European Economic Area (EEA) and European Union (EU) citizens can live in Spain without a visa, but there is some paperwork to complete. Non-EU family members can move to Spain, too. There are two easy steps to get your EU certificate of registration, the card that allows you to live and work as an EU national in Spain. Here’s how to get residency in Spain for EU citizens and family members.

Note: As an EU/EEA/Swiss citizen, there is no paperwork to do before you enter Spain. Once you are in Spain, you can start the process.

Do EU Or EEA Citizens Need To Register To Live In Spain?

Yes, if you intend to stay for more than 90 days. You can freely come and go if your visit is less than three months.

The requirements in this article are for EU or EEA citizens who want to move to Spain for more than 90 days.

Note: Since BREXIT, UK citizens must follow standard non-EU processes and so need to apply for a Spanish Visa or Residence permit.

READ ALSO: Spanish Healthcare for Residency and Visas >> Complete 2024 Guide

Spanish Residency Certificate for Citizens of EU Countries – 2 Simple Steps

1) Register With Your Local Municipality

All Spanish residents need a ‘Padrón,’ the short name for a Certificado de Empadronamiento. You’ll need:

- proof of address in your neighborhood (a rental contract or utility bill)

- your passport, plus a copy.

Visit your local Citizen’s Information Office or register online.

Note: While every Spanish municipality issues a Padrón to its residents, the process and requirements can differ. In short, you’ll need to show you have an address in Spain. The Barcelona town hall, for example, will issue a Padrón if you have a lease as short as three months. Other municipalities will want a minimum lease of 11 months, so check with your lawyer before you start the process.

2) Get Your EU Registry Certificate

The final step is to get your EU Registry Certificate or Certificado De Registro De Ciudadano De La Unión Europea. During this process, you’ll get your NIE ( número de identidad de extranjero) which is your fiscal ID number as a foreigner. You’ll come to love your NIE – you’ll use it all the time!

To get the certificate, you’ll need some documentation.

- A completed EX18 Application form.

- A receipt for the fee payable (from the Impreso Tasa Modelo 790 Code 012.) This fee is €12 for a single applicant.

- Proof of sufficient means to support yourself and your family in Spain. This could be a bank statement, income statement, employment contract, self-employment registration, or proof of assets. The minimum amount is 100% of 2024 IPREM, or € 7,200 for the primary applicant. You’ll also need 75% of IPREM, or €5,400 for each dependent family member.

- Health Insurance Cover. You’ll be eligible for Spanish public healthcare if you work in Spain and pay into the relevant social security scheme. You may also be able to use a European Health Insurance Card (EHIC). You’ll need a qualifying Spanish Private Health Insurance policy if you don’t have either of those.

- Tip: You can get two quotes using our Health Insurance quote tool from the Health Insurers we recommend.

- The Padrón you got in Step 1 above.

- A valid EU/EEA/Swiss passport with a copy.

Note: If you have a job in Spain, a letter from your employer will be all you need to show you can support yourself. So, no need for any of the items in numbers 3 and 4 on the list above.

You’ll apply for your residence permit at the nearest Foreigners’ Office, Immigration Office, or the local police station. If you are not using a lawyer, you’ll need to book the appointment online. Be aware that getting the correct appointment on time can be incredibly challenging in many areas.

Shortcut: Our Spanish Immigration Lawyer Partner can assist with residency in Spain for EU citizens, ensuring you don’t waste time or money.

