All expats need to consider the wealth tax in Spain. The Spanish government uses your total global assets to calculate your Spanish tax liability, but the amount you pay varies by region. We’ll explore who is liable, how to calculate your net worth, and how much wealth tax you’ll pay in each region. And remember to have March 31st on your calendar for your Modelo 720. Check out our guide to see how the Wealth and Solidarity taxes fit into the Spanish Tax System for Expats.

Spanish Wealth Tax – impuesto sobre el patrimonio

The Patrimonio is an annual tax, commonly called the wealth tax, introduced in 1977 and amended in 1992. It is calculated using the total net value of eligible assets on 31 December each year. The tax is progressive, so the percentage tax increases with the total value of your assets minus associated liabilities. There is a national rate, but some regions apply different tax percentages and thresholds.

Each region applies a deduction, meaning net worth under the deduction is not taxed. The national deduction is €700,000, but it varies in some autonomous regions, and we’ll cover these in detail later in the article.

An Individual Tax

The tax is applied to individuals. This means that each individual must declare joint assets as the percentage owned. So, if a husband and wife jointly own a house worth €1,000,000, they would declare 50% of the value (€500,000) each.

In addition, the deductions are individual as well. In the example above, the husband and wife could claim standard national wealth tax in Spain deductions of €700,000 plus the €300,000 for the family home. So, this makes €1,000,000 each, or €2,000,000 in total.

Spain Wealth Tax Rates 2024 – National Rates

| From | To | Percentage |

| – | 167,129 | 0.20% |

| 167,129 | 334,253 | 0.30% |

| 334,253 | 668,500 | 0.50% |

| 668,500 | 1,337,000 | 0.90% |

| 1,337,000 | 2,673,999 | 1.30% |

| 2,673,999 | 5,347,998 | 1.70% |

| 5,347,998 | 10,695,996 | 2.10% |

| 10,695,996 | And Above | 2.50% |

Communities with different wealth tax rates and thresholds.

| Region | From | To |

| Catalonia | 0.21% | 2.75% |

| Asturias | 0.22% | 3.00% |

| Region of Murcia | 0.24% | 3.00% |

| Andalucía (note: 100% relief, so effective 0%) | 0.24% | 3.03% |

| Cantabria | 0.24% | 3.03% |

| Community of Valencia | 0.25% | 3.12% |

| Balearics | 0.28% | 3.45% |

| Extremadura | 0.30% | 3.75% |

Note: The Madrid and Andalucía regions apply a 100% wealth tax relief. This means that you have an effective 0% rate and pay no tax in these two regions.

Who Pays Wealth Tax in Spain?

Your region’s wealth tax policy will dictate how and if you are liable for this tax. You should speak to a Spanish taxation expert to ensure you follow your regional requirements.

In general:

- Spanish Tax (Fiscal) Residents calculate Wealth Tax on their global net worth.

- Non-residents for Tax calculate Wealth Tax only on Spanish assets.

Need Tax Advice?

Need clarity on your tax obligations and a solid financial strategy ? Schedule a consultation with our recommended tax advisor, Louis, to gain complete clarity and peace of mind.

Wealth Tax Deductions – 2024

There is a national deduction schedule, but there are also regional variations. Federal deductions will apply if a region has not set a local deduction.

National Wealth Tax in Spain Deductions

- Individual deduction: €700,000

- Family Home in Spain: €300,000

- Any wealth tax paid in a country with a Spanish Taxation Treaty (DTT).

Regional Wealth Tax in Spain Deductions

Each autonomous region can apply different deductions and levels to the national wealth tax. These override those set nationally. Here are three examples of variations.

- In Cataluña, the individual deduction is lower at €500,000. However, the family home deduction is higher at €500,000.

- Some regions in Spain allow deductions related to your professional activities.

- Others, including Madrid and Andalucía, apply a 100% deduction. This means you will pay no tax in these regions (although you may still have to submit your declaration.)

