanish entity, then:

1. The Spanish company must apply for a standard work permit

2. They won’t need health insurance, but any dependents will need private cover

3. They may be eligible for Beckham law (a reduced tax rate and excluded from wealth tax.

4. Our law firm can manage all this paperwork to make it as easy as possible for the company – the company must apply, but the applicant can drive the process and paperwork.

Hello.

About the Digital Nomad Visa. You stated:

“Important: If you work for a US company, you must be on a contract, not a direct employee, to use this visa type. Direct employees of US companies will need to work for a Spanish entity of their US company”.

I am a W2 direct employee working for a US company. My company has approved me working remotely from Spain. My company did request and successfully receive a “Certificate of Coverage” letter from the US Social Security Administration (similar to the A1 form in the UK), stating that my social security taxes will be paid on the US side. This letter is effective starting 1 Apr 2025.

I have read in some forums that this Certificate of Coverage has been an obstacle for many W2 employees. Since mine was approved, would you still foresee the DNV being disapproved because I am a US W2 direct employee?

Thank you,

Terry

Hi Terry – I asked our immigration lawyer to clarify – here is the answer:

“The coverage certificate issued by the US authorities only covers intra-corporate transfers. It is not foreseen for employees who are going to work in Spain remotely. The Social Security agreement between the two countries does not provide for this possibility. Therefore, in order for a US citizen to obtain a digital nomad visa, he or she must have a contract as an external consultant with a company during the last three months prior to the application.”