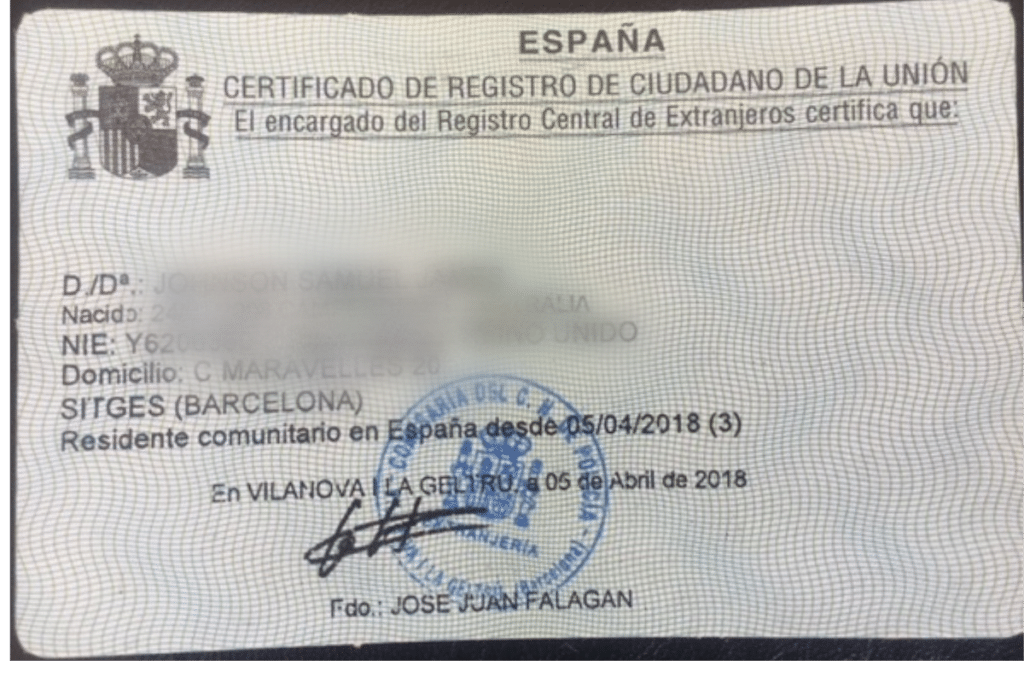

Spanish Residency Document For EU citizens

Your Spanish residence card is a credit-card-sized green paper document. It will include your name, address, and NIE. You’ll hear this sometimes called a NIE or a green card. This document identifies you as an EU citizen who can live and work in Spain.

Above is an example of what your green paper residency card would look like.

Note: Once you are resident in Spain as an EU citizen, you need to live in Spain for 183 days per year to maintain your status as a Spanish resident.

Non-EU Citizen Family Members

Once you are registered as an EU citizen in Spain, you can apply to reunite non-EU citizen family members.

The people you can include in your application will depend on your status.

1) Working, Self-Employed, or Economically Self-Sufficient

You can include a spouse (or common-law partner) and children under 21. In addition, you can include parents, parents-in-law, and disabled adult children dependents.

2) Student

You can include a spouse (or common-law partner) and your children

Steps

- Gather Necessary Documents: This includes a marriage or civil partnership certificate (apostille certified copy) or your “pareja de hecho” resolution.

- Application for Residence Card: Family members of EU nationals should apply for a residence card within three months of their arrival in Spain. They will also apply at the nearest Foreigners’ Office or Immigration Office.

- Healthcare: Ensure that your family members have access to healthcare. If they are not working, you might need to provide proof of private health insurance or show that they are covered under your health plan. Note: If your partner is working in Spain, you don’t need private health insurance.

- Accommodation: You must show you are living with your EU citizen partner. To do this, you’ll need an empadronamiento (volante de Convivencia) showing the same address.

- Financial Means: Demonstrate sufficient financial means to support your family members. This can be through bank statements, employment contracts, or other financial documents. The legislation doesn’t give an exact figure, but you should be fine if you work on 150% of IPREM (so in 2024, it is €10,800).

- Wait for Approval: Once all documents are submitted, the authorities will process the application. Depending on the volume of applications, this can take a few weeks to a few months.

- Collect the Residence Card: Once approved, the family member will be notified to collect their residence card. This card confirms their right to live in Spain as a family member of an EU citizen.

- Stay Updated: Always be aware of any changes in immigration rules or requirements. Regularly check official sources or consult with a Spanish immigration lawyer to ensure compliance.

It’s essential to ensure that all documents are accurate and up-to-date. If there are any doubts or specific situations, it’s advisable to consult with an immigration lawyer familiar with Spanish regulations.

Need help with your Residency paperwork?

If you want to save the hassle of filling out the paperwork correctly, getting all of the appointments yourself, and negotiating the process in Spanish, then we can help you. Our Immigration Partners, Raquel and her team, have helped hundreds of our happy clients.

Parejo De Hecho For Unmarried Partners

If you are in a stable relationship and have lived together for twelve months, you can apply for Pareja de hecho status (registered civil partnership). This gives you similar rights as a married spouse or civil registered partner.

- Legal Recognition: The Spanish government recognizes “Pareja de Hecho” and provides couples with a legal framework similar to that of a married couple, though there are some differences in terms of inheritance rights and other legal aspects.

- Benefits: Couples who register as a “Pareja de Hecho” can enjoy benefits such as:

- Access to a partner’s public health insurance.

- Rights to a pension in the event of a partner’s death.

- Residency and work rights for the non-EU partner of an EU citizen.

- Requirements: The exact requirements can vary by region in Spain, but generally, couples need to:

- Prove they have been cohabiting for a specific period (this can vary).

- Be of legal age and not be related by blood.

- Not be married to someone else.

- Provide identification and other necessary documents.

Note: Marriage and parejo de hecho are possible in Spain regardless of the partners’ gender. So, same-sex partnerships and marriages are legal and recognized in Spain.

READ ALSO >>> Pareja de Hecho >> A Complete Guide to Civil Partnerships in Spain in 2025

Common Documents Required for Non-EU Family Members

Application Form (EX-19):

- Completed and signed application form for the residence card of a family member of an EU citizen.

Valid Passport:

- Original and photocopy of the applicant’s passport (all pages).

Proof of Relationship:

- Marriage certificate for spouses.

- Birth certificate for children.

- Certificate of dependency or legal guardianship for other dependents.

- All certificates must be translated into Spanish and legalized or apostilled.

EU Citizen’s Documentation:

- Copy of the EU citizen’s valid passport or national ID card.

Proof of Registration:

- Certificate of registration (Certificado de Registro de Ciudadano de la Unión) of the EU citizen in Spain.