These variations make it vital to consult a quality tax lawyer to ensure you are filing correctly. They’ll help you to claim all available deductions to minimize the tax you pay.

Included Assets For Your Wealth Tax

You work out your total net worth as of 31 December each year. So, something purchased after 1 January and sold before 31 December of the same year will never be liable for wealth tax.

Remember: The calculation is on net assets, so associated liabilities like mortgages or loans are deducted from values.

- Real Estate (including your primary residence).

- Vehicles (including cars, boats, and airplanes).

- Investments, shares, bank accounts, and savings.

- Business assets (in some cases).

- Jewelry (in some cases).

- Art (in some cases).

Excluded Assets / Exceptions

- Household Contents (apart from those in the list above.)

- A business that a) you own a significant shareholding in, b) you manage, and c) pays a significant part of your net income.

- Pension rights.

- Business assets (in some cases).

- Jewelry (in some cases).

- Art (in some cases).

- Intellectual property rights.

Spain Wealth Tax Calculator 2024

You can calculate your wealth tax liability using this formula.

(Total Net Assets – Total Deductions) * Wealth Tax Percentage.

So, you’ll pay zero tax if your deductions or allowance exceed your assets.

Here’s an example of a couple, Sue and Tim, using the standard national rates and deductions.

| Assets | Asset value | Sue % | Sue | Tim % | Tim |

| Family Home | 1,000,000 | 50% | 500,000 | 50% | 500,000 |

| Joint Shares | 600,000 | 50% | 300,000 | 50% | 300,000 |

| Sue’s Boat | 500,000 | 100% | 500,000 | 0% | – |

| Tim’s Tiara | 100,000 | – | – | 100% | 100,000 |

| Total Assets | 2,200,000 | 1,300,000 | 900,000 | ||

| Deduction – Individual | 700,000 | 700,000 | |||

| Deduction – Home | 300,000 | 300,000 | |||

| Total Deductions | 1,000,000 | 1,000,000 | |||

| Taxable Amount (Assets – Deductions) | 300,000 | 0 |

There is a simpler Spain wealth tax calculator – book an appointment with our expert Spanish Tax Lawyer here.

How to File – Modelo 720 and 714

There are two forms (modelos) you’ll need to know:

