Qualifying Health Insurance in Spain for over 75s can be a problem when getting a visa. And if you’re looking to retire in Spain, the two most popular immigration options require qualifying health insurance. We’ve solved this problem for hundreds of clients with policies written up to the age of 99. Read on to find out how to get quality coverage and competitive prices.

Do all Spanish Private Health Insurance Companies Cover Over 75s?

Only selected Spanish insurance companies will offer policies for those over 75. And, of the few that do, some only write policies with exclusions, meaning the policy is useless for a visa application.

You can get a quote for a qualifying policy from our partners, who specialize in over 75 and pre-existing conditions. They offer policies from some of Spain’s largest insurance companies to people up to the age of 80.

NOTE: The DKV popular policy option for people aged 80+ has been suspended by the company for the moment. This means that we do not have an option for anyone aged more than 80 at present. We’ve been assured that the policy will be back online soon, so please still send us a quote request, and we’ll put you on a waiting list. As soon as the DKV option becomes available (or we identify another option), we’ll send you a quote.

Need Spain Private Health Insurance?

We constantly monitor the market and recommend only insurers whose policies meet visa requirements for all of our clients and who are recommended by friends and the community.

one form – up to three quotes. EASY!

While we can’t guarantee that every applicant will get coverage, most Moving to Spain clients that we refer to our partners do have successful outcomes.

Note: We’ve had reports of companies and agencies telling people that insurance for over 75s in Spain is not possible. This is simply untrue.

Why Do Seniors Choose Private Health Insurance in Spain?

There are five significant reasons seniors request quotes from us for private health insurance in Spain.

- You need insurance coverage as part of your visa or residency application or renewal.

- You don’t qualify for the public health system in Spain.

- English-speaking medical professionals and support give you peace of mind.

- Short wait times for elective procedures and specialist consultations are essential.

- You want control over the “who, what, and where” of your care.

Which Visa And Residence Permits Require Private Medical Insurance?

Most long-term Spanish visas and residence permits require a qualifying policy. These include the two most popular options for seniors moving to Spain.

What Are The Immigration Department Requirements?

The Spanish Immigration Department has seven requirements for a visa or Spanish residency permit application.

- No Exclusions for Pre-existing Conditions: Spain’s immigration authorities require a policy that covers pre-existing conditions without exclusions or waiting periods.

- Full Coverage: It should cover many medical services without significant limitations.

- No Co-payments: The policy should not include co-payments.

- Coverage for All Territories in Spain: The policy must be valid nationwide.

- Validity Period: The insurance policy must be valid for the duration of the visa or residency.

- Issued by an Insurer Authorized to Operate in Spain: The insurance company must be licensed to operate within Spain.

- Documented Proof in Spanish: Applicants must provide documented proof of the insurance policy in Spanish.

Navigating Pre-Existing Conditions

A pre-existing condition refers to any medical issue or illness diagnosed or treated before joining a new health insurance plan.

Spanish private health insurers evaluate these conditions with approaches that may differ from those in the US with three possible impacts.

- Potential variations in premiums.

- There is a possibility of certain conditions being excluded from coverage.

- The imposition of waiting periods for treatments associated with these conditions.

Note: Items 2 and 3 will mean you cannot use a policy for a visa or residency permit application or renewal.

For more information, see our guide to Health Insurance In Spain With Pre-Existing Conditions.

Evaluating Your Health Insurance Options for Over 75s

When choosing an insurance provider, you should consider more than just who will give you coverage. And, for seniors, these items matter even more.

- Comprehensiveness of Coverage: Look for plans that offer extensive medical care, including specialist visits, hospital stays, and emergency services. Other things to look for are preventive medicine, dental care, and diagnostics.

- Pre-existing Condition Policies: How does your policy cover pre-existing conditions?

- Premium Costs: What is the annual cost of your Spanish health insurance policy payment? Does it have co-payment and limits?

- Waiting Periods: Some insurers impose waiting periods for specific treatments. Make sure these don’t negatively impact your immigration or healthcare needs.

- Network of Providers: Check the insurer’s network of hospitals and doctors to ensure it includes high-quality facilities and specialists near your new home in Spain.

- Customer Service and Support: Find insurers known for excellent customer support, particularly those offering services in English for Expats.

Our partner has exceptional feedback on all these metrics from many happy US and UK clients.

DKV goes a step further by extending coverage to clients up to the age of 99, providing a valuable option for individuals who may struggle to secure coverage due to their age. On the other hand, Asisa extends coverage up to the age of 65, offering another avenue for individuals seeking comprehensive insurance solutions.

Ciaran O Toole – Spanish Health Insurance Expert and Moving to Spain partner

NOTE: The DKV popular policy option for people aged 80+ has been suspended by the company for the moment. This means that we do not have an option for anyone aged more than 80 at present. We’ve been assured that the policy will be back online soon, so please still send us a quote request, and we’ll put you on a waiting list. As soon as the DKV option becomes available (or we identify another option), we’ll send you a quote.

Steps to Take After Choosing a Plan

Once you have your quotes and you’ve selected a plan, you may need to complete some steps.

- Review Your Policy Details: Thoroughly check the coverage, exclusions, and benefits to ensure it meets your needs. Confirm the policy start date and make sure it aligns with your visa or residency timeline.

- Complete Any Pending Medical Exams: Some insurers might require a medical examination before finalizing the coverage. Schedule and complete any required health check-ups promptly.