Proof of Residence:

- Proof that the EU citizen and the non-EU family member reside in Spain, such as a rental contract, property deed, or utility bills.

Proof of Financial Means:

- Evidence that the EU citizen has sufficient financial resources to support the family member, such as bank statements, employment contracts, or other proof of income.

Health Insurance:

- Provide proof of public or private health insurance covering family members in Spain. See our guide to Spanish Private Health Insurance for Residency.

Photographs:

- Recent passport-sized photographs of the applicant.

Criminal Record Certificate:

- A certificate of criminal record from the applicant’s country of origin (and any other country where the applicant has resided in the past five years), translated into Spanish and legalized or apostilled.

Payment of Fees:

- Proof of payment of the application fee.

Key Risks and Obstacles for Obtaining Residency for Family Members in Spain:

- Incomplete or Incorrect Documentation: One of the most common reasons for delays or rejections is missing or incorrect documentation. It’s crucial to ensure that all required documents are provided, are up-to-date, and are translated if necessary.

- Proof of Relationship: Authorities may require substantial evidence to prove the relationship between the EU citizen and the family member. This can be especially challenging for non-traditional or extended family members.

- Financial Requirements: Demonstrating sufficient financial means to support family members can be a hurdle. The application might face challenges if the EU citizen’s financial situation changes or they cannot provide adequate proof of funds.

- Healthcare Coverage: Ensuring that family members have adequate healthcare coverage is essential. If they are not covered by the public healthcare system, they might need comprehensive private health insurance, which can be costly.

- Accommodation Issues: Proof of suitable accommodation might be required. The application could be hampered if the living conditions are deemed unsuitable or overcrowded.

- Dependency Proof: For dependent family members, such as adult children or parents, proving dependency can be challenging. Authorities might require substantial evidence of financial or health dependency.

- Criminal Records: Family members with criminal records or pending legal issues might face application challenges or delays.

- Language Barrier: While the process can often be done in English, there might be instances where communication in Spanish is necessary. This can pose challenges for those who don’t speak the language.

- Bureaucratic Delays: Like many others, the Spanish immigration system can sometimes experience backlogs or delays, which can prolong the waiting time for approvals.

- Changes in Regulations: Immigration rules and policies can change. It’s essential to be updated with the latest regulations to ensure compliance.

- Brexit Implications: The implications of Brexit have changed the dynamics of moving to Spain for British citizens. While previously British citizens enjoyed the same rights as other EU citizens, post-Brexit, there are additional requirements or changes to consider.

Are you an EU citizen bringing non-EU family members to Spain?

Spain is welcoming of the families of EU citizens. It is how I came to live in Spain via Alison’s pre-BREXIT British passport. However, the process is challenging, and we would have really struggled without support. However, the pathway to Spainshih residency for non-EU family members of EU Citizens is avalible.

Permanent Residency & Spanish Citizenship

After five years of living in Spain as a family member of an EU citizen, you can apply for permanent residency in Spain (PR). After ten years, you can apply for Spanish citizenship by naturalization.

FAQ – Residency in Spain for EU Citizens

Do you need legal assistance to get Spanish Residency?

No, you can complete the process on your own. However, a good Spanish immigration lawyer will make it much simpler (including getting the correct appointments).

Do you need an EU Registry Certificate to apply for a job in Spain?

No, your EU passport is sufficient to apply for a job in Spain. You can apply for your residence permit once you are offered a job in Spain and obtain a residence.

How long is your EU Residence Permit Valid In Spain?

Your Spanish “Green Card” is valid for five years. After that, you’ll need to renew it or apply for permanent residence in Spain.

What is Parejo de Hecho in Spain?

You can apply for Parejo de hecho status if you are in a stable relationship and have lived together for at least twelve months. This registered civil partnership does not have all the same rights as a marriage but does qualify for immigration in many cases. For example, with parejo de hecho, you could apply to move to Spain as the partner of an EU citizen. You can apply for Pareja de hecho status regardless of the gender of the couple.

I was born in the UK and have a British passport. I have lived permanently in France for ten years. I assume I am still classed as a British citizen. Do I still need to apply for a visa to live in spain? Does my ten year french residency count toward residency years required for spanish residency. Many thanks.

HI Carol. 1) Yes, you are still a British citizen, and all your immigration status will start with that fact. 2) Yes, all British citizens must apply for a visa to live in Spain since BREXIT 3) Unfortunately, no. Your French residency will not be counted at all by the Spanish immigration service. Regards, Alastair

I am a Polish (EU Citizen) living with my spouse (US Citizen) in the United States. Can my spouse move with me to Spain and then apply for residency? Do I need to establish residency in Spain prior to my spouse moving or does she need to apply for a visa in the US before moving to Spain with me?

Hi Tiffany, Your spouse can move with you and can apply for residency when they are in Spain. All the best, Alastair

As retirees, we plan to live in Spain 6 months of the year and return to the US the remainder 6 months, do we have to pay taxes in Spain?