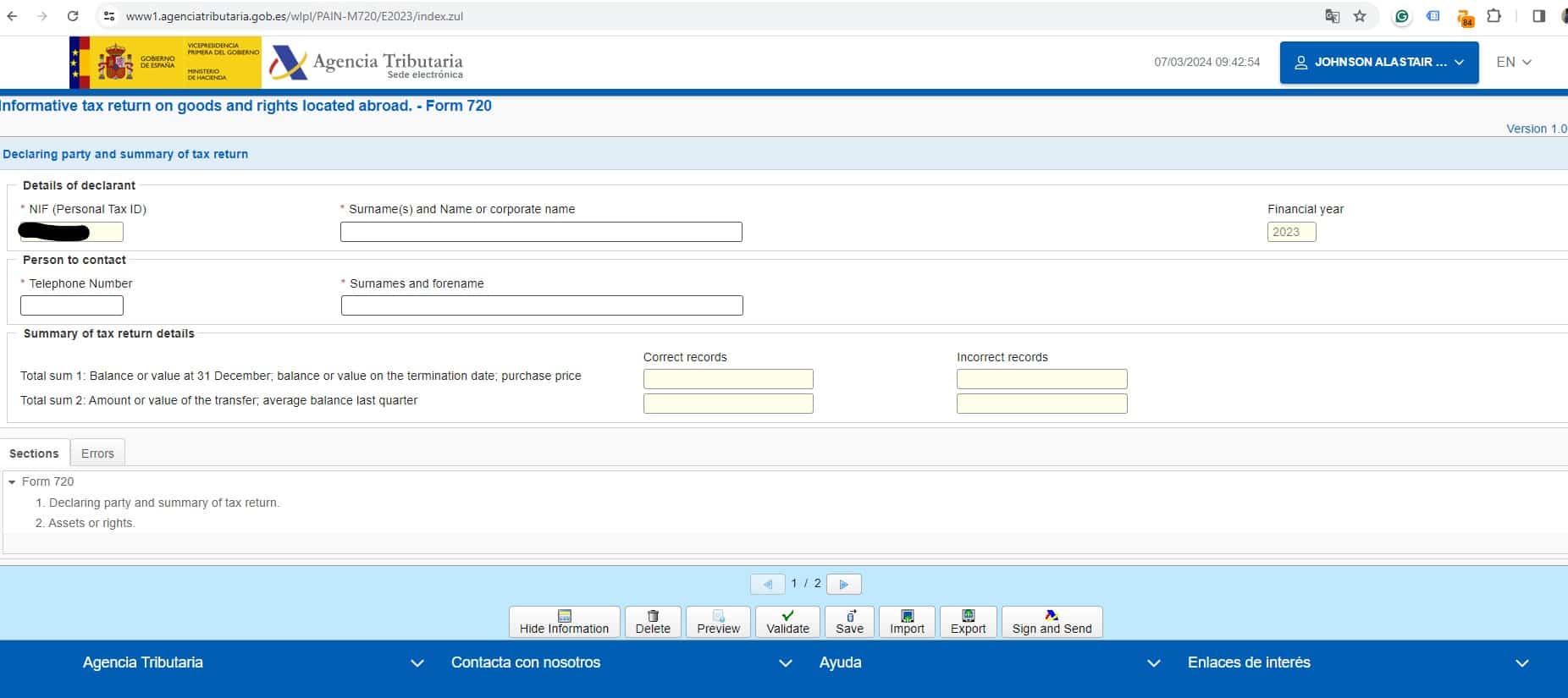

Modelo 720

The Modelo 720 is for declaring assets outside of Spain. You’ll need to file this form if you have assets exceeding €50,000 globally. You should submit the form annually if values change by more than €20,000 (total or single).

If you fall into one of the following three groups, you will need to file one:

- If you have bank savings and deposit accounts held abroad, the sum of all the accounts together exceeds €50,000.

- You have other assets and private pensions held abroad that exceed €50,000. This includes stocks and shares, bonds, life insurance, pension plans, and annuities that are currently being paid. You are in this category if they had a total or surrender value on December 31st of the previous year of €50,000 or more.

- You own a property with a purchase value of over €50,000, including private property or business premises.

Each individual must submit a report, declare the total value, and share if the assets are in joint names.

Important: You won’t necessarily pay any wealth tax on your assets if your declaration is under the limit. The declaration was implemented to prevent money laundering and fiscal fraud. However, you can be fined if you don’t file it. The fine for not filing your declaration can be as high as €10,000.

Deadline: 31 March of each year.

Remember: This is an individual tax, so joint owners must each submit a form declaring their percentage ownership of the asset.

How to submit your Modelo 720

The easy way is to have a Spanish tax expert check and file on your behalf. However, you can also file automatically through the Agencia Tributaria website using a Spanish digital certificate.

Modelo 714

The Modelo 714 is for declaring Spanish assets. Two groups need to submit this form:

- Those with Spanish assets worth more than €2,000,000.

- Anyone liable for a Spanish Wealth Tax payment.

Deadline: 30 June of each year.

Remember: This is an individual tax, so joint owners must each submit a form declaring their percentage ownership of the asset.

The 60% Rule – Pay Less Tax

For some Spanish taxpayer residents, you can reduce the amount of personal wealth tax they pay.

The total wealth tax and income tax you pay in a single year has an upper limit. The amount must be at most 60% of your taxable income.

A good tax advisor helps you understand how to manage your investments and income tax for the 60% rule.

