What Is The Spanish Non-Lucrative Visa?

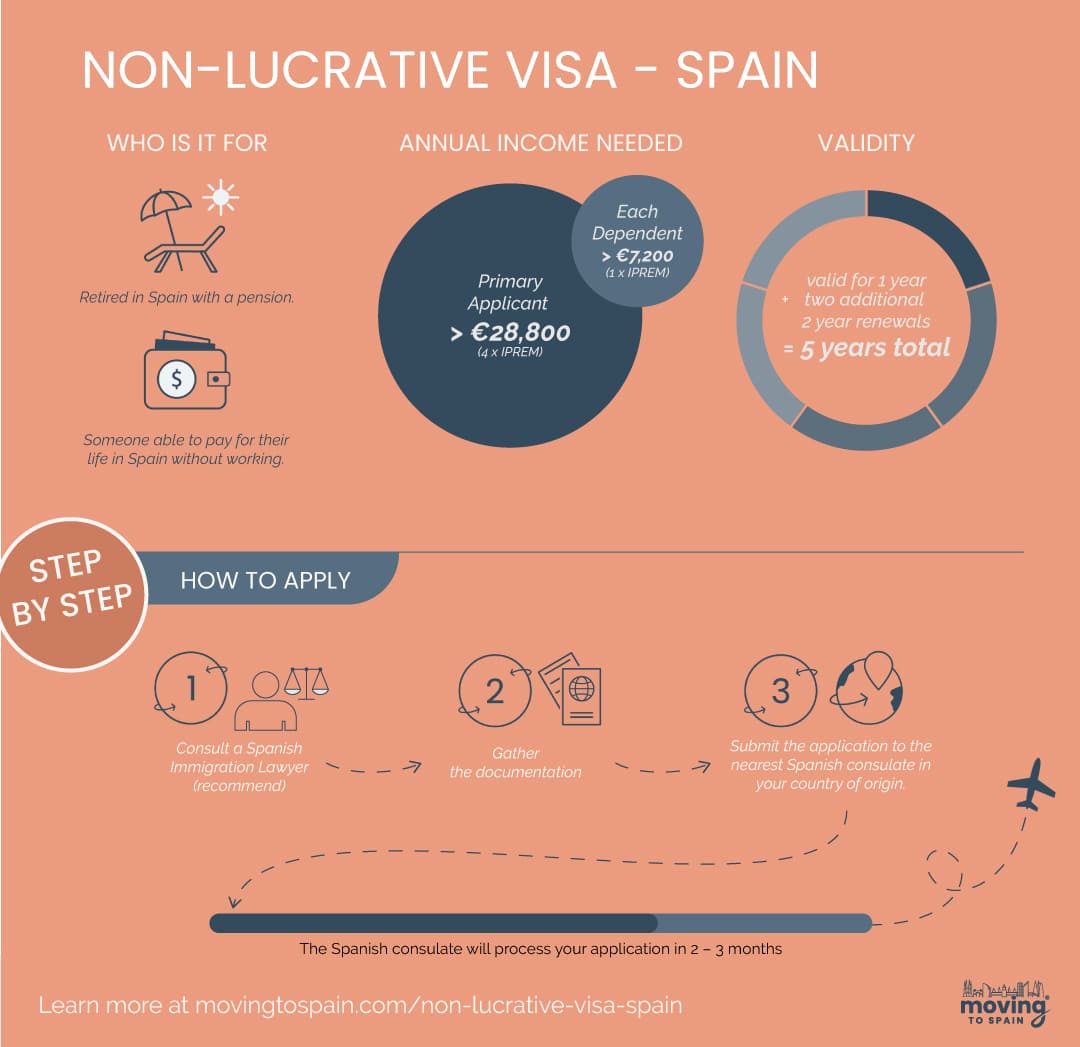

The Spain non-lucrative visa (NLV) is a long-term residency option for non-EU citizens who don’t plan to work in Spain. It is ideal for retiring to Spain as it requires passive income, such as pensions and investment income. For this reason, many people refer to the NLV as the Spanish retirement visa.

The Non-Lucrative Visa Spain Is Ideal If You Are:

- A non-EU/EEA citizen who wants to live in Spain.

- Retiring in Spain with a pension, annuity, investment income, or similar.

- Able to pay for your life in Spain without working.

Note: EU/EEA citizens don’t need a visa to live in Spain; however, there is a registration process for residency for all European citizens.

READ ALSO: Retire in Spain >> 2025 Visas, Health, Tax, Best Places & More

2025 Financial Requirements For The Spain Non-Lucrative Visa

You must show sufficient worldwide income or sufficient funds without work income.

- Primary Applicant > €28,800 annual income (400% x IPREM)

- Each Dependent > €7,200 annual income (100% x IPREM)

| Non-Lucrative Applicants | 2025 Minimum |

| Single Applicant | €28,800 |

| Applicant + 1 dependent | €36,000 |

| Applicant + 2 dependents | €43,200 |

| Applicant + 3 dependents | €50,400 |

Note: The Spanish government uses a figure called IPREM to determine this requirement. The 2025 annual IPREM is €7,200 or €600 per month. The IPREM for 2025 is unchanged from 2024.