Hi Alecia. You’ll pay tax in the country where you are a tax resident – there are several factors in how this is decided, but living in Spain for 183 days or more generally makes you a tax resident here, meaning you’ll pay taxes in Spain. Check out our Spain Expat tax guide for more details. Cheers, Alastair

I’m an EU citizen. I live in Canada and work for a Canadian company. I’m planning to move to Spain. What if I want to work remotely for Canada but live in Spain? How’s that going to work? Thanks!

Hi Roberto. Spain and Canada have a reciprocal social security agreement so that you can get a Canadian certificate of coverage. You’ll need to manage your tax liability by deducting the withheld tax from your Spanish tax return or registering it as “no tax” in Canada. See our Remote Work in Spain guide for more information. All the best, Alastair

Hello, I am a French citizen living in the UK since 1985 with a French passport. I want to go in live in Spain. Can I apply as EU resident or do I have to apply as a none EU Because I live in the UK? Appreciate your help on this matter. Thank you

Hi Robert. Your citizenship is the important factor here, and so you can apply for Spanish residency as an EU citizen. All the best, Alastair

Hi,

I am a UK citizen with a german Passport and I would like to stay in spain with my wife (UK citizen) for 5 months.

What do I need to do please

We have had a house in spain since 2003 but only had short stays

Thank you

Hi Robert. You need to follow the process described in the article to register as an EU citizen in Spain. Your wife can then apply as the spouse of an EU citizen. Our immigration law partner will be happy to assist with the paperwork. All the best, Alastair

Hello

We are a married UK couple, retired from work, own a house in Spain and have NIEs. So at present we are subject to the 90/180 day rule. It looks as though I can claim Austrian citizenship through ancestry. At present we do not want to live permanently in Spain and would be happy to make visits of no more than 90 days at a time and no more than 183 days in a year. (Which also has the advantage of allowing us to use annual travel insurance to cover any health issues). We would just like to be able to spend rather more than a total of 90 days at our house during the winter months, and then less in the summer when the uk is actually quite pleasant (!). Clearly once I have my Austrian passport I will be free to do this, but what are the implications for my spouse? Does he have to travel with me every time, or does he have exactly the same rights as me? What documentation does he have to be able to show at border control? Thank you.

Hi Theresa. Unfortunately, your passport doesn’t change your husband’s status. If you both became residents in Spain, this changes – until then, your husband will be subject to the rule. All the best, Alastair

We are US Citizens. Myself and two adult children. We are considering to move to Spain where my sister lives . We are college graduates and two of us are employed. What would it be the process for us to obtain all legal residence, social security for employment, student visa and visa paper work?. How lengthy is to complete all the paper work? I assume everything must be done here in the United States. Is it done by contacting a Spanish Embassy or Consulate? Thank you fir your assistance

Hi Carmen. I’d suggest meeting with our Spain Immigraotn Lawyer. They’ll help you find the best immigration option and walk you through the process, paperwork, and timelines. All the best, Alastair

Hi,

I am a dual citizenship holder (British and Latvian) and have been living in UK for the last 10+ years. I assume that I would be able to live in Spain without a visa?

Hi Martha. Yes, as a Latvian citizen you can live in Spain without a visa (your UK citizensship won’t be of any use since BREXIT). You’ll need to follow the EU citizen residency process above. All the best, Alastair

Hi

My Wife and I are both retired living in the UK. We both hold Croatian citizenship. We are seriously considering relocating to Spain. If we do would we qualify for the Public healthcare system as EU citizens.

Many thanks

Hi Paul. You can see the process for qualification for public healthcare in Spain in our guide here. All the best, Alastair

Hi Alastair

Great site BTW.

My long term partner (Slovakian passport holder) and I are considering moving to Spain in a few years time. We have living together for about 3 years. We have separate bank accounts apart from one joint food account. The council tax is in both of our names but the rental agreement in mine only. Is this enough evidence to prove the relationship so we can both live, work and apply for residency? We have the funds required no problem. My work would be self employment.

Many thanks and keep up the good work.

Simon

Hi Simon. Our immigration lawyer partner can give you specific advice on the pareja de hecho process and how you can show the authenticity of your relationship, given your circumstances. All the best, Alastair

Hello! My husband is a Finnish citizen, and I am a Russian citizen. We are planning to move to Spain soon. I have seen many different people talking about documents needed for residency there. I want to ask, do we need the criminal records certificate for applying for residency, and if we need, does it have to be translated to Spanish and apostilled?

Hi Stefaniia. You’ll need a police clearance showing no disqualifying criminal record, and it will need to be translated to Spanish and apostilled. Our immigration lawyer partner will be able to assist you with the process. All the best, Alastair

Hi,

I am a German citizen currently living in the US. I am planning to move to Spain with my US citizen wife for retirement. My wife is Puerto Rican and thus qualifies for becoming a permanent resident after 2 years of living in Spain, not 5. I guess, I would need to live there for 5 years as a European? In addition, how does this work with the health insurance? Do we both need private insurance and for how long? I do not have any more German health insurance. Thank you.