Note: The minimum wealth tax amount you’ll pay is 20% of the assessment, even if the 60% rule drops you below this figure.

New Solidarity Tax – 2024

The Spanish Ministry of Finance has announced the ‘impuesto de solidaridad a las grandes fortunas‘ as a temporary measure for 2023 and 2024. It will only apply to individuals with net worldwide assets over €3,000,000 who are tax residents in Spain.

Important: You won’t pay both the solidarity tax and wealth tax. If you qualify for the solidarity payment, this will include that liability.

The tax is progressive, so the percentage payable will increase with asset value. Estimates are that the Solidarity Tax will impact around 0.1% of Spanish taxpayers.

The government offers deductions similar to those for the wealth tax. Everyone gets a €700,000 deduction plus €300,000 for a main home in Spain. Other deductions, including qualifying business, may be available. This means that for most people, a minimum of € 4,000,000 will be the base for solidarity tax liability.

So, the Solidarity Tax rates (after deductions) are as follows:

| From | To | Tax Rate |

| – | € 3,000,000 | 0% |

| € 3,000,001 | € 5,347,998 | 1.7% |

| € 5,347,999 | € 10,695,996 | 2.1% |

| € 10,695,997 | Upward | 3.5% |

The Spanish government says this tax law will be temporary and will not be retained after 2024.

Note: This is a central tax, so there will not be regional variations.

Need Help With Your Wealth Tax?

This is a complicated tax with many variables. The inclusions, deductions, 60% rule, and autonomous regional variations make calculating what you’ll owe complex. For this reason, we recommend speaking to a good Spanish Tax advisor. They’ll understand how to minimize the amount and pain of the Wealth Tax in Spain.

FAQ – Wealth Tax in Spain

How much is wealth tax in Spain?

The Spanish Wealth tax is progressive, and the amount you pay depends on several factors. These factors include where you live in Spain, your net assets, and what deductions you can claim.

Where in Spain is there no wealth tax?

The autonomous regions of Madrid and Andalusia have 100% deductions, meaning you effectively pay no wealth tax.

Will Spain abolish wealth tax?

The tax was introduced as a temporary measure in 1997. It has been abolished and reinstated over the last 25 years. There are constant rumors that the government will repeal it, but there is no end in sight yet.

Do you have to pay wealth tax in Spain every year?

Yes, if you meet the threshold, you’ll have to pay tax on your global assets each year.

What assets are exempt from Spanish wealth tax?

Household goods, pension rights, intellectual property, and some businesses are exempt from wealth tax in Spain. If you have a mortgage, it is offset against the value of the property.

What is the Solidarity Tax in Spain?

The Solidarity tax is a temporary progressive tax on worldwide assets over € 3,000,000. Many people will be able to claim deductions of € 1,000,000, so Spanish tax residents with over € 4,000,000 of assets are mostly impacted. Solidarity tax rates start at 1.7%, and the top rate is 3.5%.

What is the Modelo 720 for Wealth Tax in Spain?

The Modelo 720 is a declaration form for Spanish residents to report any overseas assets they hold worth more than €50,000. You must submit the Modelo 720 to the Spanish Tax Agency (Agencia Tributaria) by March 31 each year (detailing the assets you held in the prior calendar year). ‘Modelo‘ is the Spanish word for ‘form’.

If I live in Barcelona now and move to Malaga in the future, what will happen to the wealth tax?

For example, if I live in Barcelona in 2023 and own 1.2 million euros in asset worldwide, including deposits, stocks and real estate, I will not need to pay wealth tax when I move to Malaga in 2024. So when will I not need to pay wealth tax for Barcelona?

Do I need to modify my residence information at the Malaga Tax Office, or are there any other procedures required for avoid the wealth tax? Thanks a lot

Hi. I referred this question to our Spanish tax expert partner.

