Most Expats (and 25% of all Spanish people) have private health insurance in Spain. Although we qualify for the public health system in Spain, we still pay and use our Spanish private insurance provider for most of our healthcare needs. Given that Spain has free public healthcare, why do so many people like us opt for Spanish private medical coverage? We’ll explore the pros and cons of the private healthcare system for Expats covering visa requirements, immigration, and beyond. Finally, see our recommended private healthcare companies to help you choose the perfect cover.

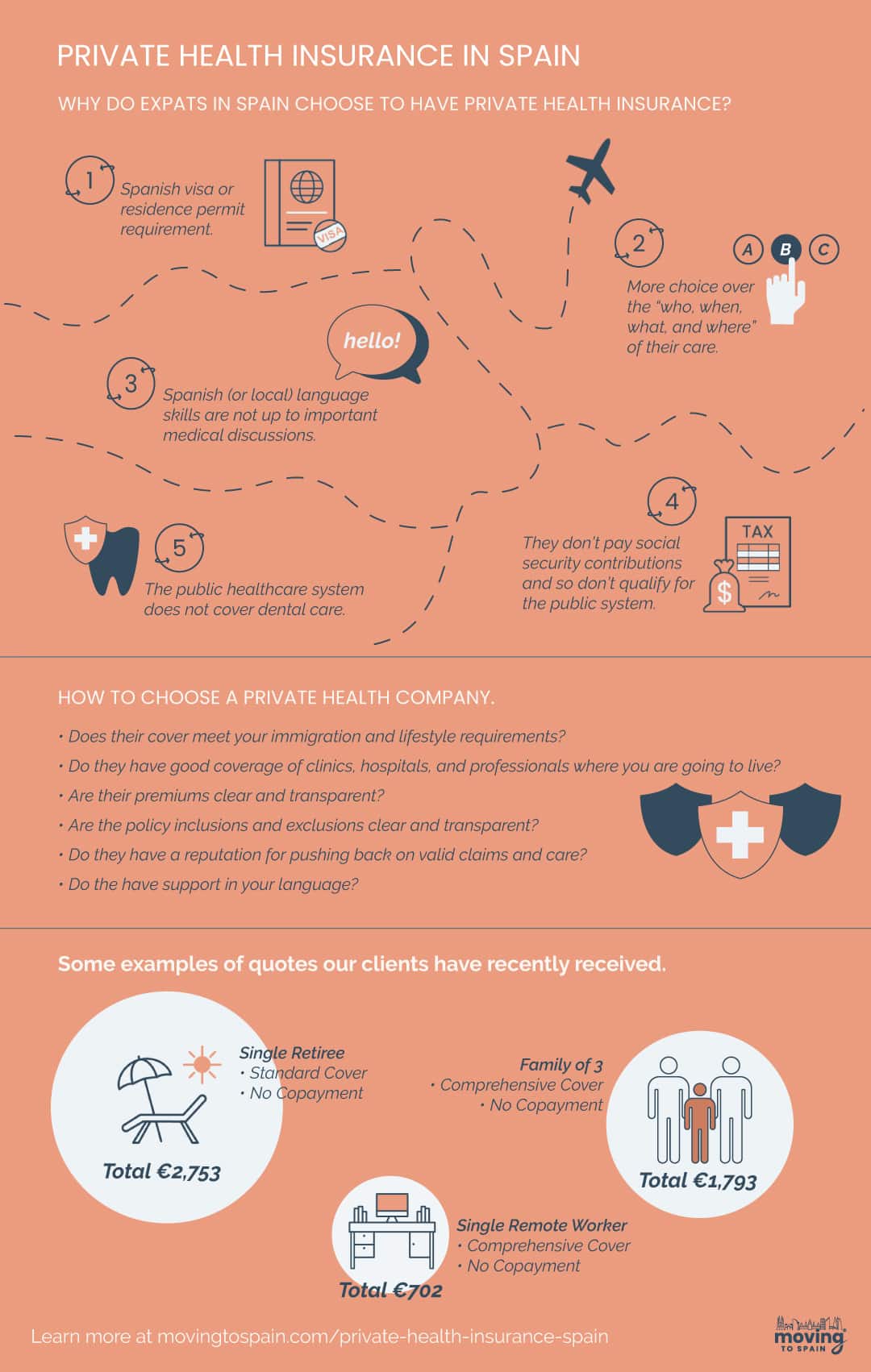

Why Choose Private Health Insurance in Spain?