Hi Petra. As you don’t have German public healthcare, you’ll need private healthcare in Spain until you qualify for public healthcare in Spain. Your wife will be eligible to apply for Spanish citizenship after 2 years, not permanent residence, and this is a very different process that does have implications on your eligibility for public healthcare. All the best, Alastair

Thank you, Alastair. Yes, I meant citizenship. In any instance, we just booked one of your packages. Looking forward to working with you. Happy New Year! Petra

Hi Petra – I look forward to talking soon. All the best, Alastair

Hello!

I am a US/Swiss dual citizen (as are my children) and my spouse is just a US citizen. Would it be possible to move to Spain if it is only my spouse who has a job (no sponsorship)? I would plan on getting one, but he has a better chance initially. I haven’t been able to find a definitive answer to this question.

Thank you!

Hi, Meryl – your Swiss citizenship gives you the right to live and work in Spain, and your husband can qualify as an EEA spouse. You’ll need to show that you have sufficient financial resources and healthcare – the source of that financial position can be your savings, investment income, or your husband’s income. All thetbestest, Alastair

Hello!

I am a UK citizen with a Maltese passport. My wife only has a British passport. Will there be many hurdles for her to overcome to live/work in Spain? Will these hurdles be less, because I have an EU passport and we are married?

Thanks!

Hi Nick – Yes, you can register in Spain as an EU citizen and your wife as your spouse, giving both of you the right to live and work in Spain without a visa. Our immigration layer partner can assist with the process. All the best, Alastair

Hi, sorry another question. What is the situation with proof of work/income, is it a problem if my work would be freelance? I.e. not full time employment?

Hi Nick – again, I’d suggest checking with our immigration lawyer partner as freelance work is more complex than a salaried position but is absolutely still achievable. For example, bank statements and tax returns may be helpful to show you meet the income requirements. All the best, Alastair

Hi, I’m a Belgian citizen and am planning to move to Spain. I would like to work remotely for the Belgian company I’m working for at the moment. If I’m right, I’m able to do this. Do I need to have a minimum income to be able to? Will I be taxed in just Spain after 183 days or does this mean i will be double taxed, so as well in Belgium as in Spain? Does the Spanish tax happen automatically after those 183 days or do I have to arrange things myself?

Hi Bonnie. As a Belgian citizen, you can work for a Belgian or Spanish company in Spain. Once you live in Spain for more than 183 days in a tax year, you must register with the Spanish tax authorities and submit a tax return in Spain. Belgium and Spain have a double taxation agreement, so you will never pay tax twice on the same income. You can chat with our Spanish tax expert to help with the process. All the best, Alastair

Hello,

Can you please help me?

I am an EU citizen, planning to move to Spain with my NON EU spouse.

I’m not employed nor self-employed. I would like to show the proof of sufficient funds. Can you please advise how much should I prove for myself as well as for my spouse?

Thank you a lot, have a great day!

Hi Jelena – The minimum amount is 100% of 2023 IPREM, or € 7,200 for the primary applicant. You’ll also need 75% of IPREM, or €5,400 for each dependent family member. Regards, Alastair

Thank you for your respond!

Can you please tell me if the bank account can be from my country and not Spanish bank account as I saw somewhere they require sufficient funds on spanish bank account?

Thanks a lot again!

Hi Alastair, my husband and I are moving to Spain later in this year. We are both UK citizens but he has an Irish passport and I have an Italian passport. Our children have British passports but we have applied for their Irish passports (approx 12 month wait). Are they entitled to stay with us in Spain longer than 90 days? Many thanks

Hi Ava. Yes, your children can live in Spain as dependents of EU citizens. You’ll need to apply for residence cards on their behalf – our immigration lawyer partner can assist with the process. Regards, Alastair

I am British and have a British passport but I have a letter confirming I am a Maltese citizen – can I go and live in Spain? My husband only as a British passport could he stay in Spain as I am a Maltese citizen?

Hi Nazzarena – you must apply for your Maltese passport to enter Spain as an EU citizen. Your husband will be able to join you as the dependent of an EU citizen. Regards, Alastair

Hi Alastair,

Me and my family are looking to relocate back to Spain (previously lived in Spain 8 years ago). My partner is Polish and both my children hold British and Polish passports. What is the easiest and quickest way for us to move to Spain?

Hi Michael – Your Polish partner can move to Spain without a visa, and you can accompany them under the “Pareja de Hecho” process. Your children will accompany you as dependents. Our immigration lawyer partner can assist with the process. All the best, Alastair

Hi Alastair, I am a British citizen, married to an Irish citizen. I own and run a small company, which we are both directors of.

We are looking into living for extended periods in Spain, probably renting in a few different places first, rather than being settled at one address. This is ahead of a potential longer-term move to Spain.

I would still work and we would both draw a small salary from the company. We have decent savings and will soon also be able to access our private pensions too

At present we are unlikely to exceed 183 days a year in Spain so would not become tax residents, but would potentially be there for more than 90 days at a time.

I know we would both need to apply for an NIE card. Does the NIE card mean I (as a British citizen married to an EU citizen) can travel freely in and out of Spain and also travel elsewhere in the Schengen area without the 90/180 rule?