Acceptable Income For Your NLV Application

The Spanish Immigration Department accepts passive income for the application, which is income obtained from sources other than employment. The Consulate will be looking for stable, regular, verifiable income that exceeds the financial requirements. Common examples are:

- Rental Income: Money earned from renting out property you own. This could be from real estate investments in your home country or elsewhere, provided you’re not actively involved in the property’s day-to-day management.

- Example Evidence: Income statements from a property management company that handles your rental properties in the United States.

- Investment Income: Earnings from investments, such as dividends from stocks, interest from bonds, or income from mutual funds. These should be investments where you’re not actively managing the day-to-day operations.

- Example Evidence: Dividend payment statements paid out from a diversified stock portfolio.

- Pension Income: Regular payments from retirement accounts or pension plans. This is considered passive because it’s based on previous employment and not contingent on current work.

- Example Evidence: Monthly 401(k) or IRA retirement account payment statements.

- Social Security Payments: Government-provided payments such as retirement benefits, disability income, or other Social Security benefits that are received regularly. So, you can use US Social Security payments for your non-lucrative visa application.

- Example Evidence: Monthly Social Security retirement benefit statements from the US government.

Note: If you need to work after moving to Spain, you can change your immigration status. However, you must wait at least 12 months. After one year in Spain, you can apply for a Spanish Work Permit or a Digital Nomad Visa.

Important: You’ll need to provide documentary evidence that your income qualifies. The exact documentation you need to show will depend on the income you are using to qualify.

“An example of the evidence, if it is a rental income, would be a copy of the property deed + rental agreement. If it is a pension, then the pension statement and bank statements may be necessary to show. We always have to submit documents regarding the origin of the income. These documents must be originals or correctly certified copies, depending on the documents and the Consulate.”

Raquel Moreno (LLB) – Spanish Non-Lucrative Expert Immigration Lawyer

Income That Will Be Rejected For A Non-Lucrative Visa Application

- Employment Income: Any money earned through employment, whether it’s from working for a company (either directly or remotely) or self-employment activities. The NLV is not intended for individuals who plan to work in Spain.

- Business Income: Earnings from actively managing a business or being self-employed, even if the business is operated remotely and not based in Spain.

- Temporary or One-Time Payments: Any income that is not regular or guaranteed, such as money earned from selling assets (e.g., stocks, real estate), gambling income, or one-time freelance gigs.

Can You Use Savings If You Don’t Have Income?

Our Spanish immigration lawyer partner advises yes, you can. However, you should have at least double the standard income requirement, so a minimum of €60,000 in an account in your name. The bank account does not have to be Spanish, but this is preferable.

Does owning a home in Spain help an applicant? According to the rules, the short answer is no; it does not. However, this is another area where different consulates assess things in their own way. Some consulates take the reasonable view that owning a property in Spain that you intend to live in means you’ll need less money to live. And with a lower cost-of-living in Spain, it makes sense to require less income.

How Long Is The Non-Lucrative Visa Valid?

The initial visa is valid for one year. You can apply for two additional two-year renewals for a total of five years. After five years, you can apply for Spanish permanent residency (which allows you to find work in Spain).

There is sometimes confusion about the terms’ visa’ and ‘residence permit’. You have 90 days (three months) from the date the consulate grants your visa to arrive in Spain. Once in Spain, your residence permit is valid for one year. You must apply for your TIE card and NIE once you are living in Spain.

Other NLV Requirements

Qualifying Private Health Insurance

You’ll need medical insurance that meets three criteria.

- Comprehensive coverage without a co-payment.

- There are no waiting periods for any conditions beyond the start of your NLV residence permit.

- The insurance company issuing the policy must be registered in Spain and approved and authorized by the Spanish Immigration Service.

You can get non-lucrative visa-qualifying Spanish Healthcare quotes from our chosen insurers here. They even issue qualifying medical insurance policies in Spain for over 75s and people with pre-existing conditions.

If you have had a diagnosis and/or treatment of a serious medical condition in the last five years, please determine your eligibility for Spanish healthcare coverage (without exclusions) before proceeding with the visa application process. – Greg C, a Moving to Spain client.

Additional Documentation

- A police record that shows no disqualifying convictions.

- A medical certificate to show you don’t have serious health issues. Refer to the template below for a list of issues that may impact you. Disqualifying conditions include serious infectious diseases managed by the WHO, drug addiction, and some severe mental illnesses.

Note: The Spanish consulate will only accept specific health insurance policies. The requirements for a non-lucrative visa application are very specific, and you must ensure you meet those standards. The company must be registered with the Spanish government, the policy must be fully comprehensive with no co-payments, and coverage must be immediate with no exclusions. You can read more in our guide to Health Insurance in Spain for Immigration.

Proof of Accommodation

Some consulates do require proof of accommodation, but this isn’t consistent. There are several ways to do this.

- Property Deed (Escritura) – If you own a home in Spain.

- Long-Term Rental Contract (Contrato de Arrendamiento) – Usually a 3 to 12-month lease.

- Letter from a Host – If staying with family or friends, they may need to provide a notarized invitation letter (carta de invitación).

- Hotel or Temporary Stay Booking – Some consulates accept this, but many require a more permanent solution.

Your immigration lawyer should give you clear guidance on the requirements of the consulate you’ll use to submit your application.

Note: You will need an address (and Padron) in Spain to get your TIE (ID card) when you arrive in Spain on the NLV.