Based on my experience living in Spain since 2015, there are 7 benefits of Private Healthcare in Spain for Expats.

- Your Spanish visa or residence permit requires qualifying private health coverage.

- You don’t pay social security contributions, so you don’t qualify for the public system.

- You want more choice over the “who, what, and where” of your care. You can select professionals based on your preferences, such as expertise in a particular medical field, location, or language proficiency.

- Private healthcare typically offers quicker access to specialists and faster scheduling of surgeries or treatments compared to the public system. And you have more flexibility in scheduling appointments and treatments.

- Many private healthcare providers in Spain have English-speaking doctors, staff, websites, and resources. If your Spanish (or local) language skills are not up to important medical discussions, it can make medical consultations and treatments stressful and put your health at risk.

- The public healthcare system does not cover dental care, risking significant out-of-pocket expenses for quality dental care.

- Ultimately, private healthcare offers you peace of mind, knowing you have prompt access to quality medical care in a language you understand, which can be incredibly reassuring when moving to Spain.

We’re delighted to use the fantastic Spanish public system for emergency care, standard medical issues, and prescriptions. However, for more severe or complex problems, we like to use doctors we know who speak excellent English in top-class facilities. Our Spanish is good enough to discuss car repairs with a mechanic, but nuanced discussions around our family health are best done in English! And our fabulous dentist (who our son trusts and is happy to see) is included in our policy.

2025 Cost of Private Health Insurance in Spain

Private healthcare insurance costs much less in Spain than in the USA or countries like Australia. Here are three examples of actual client quotes from our partners for 2025. And yes, they are annual policy amounts with no co-payments, and the policies all meet Spanish immigration requirements!

| Profile | Coverage Type | Annual Cost |

|---|---|---|

| Family of 5 (Ages 47 45 16 14 9) | Standard Cover | €2,652 |

| Family of 5 (Ages 47 45 16 14 9) | Premium Cover | €3,341 |

| Single Retiree (Age 75) | Standard Cover | €2,910 |

| Young Couple (Ages 33 and 23) | Standard Cover | €1,282 |

| Young Couple (Ages 33 and 23) | Premium Cover | €1,616 |

| Retiree Couple (Ages 64 and 63) | Standard Cover | €2,636 |

| Retiree Couple (Ages 64 and 63) | Premium Cover | €3,800 |

What 6 Factors Impact The Cost of Your Health Insurance Policy?

The amount you pay for your Spain health insurance policy will depend on five primary factors.

- Age and Health Status: Generally, the older you are, the higher the insurance premiums, as older individuals are statistically more likely to require medical services. This can mean higher prices for those retiring in Spain. Indeed, seniors may have difficulty finding cover and may need a Spanish company with specific policies for those over 75.

- Your current health status, including pre-existing conditions, can affect the average cost of private health insurance in Spain.

- Scope of Coverage: The extent of coverage significantly influences the cost. Comprehensive plans that include a wide range of medical services, such as specialist consultations, hospital stays, complex procedures, and dental care, will typically be more expensive than basic plans covering only essential healthcare services.

- Deductibles and Co-Pays: The structure of deductibles (the amount you pay out of pocket before insurance kicks in) and co-pays (the fixed amount you pay for a covered service) can impact the policy’s overall cost. Higher deductibles usually lead to lower monthly premiums but more out-of-pocket expenses when accessing care.

- Family Members Included: Including additional family members in your policy, like a spouse or children, will increase the overall cost.

- Discounts Through Referrals: Our insurance partners offer discounts or special offers to Moving To Spain clients. By using our quote tool, you can unlock these discounts, reducing the overall cost of your health insurance.

Remember: The cheapest health insurance for Spanish Residency might not be the best value for your family’s long-term health needs.

