We finally have some good news when it comes to Spanish red tape. Opening a bank account as an Expat can be pretty straightforward. We’ve recently opened an online bank account, which was painless. Through speaking with friends and clients, traditional Spanish banks have also improved their processes. For residents and non-residents, follow our guide on opening a Spanish bank account, and you’ll understand the requirements, docvumtaiton, and steps, with tips tailored for Expats!

Step-by-Step Guide: How to Open a Bank Account in Spain

Step 1 >> Use our article Best Banks for Expats in Spain to choose the right bank for your needs.

| Traditional Banks | Online Banks | |

| Step 2 >> | Make an appointment in the branch or online. | Download the app or visit the website. |

| Step 3 >> | Gather physical documents and make copies if the bank needs to keep anything for their records. | Scan copies to upload for the application. |

| Step 4 >> | Attend your appointment and fill in the paperwork they give you | Follow the e-verification process. |

Step 5 >> Wait for your account to be verified. This shouldn’t take more than two days. You’ll also receive your bank card in the mail within a week. In the meantime, you can use your account and app functions immediately.

Step 6 >> Follow the instructions that come with the card to activate it to complete this process.

Our Experience Opening Bank Accounts in Spain

- Online Bank: Opening our Revolut account took about 15 minutes from start to finish, including installing the app. There was no application fee for the account or debit card, and the cards arrived in the post six days after our application.

- Traditional Bank: For our Sabadell account, we made an appointment in the branch and completed the paperwork for our resident account. The process took around 30 minutes, and the bank representative spoke perfect English. We had to return to collect the cards, but subsequent cards were sent to us by post. We did need to go to the branch to replace our Via-T. Note: This was some time ago, and the process now looks more streamlined.

We checked the websites of two of our Top Banks in Spain for Expats, and here is their 100% online signup process for an online account.

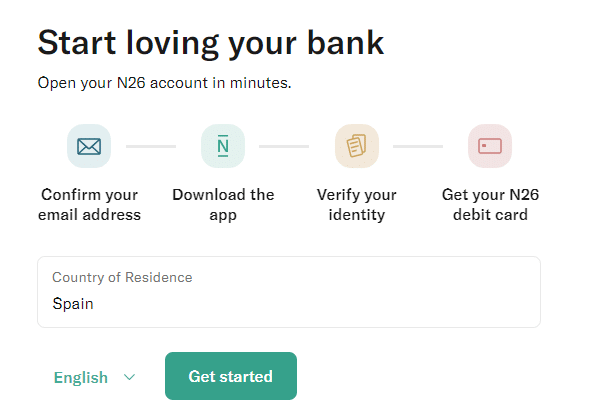

N26 – Standard Account with Debit Card (click on the picture below to get started).

Sabadell Online Account

This Sabadell account offers a debit and credit card option.

Documents You Need to Open a Spanish Bank Account

Documents Required to Open a Resident Bank Account in Spain

| Primary Identification | Valid passport or national ID card |

| NIE Number | Número de Identidad de Extranjero |

| Proof of Residence | Rental contract, utility bill (within 3 months), “empadronamiento” |

| Financial Documentation | Employment contract or proof of income, tax ID from home country |

Documents Required to Open a Non-Resident Bank Account in Spain

| Document Type | Examples |

| Primary Identification | Valid passport or national ID |

| Proof of Address | Recent utility bill or bank statement from home country |

| Certificate of Non-Residency | Certificado de no residencia (obtainable from a local police station) |

| Proof of Income | Employment contract, tax documentation, or proof of funds |

The disruption of online banks means the process is generally getting simpler and faster. Check for online-only options to avoid getting physical copies of documents and visiting a bank branch.

Documentation Translations and Certification

Spanish traditional banks sometimes require official translations and certification of supporting documentation. Check with your branch to find out precisely what is required before you start the process. Online banks will accept English (and often other languages) documentation.

AML and KYC

Anti-money laundering (AML) and know-your-customer (KYC) regulations mean banks may require additional identification and residency evidence. These requirements are similar for traditional and online banks, so don’t stress – these are standard hoops to jump through.

Should I Open a Resident or Non-Resident Bank Account?

Accounts with resident status tend to be flexible and have more benefits. If you are not planning on living permanently in Spain, a non-resident bank account will be easier to open.

You may be able to open a non-resident account and then switch it once you get residency. You may have to make an appointment at your local branch and show proof of residency.

Note: EU /EEA citizens with residency in Spain will have the same requirements.