Or is there different documentation that would be required?

Thanks for any advice

Hi William. There is no residency requirement for living in Spain as an EU citizen (or dependent) so a TIE is all you’ll need. The only thing to consider is that only years you spend more than 183 days in Spain count towards your Permanent Residency qualification. All the best, Alastair

Hi! My husband and I are full time nomads and he has dual EU/ USA passport I have only US. We don’t want to move to Europe but would like to stay longer than 90 days in Spain. Is there any easy way to do this without applying for residency? We are retired and have enough funds to live comfortably .

Hi Patricia. As a non-EU citizen, you’ll have a restriction of 90/180 days in the SCHENGEN region unless you apply for residency (as the spouse of an EU citizen). All the best, Alastair

Good evening,

we are retiring in September I have Irish passport and understand I require to prove 7200euro income, how much will my husband require? As we have a joint bank account can both sums be proven as a total income per month?

Thank you

Hi Mary. Your husband must show 75% of IPREM, or €5,400 as a dependent. Yes, you can show the joint bank account to support your application. All the best, Alastair

Hello Alastair,

I am EU (Czech) and US citizen with valid Czech and US passports. My wife is US citizen only. We live in California and want to move to live in Spain. Does my wife need a visa to stay legally in Spain longer than 90 days? In other words, is it OK if she comes with me and I apply for family reunion while we are both in Spain? Thank you dearly. Ondrej

Hi Ondrej. Yes, once you arrive in Spain, you’ll apply for residency, and then your wife can apply as the spouse of an EU citizen resident in Spain. Our immigration lawyer partner can assist with all the paperwork on your behalf. All the best, Alastair

Thank you Alastair. We’re almost ready to go, and this was helpful. Have a good day Ondrej

Hi Alistair,

I’m a dual Italian and Argentine citizen, currently living in the UK.

If I were to relocate to Spain as a EU resident, would I still be eligible to apply for Spanish citizenship after 2 years (because I’m also Argentine)? Or would I have to live there for 10 years?

Hi Carolina, you get to take advantage of both of your citizenships – lucky you. You can indeed move to Spain as an EU citizen and qualify for citizenship after two years as an Argentinian. All the best, ALastair

Hello, I am an italian citizen and got married to my American fiance in Uk last year. We are planning to move to Spain. Do i need to register my marriage in Italy or can I just apply with my Certificate apostile from the UK?

Thank you

Hi Jamal – your American marriage certificate will be sufficient – your citizenship and marriage are separate issues, so registering in Italy is unnecessary. Our immigration lawyer partner in Spain is best placed to assist with all the paperwork. All the best, Alastair

Hello Alastair,

I’m dual French and Canadian citizen, I was wondering which nationality should I use to move to Spain in few years with my Canadian husband ?

Thank you in advance 🙂

Hi Nadia – your French citizenship means you can move to Spain as an EU citizen without applying for a visa – and your husband can join you as a family member. It is a simpler and cheaper process. All the best, Alastair

Hi Alastair,

How much is the minimum percentage of down-payment on a residence for a non Spanish persons (Canadian and French) to get a mortgage from a Spanish bank?

Hi Fadi – there are many variables depending on the property, your circumstances, etc. You can chat obligation-free with our excellent mortgage broker partner if you’d like to learn more. All the best, Alastair https://movingtospain.com/housing-resources-services/mortgage-advisor/

Hey Alastair, I have dual UK and Polish citizenship, and would like to live in spain for 6 months (182 days). However, whilst living in Spain, I would be working remotely for my UK employer. Please can you advise whether I need a visa or residency permit to live in Spain, and what are the tax implications if any? Thank you

Hi Margarita. In general, EU citizens are welcome to live and work in Spain for as long as they want and if they meet the requirements. If you’re going to stay for more than three months, the rules for EU citizens moving to Spain say you should register as a resident in Spain. This residency differs from your tax residency, which only happens when you spend more than 183 days in Spain or make Spain the center of your financial activities (see this article on the tax system in Spain for Expats). Regards, Alastair

Hi. My brother is a EU citizen. Can I apply for a tarjeta comunitaria as his sister since I have a non eu citizenship?

Hi Ivana – the Family Reunification Visa is generally for spouses and children. However, in particular circumstances, it can apply to other family members (generally, where they are entirely financially dependent). Our immigration lawyer partner can help you find the most effective pathway to Spanish residency. All the best, Alastair

Hi, is the recidency card always valid for 5 years? If you come with “sufficient resources” do you need to show proof of funds according to IPREM of every year you intend to stay or only for one year. If I intend stay for 5 years do I need to show funds 5 times IPREM (36 000 euros) or is the yearly 7200 enough? Kind regards David

Hi David, I checked this with our immigration lawyer partner, who handles many EU residency applications, and she confirmed that you only need to show income for a single year and have the five-year permit issued. All the best, Alastair

Hi! I am currently in Spain looking to apply for the residency in Spain as an EU citizen, however as my documents I only have my Canadian passport and my Romanian ID (bulletin and not passport). On all websites it says to present a valid EU passport, but does the Romanian ID not count as a EU document?