Need Spain Private Health Insurance?

We constantly monitor the market and recommend only insurers whose policies meet visa requirements for all of our clients and who are recommended by friends and the community.

one form – up to three quotes. EASY!

What Do Private Insurance Companies Cover?

So, what does a regular Spanish health insurance policy cover? We got a coverage list from the Standard Policy of one of our partners. The medical procedures and services this policy will cover are:

- Immediate access to private GPs, specialists, and emergency hospitals.

- Direct access to medical specialists with no waiting lists.

- Specialist treatments include oncology with chemo and radiotherapy, laser therapy, oxygen therapy, blood transfusions, physiotherapy, etc.

- If required, a private room for surgical and medical in-patient hospital visits (and a bed for a family member).

- ICU medical treatment.

- Psychiatric care.

- 24-hour emergency assistance

- Free choice of doctors and private clinics in our network.

- High-tech diagnosis methods include CAT scan, Nuclear Magnetic Resonance, vascular hemodynamic, and digital arteriography.

- All authorized medical tests are prescribed by one of our authorized professionals.

- Preventative medical strategies like annual checkups and second opinions.

- Medical travel insurance, including repatriation (up to 90 days a year).

- Family planning and childbirth.

- Dental cover including extractions and annual teeth cleaning

You do need to check your insurance plan for inclusions and exclusions. Our recommended Spanish private insurance companies offer clear and straightforward policy documents.

Best Private Health Insurance Options for Expats in 2025

When we first arrived in Spain, we used a large national insurer for our residency application. Our experience was so frustrating. Our Spanish was rudimentary, and their support and most of their medical staff only spoke Spanish or Catalan. While the GP we used was fantastic, one of the specialists and the dentist we used was sub-standard, to say the least.

Lesson learned! After a year in Spain, we did a lot of research and switched to a new provider, and we are still with them today.

So, we’ve polled Expats, trawled forums, and asked our clients for recommendations. From that, we’ve picked excellent private healthcare providers we trust to meet all ten factors for our clients.

With this easy form, you can get quick, no-obligation quotes for Spain’s best private health insurance.

10 Key Factors to Consider When Choosing Health Insurance

- Visa Suitability: If you need cover for your visa or immigration application, make sure the cover is valid. The Spanish Immigration Service has unambiguous guidelines for companies and covers that they will accept.

- Coverage Scope: Evaluate what types of medical services are covered, such as hospitalization, outpatient services, emergency care, specialist consultations, and specific treatments or procedures. Check the coverage for pre-existing conditions.

- Dental Care: Determine if dental care is included or available as an add-on. Dental coverage can vary significantly, so if dental health is a priority for you, look for plans that offer comprehensive dental services or the option to add dental coverage.

- Network of Providers: Investigate the network of hospitals, clinics, and doctors associated with the insurance plan. Ensure quality healthcare providers are near you, and check if your preferred doctors are in-network.

- Language and Communication: For some Expats, it’s crucial to have access to English-speaking doctors, medical staff, websites, and apps. Verify if the insurance provider offers services in English or your native language.

- Cost and Premiums: Assess the price, including premiums, deductibles, co-pays, and other out-of-pocket expenses. Balance these costs against the level of coverage and your budget.

- Policy Limits and Exclusions: Understand the policy’s limits, such as annual or lifetime caps, and be aware of exclusions, such as certain medical conditions or treatments.

- Customer Service and Support: Quality customer service is vital, especially in healthcare. Consider the insurer’s reputation for customer support, ease of filing claims, and assistance during medical emergencies.

- Additional Benefits and Features: Look for extra benefits or features that matter to you, like coverage for optical care, mental health services, alternative therapies, regular health checkups, or international travel coverage.

- Ethics and Company Reputation: Research the insurer’s track record for ethical practices, particularly regarding policy cancellations and handling claims. Choose a company known for fair and transparent dealings that doesn’t unjustly fight or deny legitimate claims. Get first-hand recommendations and reviews if you can.