Non-Lucrative Visa Spain Residency Requirement

Update: In 2025, the government passed legislation reinstating the 183-day minimum residency requirement.

The change the govermnet has made in May of 2025 means that, as before, you must live in Spain for a minimum of 183 days a year to meet the terms of the non-lucrative visa in Spain.

Raquel Moreno (LLB) – Spanish Non-Lucrative Expert Immigration Lawyer

If you live in Spain for 183 days (or more) per year, you’ll likely become a Spanish tax resident. As a Spanish tax resident, you’ll pay personal income tax in Spain, which is called La Renta.

Important: To qualify for permanent residency (PR), you must spend at least ten months per year for a consecutive five-year period in Spain.

How To Apply For Your Spanish Non-Lucrative Visa

We recommend using a Spanish Immigration Lawyer to ensure your application is approved. The application and documentation requirements are precise, and rejections are common.

Important: You cannot apply in Spain. You must submit your application to the nearest Spanish consulate in your country of origin.

Need help with your Spain visa or residency?

We partner with two highly rated, English-speaking immigration law firms in Spain — each thoroughly vetted for excellence in service, professionalism, and client satisfaction. Schedule a 30-minute consultation with them to explore your best options, understand the process, and get personalized answers to your questions.

Documentation Required For Your Application:

- Proof of income or savings (like a property deed, rental agreement, or pension statement).

- Health insurance policy certificate.

- Medical certificate and police clearance certificate.

- Valid passport/s and certified copies of each page.

- Visa fees (€80 – €500)

- Two copies of the completed visa application form

- Tasas Extranjeria – Modelo impreso 790

- EX-01 – Formulario

“You should have all your documents ready for your application, but not too soon. Some documents can only be three months old when you put in your application. Also, some must be originals, and others can be copies but only with an Apostille certificate. Foriegn language documents must usually be translated into Spanish by an approved translator.”

Raquel Moreno – Spanish Non-Lucrative Expert Immigration Lawyer

How Long Will The Application Take?

The Spanish consulate will process your application within 2-3 months. There is a second step to the application process. When you move to Spain, you must apply for a residence permit and a TIE (Tarjeta de Identidad de Extranjeros), also known as an Identity Card for Foreigners.

Please note: Several factors influence the processing time for your application. The consulate, the time of year, and the workload are important factors that are outside of your control. The most significant factor in your control is ensuring your application is correct and complete with all supporting documentation in order.

IMPORTANT: Some consulates make it very difficult to schedule an initial appointment, which can significantly impact your timelines. We had one client who was unable to schedule an appointment at the Miami consulate, and their timelines were significantly delayed.

Can You Include Family Members On Your Application?

Yes, you can include family members in your non-lucrative visa application. Direct family members are eligible as long as you meet the income requirement. This option means you don’t have to make a separate family reunification application.

Note: Unmarried couples (and unregistered civil partners) must apply separately, each showing 400% of IPREM, regardless of how long they have lived together.

How to Renew Your Non-Lucrative Visa in Spain

Your original non-lucrative visa is valid for one year. To continue living in Spain, you must renew your visa or change to another type of Spanish visa.

Here are the steps to renew the visa.

Note: We recommend using our Spanish immigration lawyer for the renewal to ensure that your application and documentation meet all the requirements. This preparation will ensure a simple renewal.

Timings to Renew Your Non-Lucrative Visa

1st Renewal>> You must apply for a renewal 90 days after the initial visa has expired or 60 days before your first one-year residence permit expires. This renewal will give you an additional two years of residency in Spain.

2nd Renewal >> You must apply for a renewal 90 days after your renewed visa has expired or 60 days before the end of your first two-year residence permit (so the end of your third year in Spain). This renewal will give you an additional two years of residency in Spain.

3rd Renewal >> You must apply for a renewal 90 days after your renewed visa has expired or 60 days before the end of your second two-year residence permit (so the end of your fifth year in Spain). This renewal will give you an additional two years of residency in Spain.

OR

Apply for Permanent Residency (PR) in Spain >> Your second two-year residence permit should grant you a total of five years of lawful residence in Spain. This entitles you to apply for permanent residency (PR) in Spain if you meet the requirements.

Documentation to Renew Your Non-Lucrative Visa

The documents you’ll need are similar to the ones you used to apply for your original visa, with a few additions and minor changes.

- A valid Passport for the primary applicant and any dependents

- A copy of your TIE (Tarjeta de Identidad de Extranjeros).

- Your Padron Certificate (only if you have changed your address since the initial application)

- 2 Copies of the EX-01 Application Form

- A Copy of the 790-052 Fee Form. (Showing you have paid the required renewal fee).

- Health Insurance that is valid for a residency application.

- If you have dependent school-aged children, you must have proof of registration at a school. Note that Spain currently does not recognize any form of homeschooling for this requirement.

- Financial statements demonstrating 400% of the current IPREM (principal applicant) and 100% of the current IPREM (every additional dependent).

Important: You cannot renew your Spanish NLV if you have any outstanding debts or issues with the Tax Agency (Agencia Tributaria or Hacienda) or Social Security services. If you have any outstanding matters or disputes with a government agency, you must address these during your renewal. Likewise, if you have a criminal record from your time in Spain or a matter before the Spanish courts, it can impact your renewal.