- Submit Necessary Documentation: Provide your insurer with all requested documents, such as identification and proof of residency status.

- Set Up Payments: Arrange payment methods for your premiums. Most insurers offer direct debit from a Spanish bank account.

- Download Your Insurer’s App or Access Online Services: Many Spanish health insurers offer digital platforms for managing appointments and accessing health records.

- Carry Proof of Insurance: Keep a digital copy of your insurance card and policy details on your phone, or keep the physical card handy for easy access.

- Understand How to Make Claims: Review the process for submitting claims, including necessary forms and timelines. Know which services require upfront payment and which are direct billing.

- Emergency Services Information: Identify emergency services covered by your plan and how to access them. Save emergency contact numbers provided by your insurer.

How to Use the “Moving to Spain” Health Insurance Quote Tool

We have researched the private health insurance market and chosen four companies we think are the best value, meet visa application requirements, and provide great medical services. We have then partnered with them to ensure that as a Moving to Spain client, you get access to great discounts and specialist support. We don´t use brokers, which means any query goes directly to a licensed office of the insurer for quotes and support.

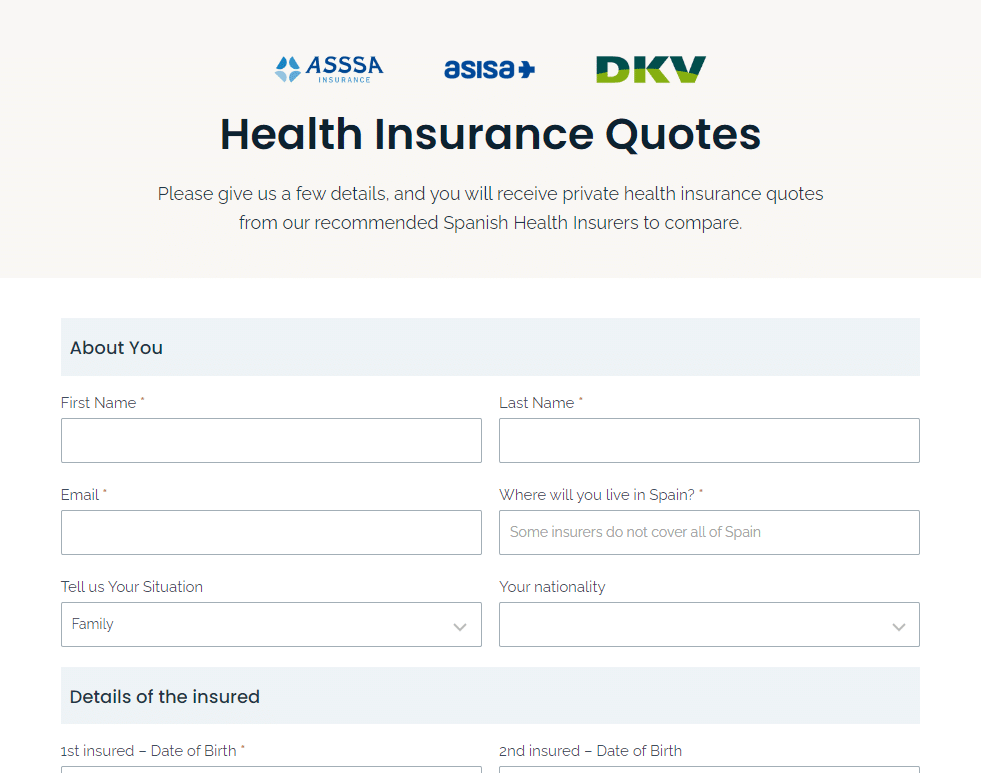

Fill in one simple form (see a photo of the form below) to get up to three health insurance quotes that you can compare.

Being Over 75 doesn’t mean you cannot get Private Health Insurance in Spain

Moving to Spain is attractive for people of all ages. Many people worry about qualifying cover for visa and residency applications, but for most people, cover is available. We’re delighted to have a great solution for Health Insurance in Spain for Over 75s.

FAQS – Health Insurance in Spain for Over 75s

Do all Spanish private health insurance companies cover individuals over 75?

Only a select number of Spanish insurance companies offer policies to those over 75, often with specific conditions or exclusions that could impact visa applications. It’s recommended to seek quotes from partners specializing in coverage for this age group and those with pre-existing conditions.

Why do Expat seniors choose private health insurance in Spain?

Seniors often opt for private health insurance in Spain for several reasons: to meet visa or residency application requirements, due to ineligibility for public health system benefits, for access to English-speaking medical professionals, for shorter wait times for procedures, and to have greater control over their healthcare choices.

Which Spanish visas and residence permits require private medical insurance?

Most long-term Spanish visas and residence permits, including the Spanish Retirement Visa (Non-Lucrative Visa) and the Golden Visa (Investor Visa), require a qualifying private health insurance policy.

Is it challenging for individuals over 75 to get private health insurance in Spain?

While finding suitable health insurance can be more challenging for those over 75, many successfully obtain coverage through specialized insurance partners. Comprehensive solutions are available to meet visa and residency application requirements, but you may pay higher premiums.

How do private health insurers in Spain deal with pre-existing conditions for seniors over 75?

Insurers evaluate pre-existing conditions’ impact on policy cost and coverage differently, potentially leading to variations in premiums, possible exclusions of certain conditions, or imposition of waiting periods for related treatments. These factors can influence the suitability of a policy for visa or residency applications.