Navigating Health Insurance for Visa Requirements

Most visas and residence permit applications require qualifying private health coverage. Raquel Moreno, our Spanish Immigration Lawyer partner, advises you to choose your policy carefully. She explains that consulates will only accept health insurance plans that are:

- Fully comprehensive with no co-payment.

- No waiting period, so the policy offers full cover from the date of your arrival in Spain.

- From an authorized insurance company in Spain.

- There are no excluded pre-existing conditions.

Americans moving to Spain require the same cover as any non-EU citizen.

Note: The consulate will not accept Travel insurance for any long-stay visa. It is only acceptable for a short-stay SCHENGEN tourist visa.

Which Spain Visas Require Private Health Cover?

Raquel confirms you’ll need private health coverage for all long-stay residence visas and residence permits. The visas include:

- Non-Lucrative Visa

- Digital Nomad Visa

- Golden Visa

- Student Visa

- Employee and Self-Employed Work Visas

You can use our easy tool to get multiple qualifying quotes from accredited private health insurance companies in Spain. If you have the right coverage, private health insurance in Spain offers exceptional value and care.

Health Insurance in Spain for Over 75-year-olds

Getting private health insurance can be challenging if you are over 75 years old. Many companies reject all applications from older Expats in Spain, but don’t despair. Our partner specializes in coverage for older applicants and accepts applicants up to 80 years old. We’ve sent them happy clients who have received qualifying cover for moving to Spain.

You should ensure you’ll get the care you need, so the policy provides broad and relevant coverage for senior health requirements.

Get a quote for Spain Private Health Insurance for Over 75s.

Remember: Insurance premiums increase with age, and policies may be more expensive than for younger people. This scaling is not unique to Spain; insurance companies worldwide work this way.

International Student Health Insurance Spain

We think there are three things that international students studying in Spain should look for in their private healthcare policy.

- Visa Requirements: Ensure your health insurance meets the visa requirements – see our guide to the Spain Student Visa for more details. This is non-negotiable, as having the right insurance is vital to your visa application. Look for policies that cover the entire duration of your studies and provide comprehensive medical coverage.

- Comprehensive Coverage for Peace of Mind: Choose a policy that covers a wide range of medical services, including doctor visits, hospitalization, emergency services, and mental health support. Having a policy that covers your health needs means less worry, allowing you to dive into your studies and enjoy the Spanish lifestyle. It will also give your family back home some peace of mind!

- Affordability and Value: As a student, managing your budget is crucial. Find insurance that offers the essential coverage you need at a price that doesn’t strain your finances. Look for plans with clear terms about deductibles and co-pays to avoid unexpected expenses.

- Support in Your Language: Navigating healthcare in Spanish when you first arrive can be a significant challenge.

Why A Pre-Existing Condition Doesn’t Disqualify You From Cover

A pre-existing condition is “any health condition that a person has prior to enrolling in health coverage” – KFF.

You’ll be asked about pre-existing conditions when applying for private healthcare in Spain. Many insurers reject your application or exclude cover for the condition, which makes it invalid for immigration. However, if you don’t disclose the issue and your insurer finds out, you could have a big problem. They can cancel your policy or refuse to pay for treatments.

We do have a partner that will cover applicants with pre-existing conditions. I asked them to clarify how it works.

“Our health insurance policies do not exclude pre-existing conditions; the pre-existing conditions are included and covered with suitable policies. The insurance premium that people pay depends on their medical review. Therefore most people pay an increased price for their pre-existing conditions.”

So, you will be covered, but you’ll have to pay for the increased risk the insurer has because of your pre-existing condition.

Get a pre-existing condition Spain Healthcare quote today.

Private Dental Insurance in Spain

Dental care is not covered by the public healthcare system in Spain. So, all dentistry and orthodontic care are user-pays. Some people pay for this out of pocket, but many use private dental insurance coverage. All of our recommended insurers offer dental care as part of a package, add-on, or standalone policy.