Resident Bank Account

- Eligibility: A resident bank account is for individuals who live in Spain for more than 183 days a year or have their fiscal/tax residence there.

- Purpose: Suitable if you work, live, or study in Spain long-term.

- Features:

- Access a broader range of banking products, including mortgages, loans, and various investment options.

- Generally, there are lower fees and better interest rates than non-resident accounts.

- You can link it to direct debits for paying bills, receiving salaries, and more.

- Taxation: Account holders are subject to Spanish tax regulations, including declaring global income if Spain is their fiscal residence. If you are a tax resident in Spain, you’ll include this information in your income tax declaration, which is called La Renta.

Non-Resident Bank Account

- Eligibility: Non-resident bank accounts are for individuals not fiscal/tax residents in Spain.

- Purpose: Ideal for those owning property or having business interests in Spain.

- Features:

- They often have both euro and foreign currency capabilities.

- They might have higher fees and charges compared to resident accounts.

- Accounts are limited in terms of credit facilities and investment options.

- Taxation: Interest earned on these accounts may be subject to Spanish withholding tax. See our guide to personal income tax in Spain to learn more.

How to Open a Spanish Bank Account as an International Student

Tip: Ask your educational institution if they have a banking partnership. In many cases, they’ll have a relationship, which makes opening a student account easier.

Fees and Cost of Opening a Bank Account in Spain

READ ALSO: The Best Ways to Transfer Money to Spain >> Cheap. Fast. Safe.

Another factor to consider when choosing the right bank is the fees involved. The amount will depend on the bank and what type of accounts they offer.

Here are two examples from banks that we recommend to Expats in Spain.

- N26 has four tiers of accounts with increasing services and benefits. The lowest tier is free, and the highest has a €16.90 monthly fee. There are no joining fees.

- Sabadell has an account maintenance fee that ranges from free to €20 per month, depending on various factors.

Banks can also charge withdrawal, ATM, foreign exchange, and overdraft fees, to name a few! Understanding how you’ll use your account and what fees you’ll pay is important when opening your account.

Ways to Minimize Fees:

| Fee Type | Description | Ways to Minimize Fees |

| Account Maintenance | Many online banks have lower fees than traditional ones. | – Choose a no-fee account. – Maintain the minimum balance required to waive fees. – Consider banks offering discounts or waivers for direct debit bill payments. |

| Digital and Online Bank Options | Many digital banks have lower fees than traditional ones. | – Explore online banks and accounts that offer free or low-cost essential services and transfers. |

| ATM Withdrawals | Fees for out-of-network ATMs are typically €1.80 – €2.50 per transaction. | – Use ATMs within your bank’s network to avoid extra charges. – Consider banks offering discounts or waivers for direct debit bill payments. |

| Paper Statement Fee | There may be a fee for receiving paper statements instead of digital ones. | – Opt for online (electronic) statements, which are often free. |

| International Transfer Fees | Charges for currency conversion and sending money abroad. | – Consider online transfer services like N26, Wise, or Revolut, which may offer lower rates. |

| Debit/Credit Card Fees | Annual fees for debit or credit cards, along with replacement fees. | – Some accounts offer fee-free cards; inquire about them during account opening. – Use credit card providers with lower annual fees. |

| Direct Debit Setup Fees | Fees for setting up automatic bill payments. | – Some banks waive fees if you set up regular direct debits. – Inquire about fee reductions or discounts for direct debits on essential payments. |

| Currency Exchange Fees | Charges for transactions in a foreign currency. | – Consider online transfer services like N26, Wise, or Revolut, which may offer lower rates. – Consider using multicurrency accounts if you regularly transact in other currencies. |

| Transparency of Fee Structure | – Choose banks with clear, transparent fee structures so you know about potential costs upfront. | – Choose banks with clear, transparent fee structures so you’re aware of potential costs upfront. |

| Online Bank Options | – Choose banks with clear, transparent fee structures so you know about potential costs upfront. | Many online banks have lower fees than traditional ones. |

Type of Spanish Bank Account

| Account Name | |

| Current/Checking Account (Cuenta corriente) | A deposit account will give you a higher interest rate than a savings account. However, your money is held for extended periods, providing even less flexibility than savings. You’ll often be required to have a minimum income with a deposit account. |

| Savings Account (Cuenta de ahorro) | Specific savings accounts can offer higher interest rates than a standard account. However, interest rates are often still pretty low, and you may have restricted access to your savings. |

| Deposit account (Cuenta de depósito) | A deposit account will give you a higher interest rate than a savings account. However, your money is held for extended periods, giving even less flexibility than savings. You’ll often be required to have a minimum income with a deposit account. |