Hi Ana – in general, you’ll need a passport as proof of citizenship. If getting a new passport issued is difficult, I’d suggest talking to your immigration lawyer partner to see if there is another way to manage your application. All the best, Alastair https://movingtospain.com/services/spain-immigration-lawyer/

Hi Alastair, I recently moved to Spain but have not worked in Spain yet. I hold a Greek passport. My partner is Polish and resident of Spain for the past 10 years. I am currently pregnant and unable to get a job. I just put my name on the house contract as a tenant. Do you know what the next steps would be to obtain the residency? Can the fact that my partner and father of my child is already a Spanish resident speed up the process? Would it help if we make a civil partnership/ marriage? Many thanks. Paraskevi

Hi Paraskevi – you can apply for your residence permit immediately now that you live in Spain. Our immigration lawyer will be happy to assist with your residency application. All the best, Alastair

Hi

As a EU-citizen intending to retire in Spain, is it possible to get a NUSS (Nº Seg. Social) without a work contract, just receiving a pension from my country of origin. The purpose is to be able to register with public Health Service. Thank you.

Hi Wolf – there is the option to use an S1 certificate if you qualify in your country of origin. This certificate means you wonlt need private health in surance in Spain as an EU retiree. All the best Alastair

Hi Alastair,

We are in the very early stages (collecting info) about the possibility of moving (retiring) to Spain. I am dual citizen Belgian/ Australian. I live in Australia and would move to Spain from Australia. Can I use my Belgian citizenship to retire in Spain? I guess my chinese wife (citizen) who has Australian permanent residency could then move with me as a non-Eu family member. Is that correct? Thank you, regards. Nico***

Hi Nico. That is correct. You are eligible to move to Spanih as a Belgian citizen, and your wife can move as a spouse of an EU citizen (regardless of her current citizenship and PR). All the best, Alastair

Hello Alastair! Thank you for this incredibly helpful information and service to those who want to move to Spain. I am an EU citizen, my soon to be wife is US citizen. We want to take our time to find the perfect home in Spain- is the 11 month lease contract mandatory in all cities? Also I do not have a paid job, she has a very well paying remote work job for many years now. Can we use her accounts and income as evidence of financial stability for the application? Thank you so much!

Hi Theo – there is no mandatory 11-month lease >> Please look at our guide to renting property in Spain for more information. You should be able to use your wife’s income, but I’d suggest talking to our immigrant lawyer to ensure the process is smooth. All the best, Alastair

Hola, mi hija vive hace 8 años en Francia y está tramitando su nacionalidad. Ella nos podría reclamar en España cuando pertenezca a la UE?

Hola Jessica. No, your daughter’s residence in France may allow you to join her in France, but it does not transfer to Spain. If your daughter qualifies for residency in Spain, you may be able to use a family reunification process to move to Spain. All the best, Alastair

Hi Alistair – I’m a UK Citizen considering re-location to Spain with my wife, who’s an EU Citizen. As her spouse, I understand I can travel to Spain with her without a Visa (?).

Slight confusion over the sequence of events thereafter. It appears she must register for Padron on arrival, then once registered the Padron can be used to apply for her EU Residency. Once that residency is approved, she can then apply to “re-unite” me as a Family member – as part of that application she will have to show 100% + 75% IPREM in income or savings, in support of both of us – is this correct ? Regards Will

Hi Will – you can check out the details in this article – and our immigration lawyer will be happy to assist with the entire process. All the best, Alastair https://movingtospain.com/spain-residency-for-eu-citizens/

Hi Alistair, great to find such a super website full of info.

As an early retired UK citizen and would qualify for NLV, however, would like to move to Canaries from UK with my adult daughter (German & UK citizen) her UK partner (of 5 years) and their 2 year old child. They both intend to work there. I’m not financially dependent on her, but have few health issues and need help sometimes, we intend to reside together. Additionally, I also have a permanent residency permit from Germany as lived, worked there some years.

Q: Would it be best to apply for residency in Spain using my German residency permit (which includes EU) OR as a dependant EU family member OR on a NLV?

Q: in first two scenarios can we all register/apply for residency within 90 days when we arrive in the Canaries or do I follow once she has registered herself there?

Q: Do the Canaries differ in the process to mainland Spain?

Hi Janet. I’d suggest meeting with our immigration lawyer partner, as your situation is complex. In general, a German residence permit won’t give you rights in Spain, but our lawyer will clarify the permission you have. All the best, Alastair

Hi Alistair,

I have dual nationality Serbian and Hungarian as well. Currently I live in Serbia but I do own a hungarian passport (EU passport). So, my question would be… Since I have my own firm in Serbia and already am paying taxes here, if I was about to move to Spain, would I have to pay taxes in Spain for my income as well and if so, how much? Since I am already paying taxes in Serbia. Would pretty much like to live in Spain but continue having my firm here in Serbia if it will be still cost-effective. I would appreciate your advice, thank you in advance,

Karolina

Hi Karolina. Once you become a tax resident in Spain, you’ll pay income tax in Spain, but if your company is registered in Serbia, you will pay company tax there. As your situation is complex I’d suggest speaking with our cross-border tax expert >> https://movingtospain.com/services/tax-advice-spain/ All the best, Alastair

My wife and I are EU citizens who are planning to move to Spain for at least a couple of years. I am still working, and will be registered as self-employed and paying taxes, and my wife is retired. We have EHIC cards from Portugal, but are having a hard time finding Spanish private insurance due to age and pre-existing conditions. My understanding is that because I am going to pay taxes in Spain, I am entitled to Spanish Health care, and my wife will be covered if we provide a recent apostilled and translated marriage certificate. Does that sound right? What am I missing?