We strongly recommend buying this cover. Dentists can be expensive in Spain (and orthodontists always are!). Finding a great dentist covered by your insurance makes a massive difference. Our experiences have been mixed. Our first healthcare company recommended a dentist in our town. They didn’t speak English and suggested a bunch of work that seemed crazy. I got a second opinion from a dentist who doesn’t accept insurance (so we paid out of pocket), and he confirmed that much of the work was unnecessary. So, we paid for dental care until we switched insurers. We now have a brilliant dentist with annual checkups, and our policy covers all work.

How Does Private Health Insurance in Spain Compare to Public Healthcare?

Spain offers excellent healthcare, both public and private. Both systems have pros and cons, so we’ve compared the most important factors.

| Feature | Public Healthcare | Private Healthcare |

|---|---|---|

| Access and Waiting Times | Longer waiting times for certain treatments and procedures Average specialist wait times: 67 days | Quicker access to specialists and elective procedures Average specialist wait times: 7 days |

| Choice of Providers | Assigned doctors and hospitals within your local area. | Freedom to choose doctors, specialists, and hospitals, including private facilities. |

| Language Services | Possible language barriers for non-Spanish speakers. | Often includes English-speaking doctors and staff. |

| Coverage Scope | Comprehensive for most health needs; may lack certain services like dental care. | Broader options for services, including dental and optical care. |

| Costs | Funded through taxes, free at the point of use except for prescriptions. | Involves premiums; costs vary based on coverage and individual factors. |

| Convenience | Standardized services with a focus on wide accessibility. | More flexible appointment scheduling and modern facilities. |

Another Option

International Health Insurance (also called Expat Health Insurance) is a different product. And, if Spain is not your last or only Expat home, consider this option.

International Health Insurance policies are not country-specific. So, If you live in Spain and then move to Dubai, your cover moves with you. You don’t need to find a new insurer and reapply each time you emigrate.

These products are generally more expensive than local Spanish policies but offer excellent value for many serial Expats.

Check out more information on International Insurance here.

Ready to Choose?

Based on my years of experience, the right insurer offers peace of mind. Our initial insurer is a significant player that many lawyers recommend. Our experience was terrible – language was a constant issue, and some healthcare professionals were substandard. We struggled to even book appointments in some cases.

We moved to our current insurer and have been very happy since then. We advise getting independent recommendations, checking Expat forums for first-hand reports, and getting multiple quotes. Private health insurance in Spain offers exceptional value and care if you have the right coverage!

FAQ – Private Health Insurance Spain

What are the Key Benefits of Private Health Insurance in Spain for Expats?

The key benefits of Private Health Insurance in Spain are improved choices of where, when, and how you are treated. You have access to more facilities, your access to English-speaking healthcare professionals is more accessible, and wait times are shorter.

How Does Private Health Insurance in Spain Compare to Public Healthcare?

The Spanish public healthcare system is one of the best in the world. Our experiences have always been excellent, from emergency room care to vaccinations. However, private health insurance in Spain typically offers faster access to medical services, reduced waiting times compared to public healthcare, and flexibility in choosing doctors and hospitals. Private insurance has more English-speaking medical staff and covers services not fully included in the public system, such as dental care. While public healthcare is funded through taxes and social security and is generally free at the point of use, private insurance involves paying premiums.

What Should Expats Look for When Choosing Private Health Insurance in Spain?

Expats should look for private health insurance that offers comprehensive coverage, including for pre-existing conditions and a range of medical services. Choosing a plan with a broad network of hospitals and clinics, preferably with English-speaking healthcare providers, is essential. The cost, including premiums and out-of-pocket expenses, should fit within their budget. Additionally, you should evaluate the insurer’s customer service reputation, policy limits, and any additional benefits like dental or international coverage.

Which Spain Visas Require Private Health Cover (and the conditions to qualify)?

All long-term visas in Spain require qualifying private health insurance until you have public healthcare in Spain. This includes the Non-lucrative visa, Digital Nomad Visa, Golden Visa, and Student Visa.

The cover must be fully comprehensive and have no exclusions for pre-existing conditions – use this tool to get qualifying Spain private healthcare quotes.

Does Private Health Insurance in Spain cover Pre-Existing Conditions?