How to Apply for the Renewal

- Get an experienced non-lucrative visa lawyer to review all your documentation (not required but recommended).

- Use your Digital Certificate to submit your application online at Sede Electrónica.

How to Change To Another Immigration Option from Your NLV

After your first year, you have the opportunity to change to another immigration option in Spain. To do this, you’ll follow the standard application process for your chosen Spanish visa option.

Some popular options to change to include:

- Spain Self-Employed Visa

- Spanish Employee Work Permit

- Spanish Student Visa

- Spanish Digital Nomad Visa

After five years of non-lucrative residence, you can apply for permanent residency in Spain, which allows you to work as a freelancer, self-employed person, or employee within Spain or for an international employer.

Note: You must wait 12 months before you change your permission.

Spain Digital Nomad Visa vs. Non-Lucrative Visa Spain

The Spanish Digital Nomad Visa is an excellent option for non-EU citizens who want to work in Spain.

There are two significant differences between these three residency options.

- The Digital Nomad Visa allows professional activity for non-Spanish employers or clients.

- You can apply for a Digital Nomad visa while you are in Spain.

- The DNV uses the minimum wage as the financial qualification, while the NLV uses IPREM.

See more in our 2025 guide to Spain’s Digital Nomad Visa.

Note: Both visas are pathways to Spanish permanent residency and Spanish citizenship.

Next Steps

Are you ready to get started on your Spanish adventure? Find out if you qualify and how to apply in a 30-minute call with our Spanish immigration law partner. They’ve helped hundreds of people worldwide secure their non-lucrative Spanish residency visa.

Non-Lucrative Visa Spain – FAQ

What is a non-lucrative visa in Spain?

A non-lucrative visa in Spain is a long-term residency option for non-EU citizens who do not plan to work in Spain. It allows non-EU/EEA nationals to live in Spain if they are not working or earning active income. You must show you have sufficient passive income (such as pension or investment income) to support yourself while in Spain.

Who is eligible for a non-lucrative visa in Spain?

Non-EU citizens with sufficient financial means to support themselves and their dependents without needing to work in Spain are eligible for a non-lucrative visa. Retirees to Spain with a stable pension, individuals with passive income, or those who can demonstrate sufficient savings are typically eligible.

How long is the non-lucrative visa valid?

The initial non-lucrative visa in Spain is typically valid for one year. However, it can be renewed for two additional two-year periods, totaling a maximum of five years. After five years, it is possible to apply for Spanish permanent residency.

What are the financial requirements for the non-lucrative visa in Spain in 2025?

To meet the financial requirements, the primary applicant must have an annual income of at least €28,800 (400% of the IPREM), and each dependent must have an annual income of at least €7,200 (100% of the IPREM). The IPREM figure for 2025 is €7,200 per year, equivalent to €600 per month.

What income can I use for my Spain non-lucrative visa application?

You must show you have passive income that is regular, ongoing, and verifiable. This includes pensions, annuities, Social Security payments, investment income (such as rental income), and royalty payments. Unstable or one-off income sources (like gambling or asset sales), payment for work (salary, wage, commission, or fees), or business ownership income cannot be used.

Can savings be used to meet the financial requirements?

Yes, you can use savings to meet the financial requirements for a non-lucrative visa in Spain. If you don’t have a regular income, you should have at least double the standard income requirement (€60,000) in a personal bank account. The bank account does not necessarily have to be in Spain.

Can I work in Spain with a non-lucrative visa?

The non-lucrative visa does not initially allow you to work in Spain. However, after residing in Spain for at least 12 months, you can change your immigration status and apply for a Spanish work permit or a Spanish Digital Nomad Visa if you wish to work there.

How do I apply for a non-lucrative visa in Spain?

To apply for a non-lucrative visa in Spain, you must submit your application to the nearest Spanish consulate in your country of origin. The application process requires specific documentation, including proof of income or savings, private health insurance, a medical certificate, a police clearance certificate, and a completed visa application form.

What are the common reasons for Spanish Non-Lucrative visa application rejections?

In our experience, there are three main reasons for rejection.

1) Insufficient qualifying passive income.

2) The Spanish Consulate can see you work in the USA (or your home country) and believe you will work remotely from Spain. This can be from checking your regular income on your bank statements.

3) You cannot get qualifying private health insurance in Spain.

Can I use US Social Security payments to qualify for a non-lucrative visa in Spain?

Yes, US Social Security payments meet the Spanish non-lucrative visa requirements of being passive, stable, and outgoing.

What are the most common reasons for the rejection of Spanish non-lucrative visa applications?

Common reasons for rejection include:

– Insufficient qualifying passive income.

– The Spanish Consulate suspects you will work remotely from Spain based on your income sources.

– You can’t get qualifying private health insurance in Spain for your visa.

How long does the non-lucrative visa application process take?

The Spanish consulate typically processes applications in 2-3 months. Once you move to Spain, you must apply for your residence permit and TIE (residence card).

IMPORTANT: Some consulates make it very difficult to schedule an initial appointment, which can significantly impact your timelines. We had one client who was unable to schedule an appointment at the Miami consulate in time to meet their travel deadlines.

Do I need proof of accommodation for my NLV application?

Some Spanish consulates require proof of accommodation for non-lucrative visa applications, but this isn’t a consistent requirement. There are several ways to show proof of accommodation, including a lease, ownership of a property, or an official invitation from a Spanish resident.