Hi Philip. If you are working in Spain and paying social security contributions they you and your wife are eligible for public health cover. All the best, Alastair

Hello,

My wife and two 12-year-old boys are EU citizens, and I am a US Citizen. We live in the US right now. My wife’s employer has offices in Spain. Her employer said they would not have a problem her moving to Spain to work from the offices there. Can she just go there with an NIE (obtained from Spanish Consulate in US) and begin work with here company or does she need to through the process to obtain the Certificado De Registro De Ciudadano De La Unión Europea? Thanks!

Hi Steven. Your wife (as an EU citizen moving to Spain) has 90 days to register as a resident in Spain. She already has the right to work for a Spanish company. All the best, Alastair

Hi Alastair,

Fantastic Site.

As an EU citizen, will my partner and I qualify to live in Spain full time with 150,000 euro savings and no further current income ?

Thank you.

Hi John. Yes, as an EU citizen, you should qualify to live in Spain with your savings. Our immigration lawyers can assist with an application. All the best, Alastair

Hi,

Me any my partner are considering to move in Spain. We are Croatian citizens, I will continue work for Croatian company, will I be double taxed? He will be unemployed, but with enough funds for gaining residency.

Kind regards

Hi Josipa. No, you won’t be double taxedwhen you become a resident in Spain, because Croatia and Spain have a tax treaty. I’d suggest speaking to our Spanish tax specialist to understand how the move will impact you. All the best, Alastair

Hi, we are a retired us citizens and would live to live in Spain half of the year and half in us. What are our requirements to do that?

Hi Esperanza – to live in Spain for more than 90/180 days you’d need to apply for a Spanish residency visa. The most common option for US retirees is the Non-Lucrative visa. All the best, Alastair

I am a dual US-Polish citizen who has been married to my American same-sex partner for several years (we were married in the US). We currently live in the US and are thinking about moving to Spain—I know I can legally reside there as an EU national but want to see how my partner could do so also, since I know that Poland does not recognize same-sex marriage although both the US and Spain do. Will Spain accept our US marriage certificate for the purpose of family reunification?

HI Michael – you can register your US marriage in Spain and your partner can join ou on that basis. Our immigraiotnlawyer partner can help with the paperwork. All the best, Alastair

Hi Alastair,

I am a US/EU Spain dual citizen and I currently live in the US with my husband and my son who are only US citizens. We are planning to move and live in Spain for one year. Do my husband and son need a visa? Or can we move there and then do everything in Spain?

Do I need to register our marriage and my son’s birth in the Spanish consulate and civil registry first?

What is the easiest/quickest way to complete the process and to move to Spain?

Thank you!

Adrianna

Hi Adrianna. Your husband and son do not need visas to enter Spain and can apply for residency in Spain once they are here. I’d suggest booking a consultation with our Spanish immigration lawyer to assist with the process; they’ll advise you on how registering marriage and birth may help this process. Also, ask about registration to obtain Spanish citizenship for your son, too – he may already be eligible for a Spanish passport by descent. Once again, our partners can assist with this process. All the best, Alastair

Hello – My wife is eligible for Spanish citizenship through ancestory. Her brother has already applied and was granted citizenship and got a Spainish passport. We are planning to move for retirement, from what I read in the article and comments. I won’t have to file for a NLV to move, I can just move with her and provide our marriage certificate. Is this accurate?

Hi Rick. When your wife has her Spanish passport, then yes, you can live in Spain without a visa. You’ll need to apply for residency here in Spain (it takes a bit more than just a marriage certificate). Also, after just one year of living in Spain, you’ll also be eligible to apply for Spanish citizenship. Cheers, Alastair

Hi Alastair I am an Irish Citizen, and live in the UAE. I will have been living here more than 10 years. I will be retiring t0 Spain in 2029.

I know it is premature to start this process now. I own my own my property in Spain. What would the process be for me to get my residency?

Can I get a Padron in Spain before I finish work here?

What would I need to get from the embassy here? Getting an appointment at the embassy here can take months.

Hi Valarie. I wouldn’t do too much preparation now as requirements may change in the coming years. Currently, you can come to Spain and register your EU residency upon arrival. You’ll need to understand how to access healthcare in Spain (either public or private), as that can be a stumbling block. The padrón is a record of Spanish residents, so you cannot obtain your padrón until you are a resident of Spain. All the best, Alastair