Banks can also provide yoU with:

- Mortgages (cuenta hipoteca)

- Fixed Deposits (cuentas de depósitos a plazo fijo)

- Credit Cards (cuenta de tarjeta de crédito)

- Investment Options (cuenta de fondos de inversión)

- Salary Accounts (cuenta nómina)

- Student Accounts (cuenta de estudiante) for those under the age of 26

The Main Banks in Spain

Check out our guide to the best banks in Spain for Expats. We’ve broken down the pros and cons of 8 major banks to help you choose the perfect banking partner. We feature N26, Bunq, Revolut, Banco Sabadell, Banco Santander, ING, Wise, and BankInter. The article also covers the things you need to know to select a bank in Spain.

Ready to Open Your Spanish Bank Account?

Once you break down the process of opening a Spanish bank account, it’s not so scary. You’ll find your experience to be similar, if not the same, as the experience you had when opening an account in your own country. The paperwork is different, but everything else will be familiar to you.

But don’t forget, if you feel more comfortable not going through this process alone, you can take someone with you. If you need a friend for support or a translator to help with any questions, they can attend your appointment. Now you know how to open a Spanish bank account, which one will you choose?

FAQ – How to Open a Spanish Bank Account

Can foreigners open a Spanish bank account?

Yes. There are various bank account options for foreigners, depending on your residency status.

Can you open a bank account in Spain online?

Yes, you can. Not every bank will have this option. If there is a particular bank you’d like to use, check their website to see if you can open an account online.

Can you open a Spanish bank account from the US?

If the bank offers the option to open an account online and you have the correct paperwork, you can do so. However, you will need a Spanish address to receive the card. And ensure that the bank won’t require you to visit a branch in person to complete any final steps.

What is needed to open a bank account in Spain?

– Spanish TIE card (or just the temporary certificate from the police if you aren’t yet a resident).

– Your national ID document (passport or resident card).

– Proof of your current address in Spain.

– Proof of current employment status and/or certificate of non-residency if applicable.

Can you open a bank account in Spain without NIE?

Yes. Not every bank offers this option, but a few do, including Sabadell, Santander, and CaixaBank. However, having an NIE will make tasks like this much more straightforward.

How long does it take to open a bank account in Spain?

If you can open the account online, the process should take around ten minutes. If you open an account in a branch, you’ll be there for around 30 minutes, more or less. You can have your account details on the same day with all your documentation in order.

Can a US citizen open a bank account in Spain?

Yes. As an American, there are several ways you can open a bank account in Spain, depending on your situation. You can open selected Spanish bank accounts with a USA address.

Can I open a student bank account in Spain?

Yes. Some major banks have branches on campus in Spanish universities. Your student card is required to prove your academic status, and in addition, you can enjoy numerous other benefits and special offers.

What are the key types of bank accounts you can expect to come across in Spain?

– Cuenta bancaria o Cuenta corriente (current account). This is the primary account you’ll use for basics.

– Cuenta de ahorros (savings account). This is where you can put your savings to earn extra interest.

– Cuenta de depósito (deposit account). This is like a savings account but with fewer options to access funds and offering higher interest rates.

Do banks offer support and services in your language if you don’t speak Spanish?

Yes, but it can be a limited service depending on your area and is usually only in English. Major banks and branches in areas with many Expat customers have the best support. Online banks like N26 and Revolut have full English language capability.

What is the minimum age to open a Spanish bank account?

The minimum age to open a bank account in Spain is 18, but some banks have a youth account linked to a parent or guardian account.

How long does it take to open a bank account in Spain?

Simple current accounts with a debit card are pretty quick. Expect a functioning account with a card in 1 – 5 days. Mortgage, loan, and credit card accounts can take longer to process. Online bank accounts can be operational in as little as 10 minutes.

Can foreigners open a bank account in Spain?

Yes, there is no restriction on foreigners opening a Spanish bank account. Non-residents in Spain need a non-resident certificate to open a Spanish bank account.

I am planning to move permanently to Spain from the United States. I am an Italian and US citizen. I know that due to FATCA regulations, European banks tend to avoid US citizens as customers and when they accept them tend to charge a lot in maintenance fees. Can you recommend a good Spanish bank not too picky about citizenship?

Thank you!

Hi Angelo – please see our guide to the best Expat banks in Spain. All the best, Alastair