Do I have to live in Spain for a minimum of 183 days per year on the Spanish non-lucrative visa?

Yes, there is a minimum residency requirement of 183 days per year for your non-lucrative residence permit. If you don’t meet this requirement, you will have issues when you try to renew your NLV. Living in Spain for 183 days per year will, in most cases, make you a tax resident in Spain.

You say if you are using savings for the non lucrative visa you should double to 60,000 Euros.

Is this per year?

For how long?

and after getting permanent residency does this figure reduce and if so to what amount?

Thank you

Hi Maurice. The 60,000 amount is for the initial two years of the visa, and you’ll need to show similar savings for the renewals of your visa. Once you have Spanish permanent residency, there are no longer financial requirements as you don’t renew the permission. All the best, Alastair

Hi Alistair.

So, you need €60,000 × 5 years then, until you get residency?

Hi Mike. You need to meet the financial requirements when applying and renewing. You could use the same savings for the application and renewals as long as the balance meets the minimum at the time of your subscription. Thanks, Alastai

I’ve been taking $15,000 a year from my Fidelity IRA (I’m not RMD age yet) for the last couple of years, and will again soon for 2024. Will that count toward my yearly passive income amount? Thanks!

Hi Margaret. Yes, the IRA will count as passive income from an investment. Your immigration lawyer will help to present the overall financial situation to give you the best chance of approval. All the best, Alastair

Hi,

I was self employed but now retired but not retirement age until next year, I have enough income to retire to Spain to live, I am applying for the NLV, and have the documentation required except for a P45 which you do not get when self employed can you tell me what the equivalent of the P45 what is acceptable .thank you.

Hi Barbera. The solution will depend on the consulate officer where you apply, as each has slightly different requirements. Two options are a notarized statement saying that you have retired and will not work in Spain or an official letter from your accountant stating that you have retired. Our immigration lawyer partner, Raquel, would be able to assist with your particular case. All the best, Alastair https://movingtospain.com/services/spain-immigration-lawyer/

Does income from remote work count for NLV? Like if I work for a company that lets me work remotely internationally.

H Oleg. No, only passive inbcome can be used to qualify for the non-lucrative visa. Remote work income can qualify you for a Spanish Digital Nomad Visa. Regards, Alastair

How much tax do I need to pay being a tax resident in Spain?

Hi Mary. There is no amount that classifies you as tax resident. Generally, if you spend more than 183 days per year or have significant ties to Spain you may be classified as tax resident. See here for more details. https://movingtospain.com/spanish-tax-system/ Regards, Alastair

I have gotten conflicting advice, perhaps you would be so kind to weigh in please. If I apply for a Non-lucrative visa (have USA Social Security exceeding qualifications), spend less than 183 days in Spain as we travel all over, do not wish to have a permanent address or apartment in Spain and just rent 4 months a year, will I be able to renew my visa? And pay no taxes or other annual expenses beyond rent? We did this in 2017 to travel Europe all year, and did not try to renew, but I fear we would not be able to apply and renew under the newer guidelines. Thank you in advance.

Hi Robert. The NLV stipulation is that you spend a minimum of 183 days in Spain in order to renew. You’ll need to renew after one year, meaning you’ll probably be classified as a resident in Spain for taxation. Regards, Alastair

Sorry but the replies above to the tax related questions were not clear. Can you please clarify: if someone gets their NLV based on (1) passive rental income, (2) retirement savings income such as IRA distributions, and (3) dividends in the USA, and begins living permanently in Spain, can they expect to continue paying taxes in the USA as normal, or will they expect to eventually begin paying Spanish taxes? I understand there is a double taxation treaty in place.

Hi – Where you pay tax depends on your tax residency, which is defined differently from where you live (physical residence). Once you live in Spain for more than 183 days per year, you may become a resident in Spain for taxation. Being a tax resident in Spain means you’ll need to submit a tax return in Spain and will pay some taxes in Spain. So, if you are living permanently in Spain, in most cases, you’ll pay tax in Spain on your US income. Generally, taxes withheld in the US can be used as a tax credit in Spain. Regards, Alastair https://movingtospain.com/spanish-tax-system/

Hello – my wife and I are interested in moving to Spain. We have sufficient savings to cover the necessary minimum’s for the NLV, but while I am fully-retired, my wife still works 25-30 hours/month and she wants to continue doing that after we move. For which visa should we apply?

Hi Jim – as a non-lucrative visa holder your wife should not be working in a paid position (in Spain or abroad). Given the complexity of your situation I’d suggets meeting with our immigration law partner to choose the best option for you both. All the best, Alastair https://movingtospain.com/services/spain-immigration-lawyer/

Thanks for info. My husband and I plan on relocating to Gran Canary islands in the next few months. We are US citizens and will apply for a non lucrative visa. Staying over 90 days. We have Tricare insurance since I’m retired Navy is that ok?

HI Kenneth – I’ve had a quick look at the Tricare website, and my understanding is that they won’t cover medical expenses if you are living in Spain. That means you’ll need local health insurance in Spain for your NLV application. All the best, Alastair

Mr Alastair Johnson,

Please tell Kenneth to keep Tricare Military Retirement Health Insurance. Thete is a Naval Base in Rota Spain where he and wife may go to clinic on base. It is important that Kenneth and wife also obtain private health insurance in Spain.