Coverage for pre-existing conditions varies among private health insurance providers in Spain. Some insurers cover pre-existing conditions with specific limitations or higher premiums, while others might exclude them. It’s crucial to carefully review the policy details or consult with insurance providers to understand the coverage for pre-existing conditions.

How Do Age and Health Status Affect Private Health Insurance Costs in Spain?

Age and health status significantly affect the cost of private health insurance in Spain. Generally, older individuals and those with pre-existing health conditions or higher health risks may face higher insurance premiums. When selecting a suitable private health insurance policy, you should compare different plans and consider these factors.

How much do you pay for health insurance in Spain?

In 2025, standard cover with a significant co-payment for a young person can be as little as €300 annually. Comprehensive cover with no co-payment for a 70-year-old could be around €2,500 annually. Remember: Private health insurance for Spanish residency or visa applications must have zero co-payments.

Do you have to pay for health insurance in Spain?

No, Spain has free universal healthcare for many Expat residents and all Spanish nationals. However, if you do not qualify for free care, you must pay for private medical insurance to live in Spain.

Can US citizens get healthcare in Spain?

Yes, Americans moving to Spain can buy private health insurance in Spain and sometimes qualify for free public healthcare.

Can US and UK citizens get free healthcare in Spain?

Only Americans and British citizens who pay social security contributions can qualify for free healthcare in Spain. Most Expats must pay for Private Healthcare in Spain as part of their visa requirements.

Do you need insurance to go to a hospital in Spain?

No, not in an emergency. In Spain, everyone is entitled to free emergency medical attention. Many private hospitals also accept direct payment for treatments.

Re: Health insurance

Last year (2022) my wife and I applied for NLVs which were approved but due to personal circumstances we had to cancel the application at the last moment. The Spanish consulate in London accepted our S1 forms for Spanish health care so we did not need to get private health insurance.

We are now in a position to move to Spain again and are thinking of making a fresh application.

Has anything changed re acceptance of the S1 ?

Hi John. Consulates have accepted an unregistered S1 in some cases. As The London Consulate accepted your S1 last time, I’d be relatively confident in using it again as there has yet to be any official communication of any changes. This advice comes with the caveat that the decisions of consulates can differ!

Hi Alastair,

Your website has helped greatly. Private health insurance was our major concern at our age. We look forward to utilizing some of your services.

Regards,

Randy Klein, USA

All the best the move, Randy. Regards, Alastair

Hi I have previously had thyroid cancer and type 2 diabetes would this exclude me from private health insurance

Hi Cheryl. One of our partners has a product covering pre-existing conditions; however, many companies in Spain won’t offer coverage. Be aware they will cost more (as the insurer carries more risk), but Spanish immigration authorities accept the policy for visa applications. I suggest getting quotes from our insurers (using the form) – it is zero obligation, and you’ll get a clear picture of your ability to obtain suitable private health insurance in Spain. All the best, Alastair

Are the cost examples above the monthly payments or yearly?

Hi Dave. All the examples given are annual policy premiums. Please use our free Spanish Healthcare quote tool for confirmation .Regards, Alastair

I have been trying to get educated as much as I can before starting the NLV process. The San Francisco Embassy has this note under the “Health Insurance” requirement section: “The health insurance must not have a deficiency-exclussion due to pre-existing conditions, copayment, or coverage limit; it must cover 100% of the medical, hospital, and out-of-hospital expenses.”

I got in contact with ASSSA (on of the companies you recommend) and due to pre-existing conditions we have they told us:

“If you may need any further treatments, operations or hospitalization related to the pre-existing conditions, it won´t be covered by ASSSA and you need to pay yourself because it is something you had before getting health policy with us.”

My questions are: are we wasting our time with the visa process since we will fail this requirement? or are there other insurance companies that do not discriminate due to preexisting conditions that can give us full coverage?

Hi Gerardo. Some policies will cover pre-existing conditions but are more expensive (as they carry more risk for the insurer). We’ve just signed a deal with a company that finds insurance for cases like yours – please use our standard Spain Private Health Insurance quote tool, and you’ll get a response from them (we promise we’ll update the website with this information in the next few days!). All the best, Alastair

Hi Alistair, I have been successfully on Home Dialysis for 2 years. Could I continue this in Spain? I cope at home but would need supplies delivered. It is our dream to continue our retirement, moving to Spain.