1. If someone moves from Barcelona to Malaga during the Tax year, which tax rates apply for taxes like Wealth Tax? – Where you are empadronado for the majority of the tax year, you will typically pay tax ates for that area.

2. Is the padron sufficient to show that you have moved? – You need to have a new empadronamiento and separately notify your address to the Agencia Tributaria

If we have a GV property in one spouse’s name, for €500,000, is the deduction only €300? And if so, can the personal €700,000 count towards that? Meaning if all other assets plus the remaining €200,000 from the home are under €1,000,000, would we be exempt from the wealth tax?

Hi Derek. I can give specific tax advice as I am not a qualified Spanish tax advisor. However, in general, the owner of the property will have the €700K personal plus €300K home deduction, so a €1,000,000 total deduction, while the non-owner partner will have the €700K personal deduction. So they’ll have a combined €1,700,000 in total. Our tax partner will be able to assess your case and help you plan the most effective way to meet our obligations. All the best, Alastair

If I have 20 mln euro, so above 10 mln euro (for simplicity don’t mention deductions) I will pay 2,5% Nationality and 3,5% Solidarity ? I was thinking about Spain, but it seems irrational to live there as rich person.

Hi Mike. The low cost of living, lifestyle, and public services make Spain a compelling choice for many high-net-worth individuals. However, the tax bill is unarguably higher than in the USA and other options. Remember that the Wealth Tax is 0% in some parts of Spain. A chat with our wealth management partners can give you an excellent picture of managing a move and other options in Europe to minimize your taxation impact. All the best, Alastair

When calculating Assets to br used in determining if someone must pay the Wealth Tax in Andalucia..do we include any accts we will be the beneficiary of? In other words does my husband need to include my 401k retirement acct if he will be the beneficiary of it upon my passing? Thank you! Eve Jarrett

Hi Eve. While I cannot give specific taxation or financial advice, in general, Spanish residents only need to declare assets they own at the time of the declaration on your Modelo 720. Please get qualified Spanish tax advice for your specific situation. All the best, Alastair

In your Tim and Sue example, shouldn’t the total taxable amount be 200,000 (not 300,000)?

Hi Eric – the example is correct. Spain’s wealth tax is an individual tax and so Sue owes €300,000 and Tim owes €0 (if it were a joint tax then, yes, they would cumulatively owe €200,000). Thanks, Alastair

Hello,

This article is very helpful but I don’t see any mentioning of the Canary Islands. Is there a wealth tax relief like in Madrid? If not, what are the values for your table “Communities with different wealth tax rates and thresholds?”

Gracias,

J

Hi Jeanne – I’ve checked with our cross-border taxation specialist, and currently, the Canary Islands apply the standard federal wealth tax rates. All the best, Alastair

Thank you for posting this information. It is helpful.

Questions:

1. For investments (ex: stocks), do I only value them as of the end of the calendar year or is their value calculated as an average? Not specific to investments, I read that bank accounts are valued at the greater of the end of year value and the last quarter average. So if my investments lose money, the value at the end of the year might be less than the average of the last quarter.

2. For how many years into the future can I use the purchase price of the home to calculate the actual homeowner’s allowance? Just the one? And then do I need to revert to the catastral value? From what I understand, 300,000 Euro is the maximum allowance and the actual allowance is calculated as the maximum of either the purchase price or the catastral value (or another administratively imposed alternative to that). An example from what I understand: if I just purchased my home for 270,000 Euro and its catastral value is 100,000 Euro then I would use 270,000 Euro as my allowance.

Hi Chris. All information we provide is general guidance (as we are not qualified tax accountants), so we can’t give individual advice. Our Spanish taxation specialist will be able to assist with your estimate. All the best, Alastair

Please provide more information about the pension rights exclusion. For example, would an U.S. IRA or 401k be excluded ?

Hi Dave – it would be best to chat with a qualified cross-border taxation specialist in Spain to understand your specific liabilities. All the best, Alastair