Thanks for this Anya – @Kenneth – please feel free to confirm this with the US Navel base in Rota.

I’m a Brit living in US for last 10 years. My wife is US Citizen. For the Spain visa I need a police check, is this from country where I permanently live I.e. US or from UK? I am a U.S. permanent resident not a US citizen.

Hi Mark. The police check is from where you have lived for the last five years. The exact working from the Spanish immigration website is “Certificate of criminal record dated no more than six months before the application date, stating that applicant does not have criminal record where they have resided for the past five years.” Regards, Alastair

Hi Alastair

My husband and I are about to submit our application for a NL Visa and have more than the qualifying savings, however, as we cannot rent our house until we move to Spain – how do we prove what the passive income expected from the rental of our home? Also, we have not “officially” retired. Thank you

Hi Audrey. The NLV assumes you will not be working in Spain, so you should be careful in your choice of visa and how you manage your application if you will be working while in Spain. While the Spanish immigration department does like to see historical passive income, if you have sufficient funds, you can make your application meet the requirements. A good Lawyer may give you a path to include predicted rental income in your application, but you can’t rely on that for your approval. All the best, Alastair

Hello Alastair,

I am going to retire in Spain after 65 from Canada. My pension will be 2400 euro/month.. If I have Non-Lucrative Visa do I have access to Public Healthcare?

Hi Vladimir – the NLV requires private health coverage, and you won’t be eligible for public healthcare as you are not making eligible social security payments. You can see more in our Spanish Healthcare guide. All the best, Alastair

Hello there,

We are Australian retired from the Australian government.

We are about to apply for NLV and wondering if we do need a NIE and a lease agreement before hand.

We do cover the financial requirements.

Many thanks.

Hi Broady – You don’t need a NIE or a lease for your NLV application. They’ll be a part of your padron and residency card process when you arrive in Spain. Our Spanish immigration lawyer partner can assist you with the NLV application and the later residency steps if required. All the best, Alastair

My wife and I are both dual-national (US & UK) citizens… I am now retired and she retires in 2025. After she retires we plan to spend 3-5 months per year living in Spain, which would not meet the 183-day minimum stay for an NLV. What is another “retiree” visa available that would allow us to remain in Spain for 3-6 months?

Also, due to her job with the USG, we are now living in Germany since 2021…. so, for a Spain visa, should we get a police report from Germany, the US, or the UK? (We have each lived in the both UK and the USA for over 15 years.)

Hi Marc – With your situation’s complexity, I’d suggest speaking to an expert immigration lawyer nearer to your wife’s retirement to ensure you have up-to-date advice. The Spanish immigration service requires police clearance from all countries you have lived in over the five years before your application. All the best, Alastair

As an owner of a Canadian incorporated business, who wants to stay in Spain longer than 90 days but less than 184, is the digital nomad visa my best option? I will not have “income” while in Spain, but I may make telephone calls, send emails, etc., regarding my business activity in Canada while I am in Spain. Is this considered “working” in Spain?

Hi Mary. That is a grey area, and it probably could be argued that you are not working, per se. But be aware that both the Digital Nomad Visa and Non-Lucrative Visa have 183-day minimum stay requirements to renew your immigration permission. Our immigration lawyers would happily discuss your situation and help you pick the best option. All the best, Alastair

My husband has a Eu passport (Ireland) and i am a British passport holder. Therefore for us to retire (don’t plan to work) and stay in Spain longer than the 90 days, is it just me that has to apply for a NLV as a primary ie, show income of 28,800 or 60K in euro savings?

As an EU passport holder , what visa if any does he have to apply for? Are there no restrictions at all to reside and work?

Is there any other route for me? can he sponsor me in some way or is it simply NLV ?

Hi Karen. As an EU passport holder, your husband can retire to Spain without a visa, but there is a process he needs to follow. As a spouse of an EU passport holder, you can also get residency without a visa. Please see our article on Residency in Spain for EU citizens for more details. Alternatively, book a consultation with our Spanish immigration law partners – they have extensive experience helping EU citizens with non-EU family members navigate the paperwork and process of Spanish residency. All the the best, Alastair

Hi. My family is planning to apply for NLV. Isn’t that for the financial requirement, one only needs to fulfill the required amount for 1 year since the visa is for 1 year initially which means ~30k Euro savings? Also, can shares of stocks (publicly listed) be used for this requirement e.g. 30k euro value of shares?

thanks

Hi Rod. For the initial visa, you’ll need to show €28,800 (400% x 2024 IPREM) of passive income. If you are using savings (as opposed to income), our Spanish immigration lawyer partner suggests a minimum of twice that amount (so €60,000). I’d recommend meeting with them if you can’t clearly show the income amount to ensure your application will be approved. All the best, Alastair

We want to apply for the NLV for Residency in Spain as a married couple, but although we have a joint savings account of £44,000, my husband’s additional state pension together with private pensions is much higher than mine at £15,500 pa against mine which is only £4k pa basic state pension. Do they take a joint savings account into account towards the iPrem for each individual Visa Application or are the financial sources treated as a family income in the case of both husband and wife applying for Visas together ?