Thanks for any advice.

Sheila.

Hi Sheila. I’d suggest contacting our health insurance partners to discuss your requirements. They’ll be able to give you a clear answer on arranging cover and support for your medical requirements. Where you live in Spain may also have a bearing on the availability of these services. All the best, Alastair

Hi Alistair,

I am planning to move my family to Spain in June on a Digital Nomad visa. I currently have a company in Chile but work remotely. As I pay every year a 35% tax on my income in Chile, will that be credited towards the 24% flat tax that I would have in Spain? Many thanks,

Michael

Hi Michael – Spain and Chile have a double taxation treaty, so you should only be taxed once on the same income. However, where you pay tax and the amount will depend on where you are a tax resident and where you declare the income. Our Spanish Expat tax experts can advise you on the best approach. Cheers, Alastair

Hi, usually how long does it take to be approved for a private healthcare provider?

Also, if you are just visiting Spain and don’t have public or private- would you still be able to receive healthcare?

Thanks!

Hi Elaine. You can get a private insurance policy quickly approved if you provide all the required documentation. Spain will offer emergency health care to visitors in most circumstances, but only if the care is considered emergency. EU citizens with an EHIC can get care, and travel insurance will cover other situations. All the best, Alastair

Is it possible to pay for the health insurance monthly or do all companies require the premium be paid in full upfront?

Hi Laurie. Many policies have a monthly premium – however, if your policy is for a visa or residence permit it needs to cover the duration of the visa – most usually an annual payment in advance. All the best, Alastair

HI Alistair and Allison,

I am slowly going through your free material, as we are interested in Retiring from Portland, OR, USA to Spain in 2028. It is a few years off, but we want to do our homework to see if it will be possible for us.

In reading your Private Healthcare information, I did not see anything regarding prescriptions. Do private companies offer free prescriptions? What about new specialty medications? If they are out of pocket, are prescriptions cheap? Do you have any examples of costs?

Thanks so much for all your information. It is really helpful to see it all in one spot. Overall, when we started to think about this the information was patchy and overwhelming.

Mark and Bob

Hi Mark and Bob. Most private cover in Spain excludes prescriptions or has a small provision. For example, our current policy includes up to €200 per annum for our family of three. However, medication costs in Spain are generally much lower than in the USA, and generic versions of many pharmaceuticals are available and freely dispensed in Spain. We plan on comparing medication costs between the US and Spain later this year in an index, but until then, you can always contact a pharmacy in the area you plan to move to and ask them for the price of specific medications. All the best, Alastair

Hello, I filled out the form twice but only got one quote. I’m 67 and my husband is 72. Are there no insurance companies that will cover someone of his age?

Thanks

Kathi

Hi Kathi – apologies. Our other insurance partner had a technical issue and has yet to send the quotes we referred to them for a short period last week. They have resolved the issue, and you can expect a quote from ASSSA in the next day or so. Apologies for the delay. Alastair

We are nearing our one year anniversary in Spain on non lucrative visas. Because of our ages – 78 & 83- our private insurance is 8.000 euros and going to 10.000 a year in 2025 for the two of us. We are in a very small town in Galicia and having private insurance has not netted us English speaking doctors or the other benefits you often mention in your articles. We are very interested in the Convenio Especial which would save us thousands a year but are not clear from your articles if it meets the visa requirements. Since our private insurance doesn’t cover prescriptions or dental, it looks to us like the coverage is identical.

Hello. I am moving to Spain and need a private health insurance that covers multiple sclerosis. All insurances have rejected me. However, here it say that there are insurances that do cover existing conditions at a higher cost but it doesn’t say which. Coul you please tell me which private health nsurances cover pre-existing conditions?

Hi Camila. Please use our quote request form, and it’ll pass your request to the most appropriate option. As we say in the article, not everyone can get coverage. We cannot find coverage for some conditions, but we will try our best. Regards, Alastair