Hi Janet. The Spanish government sets limits to ensure Expats can financially support themselves, so they look at your entire financial situation. As a couple, your income requirement is €36,000, so you don’t meet the income threshold, but your savings may change the equations somewhat. Given the complexity, I’d suggest you meet with a good Spain Immigration lawyer to give you the best chance of success. All the best, Alastair

I am professional bettor with substantial savings. My question is, can i bet in Spain (online or in land based bookmakers) with this type of visa. Does that count like lucrative activity or gainful work.

Hi Vladan. I’ve queried this with our Spain Immigration Lawyer partner, and her response was: “In my opinion this is not a professional job, as he does not need to be registered as a self-employed for that (nor issue invoices, etc.). So, this should be considered passive income. However, to apply for the visa, he needs to show some source of passive income. This is a very unstable income, so it would not be convenient to use this as a source of income, but the savings, yes.” All the best, Alastair

I am retired from the USA and easily meet the savings requirement also I full time travel around the world and do not plan to go back to the United States anytime soon, currently me and my Filipina wife are in the Philippines can I apply at the Spanish embassy here in the Philippines? Also is my spouse eligible to come

with me to Spain with her Philippine passport?

Hi Jason. You need to apply for the NLV in the country of your legal residence. So, if you are resident in the Philippines you can apply there, if you are still a US resident you’ll need to return and apply in the US. You can include oyur wife on your application and, when approved, you can head to Spain. All the best, Alastair

Hi Alistair. Is it true that you cannot have an outstanding mortgage in the US to apply for the NLV?

Hi Christopher – I’ve checked this with our immigration partner, and it is a qualified answer. Remember, each Spanish consulate can interpret the regulations in slightly different ways. Our partner’s experience is that only the Los Angeles consulate sometimes flags a US mortgage as a reason to reject an NLV application. If you do have a mortgage, it’ll be worth chatting to our partner to ensure your application is set up to succeed. Thanks, Alastair

My wife and I are physicians in the US who would like to live in Spain for about a year. I would like to travel back to the US every 2 months or so to work for 1 week each time as a contractor. Since I would not be working in Spain and would not be doing remote work, would I still be able to get the NLV? We have adequate savings and would not utilize this income in our application.

If not the NLV, is there a visa option that would fit our situation better?

Hi KK – given the description of your circumstances, the NLV may be a good fit if you have sufficient passive income/savings to meet the requirements. However, as this is not clear-cut, I suggest meeting with our immigration lawyer partner to discuss how best to approach your move. All the best, Alastair

Alastair, can you apply for the non lucrative visa through the Spanish consulate in any USA city? Plz., advise.

Hi José – you need to apply to your designated consulate – each US State has a specific consulte. All the best, Alastair https://www.exteriores.gob.es/Embajadas/washington/en/Embajada/Paginas/Consulados.aspx

Hi Alastair, going as a married couple our pensions fall under the amount needed so it would be savings based. As we still have income from our pension, is the 60k required reduced cause of this?

Hi Mark. The Spanish government is looking at your entire financial situation, so a combination of income and savings may meet the requirements. With these more complex applications, we suggest you speak with our immigration lawyer partner, who’ll help you position your application in the best possible way. All the best, Alastair

I’m curious as to exactly when, after moving to Spain on an NLV, one becomes a tax resident. Is it on day 183 of your first year? Day one?

I plan to sell an investment property but don’t want to pay capital gains in the US AND Spain.

My main income would be from a public school teacher’s pension. approx $90000 USD. I know I have to pay US tax on that- would Spain also require a bite?

Hi Matt – this advice is general and does not address your specific situation as I am not a qualified tax expert. It would be best to speak to our tax or financial planner partners to get great advice on your specifics. Generally, you pay Spanish tax for the entire year you become a tax resident in Spain. So, for example, if someone moved to Spain in November 2023, they’d pay the 2023 tax in their country of residence but the 2024 tax in Spain as they’d pass the 183-day threshold during 2024. Spain and the USA have a double taxation treaty, so income is never taxed twice. When you sell your property and when your tax residency changes can significantly impact taxes owed. We do advise getting advice as soon as possible. All the best, Alastair

Hello, Alastair! I am currently drawing my late husbands pension and it will JUST cover the minimum required monthly passive income requirements. Will the fact that it covers the requirement at EXACTLY the required amount be a problem? I have plenty in savings and by the time I apply it will be even more.

Also, does Spain follow the normal European progressive tax system or is there any tax incentive for US Expats? Thansk!

Hi David. The Spanish immigration department looks at your overall financial position, so savings will bolster your application. I suggest you chat with our immigration lawyer partners to ensure your application accurately reflects your comfortable resources. YOu can check out our guide to the Spanish Tax System here or our guide for Americans moving to Spain for guidance on your potential tax liability. All the best, Alastair

Hi Alastair, the information you provide is excellent. But I would like to ask the following:

If we purchase a property in Spain before we have a visa, do we need an NIE to do so and once we have a property, do we still need to show that we have 60,000 euro?

We are retired Australians with not a lot of financial savings but do get the Australian pension.

Thank you

Hi Narelle. You´ll need an NIE, but that is easy to get with some support. You´ll need to show that you can support yourself so the Spanish immigration service can look at your entire financial situation. Ideally, you have the full passive income amount (for the two of you, €36,000 per annum from your pensions and other investment income). Alternatively, the €60,000 savings is also accepted in most cases. If you have bought a home, then your expenses will be lower, and some consulates may look at this, but it is your overall situation they are assessing. For any application like this we recommend speaking to our Spanish immigration lawyer partner. All the best, Alastair

I was married in morocco 28 years ago so my marriage certificate was in arabic and we have it also translated to english…would we need a new one..or just one translated to spanish

Hi Debbie. The standard for Spanish immigration is that key documents must be under three months old and translated into Spanish. In some cases, the Apostille certification is required. Our immigration lawyer will assess your particular requirements. Thanks, Alastair

Hi Do I need to filling EX-01 and 790-052 forms on English or in Spanish? As these Forms in Consulate Website show in Spanish.

Hi Tina – different consulates have different requirements. Our immigration lawyer partner can assist you, or you should check with the consulate directly. All the best, Alastair

Thank you for this informative site. I see the Spanish Immigration Department requires the original passport. Do I have to submit my actual passport with the documents — disappearing into an office? Or does someone just examine the passport in front of me and immediately hand it back…further processing relying on the certified photocopies?

I’m reluctant to relinquish my passport to a month-long process where things can get delayed or lost.

Thank you,.

Hi Barbara – You will need to submit your passport. I’ve yet to hear of a single client using our immigration lawyer partner with a misplaced passport. All the best, Alastair

I am a prime candidate for an NLV, and have received one about 5 years ago. That said, I have a small Etsy shop that will bring in some income. And possibly while there, I’d get a few contract-based work opportunities (likely back in the USA). Given it is insignificant relative to the amount of money required to live in Spain, would this be an issue? And how would anyone know? Will the Spanish government audit me if I renew the NLV?

Thanks!

Hi Jake. This is a bit of a grey area, and while you should report all global income in your Spanish tax return, that tax return doesn’t make up part of the documentation to renew your NLV. You can meet with our immigration lawyer partner, who can assess your eligibility and options. All the best, Alastair https://movingtospain.com/services/spain-immigration-lawyer/

For Non-Lucrative Visa form the US, does the cost of living in Spain, such as mortgage or rent taken into account against (or subtracted from) the required annual passive income?

Hi John. No, you just need to show 400% x IPREM or €28,800 of income. The assumption is that that amount is sufficient to cover your expenses. All the best, Alastair

I’ve heard that the difficult part of the process is actually getting an appointment with a consulate in the US. The closest one to me is in San Francisco. Have you heard of this issue and is there any workaround? Thank you

Hi Brian. Yes, getting an appointment with the consulate can be tricky sometimes, whereas it is simple for others. Our partners can advise and assist with San Fran and other US consulates. Also important is ensuring that your application is 100% correct before submission so there are no additional delays. All the best, Alastair

What is the current status (as of Nov-2024) of residency requirement (183 days) for the Spanish NLV? also is there a requirement to maintain a Spanish address or phone number for the 5 years of NLV residency?

Hi Nav – this is still a grey area with the ruling still not being clarified by the government. However, you should expect to show you’ve been a resident of Spain when you come to renew your residence permit, as we think that is the most likely outcome. All the best, Alastair

Regarding the medical certificate: The text in the article says “Disqualifying conditions include…some severe mental illnesses” but the template for download says simply “mental illness.” Is a history of major depression a disqualifying condition?

HI Lee – no, major depression is not a disqualifying condiiton. All the best, Alastair

The 2005 International Health Regulations (IHR) states “you do not suffer from any disease that could pose a serious public health risk” so thast covers mental health conditions that mean the person is

– Is currently a danger to public health or safety,

– Is severely impaired in ways that would prevent them from functioning independently,

– Or the condition involves serious violent or psychotic features and no treatment plan is in place.

Thanks very much.

I am a retired Inspector General of Police. I have a savings of Euro 70000 sitting in my National Savings Centre account. I get a pension monthly of Euro 1694. I an 75y.o. I want to spend my retirement days in Spain. I love the culture language happy spirit and what have u. I have few questions Will my money that is the savings and monthly pension be required to be transferred to Spain. Will it be taxed cos there is no tax in Pakistan pensioners. How can I get a private health insurance while sitting in Pakistan I will have to be in Spain to complete the process, plz advise thanx

Hi Saleem – You’ll need to chat with a Spansih tax expert as only some pensions/retirement programs are exempt from Spansih taxation. For private health insurance, you do not have to be in Spain to get coverage before you arrive. You can get qualifying quotes here >> https://movingtospain.com/services/spain-health-insurance-cost/. All the best, Alastair.

I am currently a legal resident of Spain with the Non-Lucrative Visa and have been for the last four years. My renewal next year will be for the 5 year NlV. What are the financial requirements at that time?Does the amount of savings or threshold for passive income increase?

Hi John. The limit is technically lower – you need to show you can support yourself in Spain so showing the current NLV minimum will be fine in most cases. All the best, Alastair

Hi I read above that one does not need to spend more than 183 days to maintain this visa. Other sources mention that one must spend more than 183 days. What is the current legal requirement? Can I spend less than the 183 days (and not be a resident for Spanish tax) and still maintain/ renew the NLV?

Hi Salman. In 2025, the government amended the legislation to reinstate the 183-day minimum residency requirement. This change means you must live in Spain for a minimum of 183 days to renew a NLV. We’ve updated this article to reflect this change. All the best, Alastair