IPREM Spain is the Indicador Público de Renta de Efectos Múltiples, a figure the Spanish government uses for many official calculations, including the Non-Lucrative Visa and Student Visa income requirements. Read on for all you need to know about the IPREM Spain 2024.

What is the 2024 IPREM Spain amount?

As of 14th February 2024, the Spanish parliament has not approved a budget for 2024, and so the 2024 IPREM is unchanged from 2023. When the budget is approved, we expect an increase to be announced. However, until then, this is the 2024 figure you should use for visa applications.

- The 2024 Spain IPREM is €600 per month or €7,200 annually.

- The daily IPREM is €20 in 2024.

The 2024 IPREM is as per 2023, with no increase until the government passes the Presupuestos Generales del Estado.

Note: There is another figure based on 14 annual payments, but this figure of €8,400 is not used for visas.

2024 IPREM Watch: Update January 31, 2024 >> We were expecting the 2024 IPREM announcement sometime in December 2023, but it seems we’ll have to wait a while longer. IPREM is normally updated as part of the Presupuestos Generales del Estado, which has been delayed. So, the 2023 IPREM will continue to apply in 2024 until the change is announced (expected before April 2024). Our Spain Immigration lawyer partner anticipates a 5% rise, so a 2024 IPREM of approximately €630 per month or €7,500 annually.

What is Spain’s Public Multiple Effects Income Indicator (IPREM)?

In 2004, the Spanish government created a new economic indicator for standard calculations. They came up with the Indicador Público de Renta de Efectos Múltiple or IPREM. A direct translation is the Public Multiple Effects Income Indicator. Spain uses this figure, whereas many countries would use a minimum wage. This replaced the Salario Mínimo Interprofesional which the government had previously used.

The government reviews IPREM yearly, with the new figure announced in December.

What is IPREM used for in Spain?

1) The NLV / Retirement Visa Income Requirement

The primary applicant income requirement for the Spain Non-Lucrative Visa application (retirement visa) is 400% x IPREM. You can use the non-lucrative visa if you are looking to retire in Spain.

- NLV = 400% x IPREM = €28,000 minimum passive income per year.

2) Spain Student Visa Income Requirement

You’ll need to show you have 100% x IPREM to qualify for the Spain Student Visa.

- Study Visa = 100% x IPREM = €7,200 minimum income per year.

3) Residency in Spain for EU Citizens

EU Citizens who apply for residency in Spain need 100% x IPREM.

- EU Citizens moving to Spain = 100% x IPREM = €7,200 minimum income per year.

Note: The government does not use IPREM to calculate the financial requirement for the Spanish Digital Nomad Visa. The DNV uses the 200% x 2024 Spanish minimum wage (€15,876). This means the minimum qualifying income you need is €31,752 per year.

4) Family Member Residency

If you include additional dependents on your residence permit application or application for family reunion residency, you use IPREM. You should show you can support them living in Spain. You’ll need 100% x IPREM for each dependent on a non-lucrative application. You’ll also need health insurance for each.

5) Social and Welfare Payments

The government uses IPREM Spain to manage unemployment benefits, social welfare programs, and some education grants and scholarships.

6) Tax calculations

The Spanish Tax Agency uses IPREM for some deduction calculations. See our Taxes in Spain guide for more information.

Historic Annual Spanish IPREM Amounts

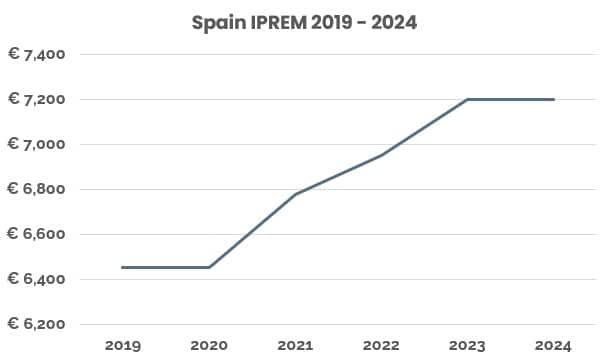

- 2024 – €7,200.00 (0% increase on 2023 – however, we are waiting on an approved budget)

- 2023 – €7,200.00 (3.6% increase on 2022)

- 2022 – €6,948.24 (2.5% increase on 2021)

- 2021 – €6,778.80 (5.0% increase on 2020)

- 2020 – €6,454.03 (0% increase on 2019)

- 2019 – €6,454.03 (0% increase on 2018)

FAQ – 2024 IPREM in Spain

How much is IPREM 2024?

The 2024 Spain IPREM is €600 per month or €7,200 annually. This figure is the same as in 2023 until the government passes a new budget in 2024 (Presupuestos Generales del Estado). We expect a 5% raise to approximately €630 per month or €7,500 annually when that happens.

What is Spain’s Public Multiple Effects Income Indicator (IPREM)?

IPREM stands for Indicador Público de Renta de Efectos Múltiples, which is the Public Indicator of Multiple Effects Income. It is an economic indicator used in Spain to calculate certain benefits, subsidies, and grants, including residency and visa-related income requirements.

How is IPREM used in relation to visas and residency in Spain?

IPREM is used to calculate the minimum income required to obtain certain types of visas and residency permits in Spain. For example, the minimum income required for a non-lucrative visa is currently 400% of the IPREM, which for 2024 is €28,800 per year.

What other benefits and subsidies are calculated based on IPREM in Spain?

IPREM is also used to calculate unemployment benefits, housing subsidies, and other social benefits in Spain. The exact amount varies depending on the current IPREM rate and other factors.

Will the IPREM rate change in 2024?

The Spanish parliament has not approved a 2024 budget, so the 2024 IPREM is currently unchanged from 2023. However, when the budget is approved, we expect an increase of at least 5% on the 2023 figure.

Where can I find more information about IPREM and how it is used in Spain?

You can find more information about IPREM and how it is used in Spain on the website of the Spanish Ministry of Inclusion, Social Security, and Migration, as well as on the websites of other relevant government agencies and organizations. It’s always a good idea to consult with a professional, such as an immigration lawyer or financial advisor, to get personalized advice and guidance on your specific situation.

What is 400% of IPREM in Spain?

The Spanish non-lucrative visa requires a proven income of 400% of IPREM. In 2024, that is €28,000 (4 x €7,200) minimum passive income per year.

Does the Spanish Digital Nomad Visa use IPREM?

No. The DNV financial requirement is based on the minimum wage, not IPREM. The 2024 financial requirement for the Spanish Digital Nomad visa is 200% x 2024 minimum wage = €31,752.

Hello, is the monthly income requirement (based on the 400% x IPREM) based on your gross income or the net income you receive in your bank account for the non-lucrative visa?

Hi Luci – you’ll need to show your net income; bank statements can be used as evidence for the application along with pay slips. All the best, Alastair

Alastair,hope you doing well.

If I live in Spain and want to sponsor my wife and baby to join me on family reunion, how much should be total amount I can show as my income because am bit confused with the calculations

Hi Kingsley – the amount required for dependents to join you depends on your visa or residence permit to live in Spain. For example, if you are on a non-lucrative visa, you should show €7,200 annual income per dependent. For a Digital Nomad Visa, it is €11,340 for the first dependent and €3,780 for any additional dependents. All the best, Alastair

Hi Alastair,

Thanks for creating this post, I’ve been trying to get clearer info all over on line. This is a big help.

So if I go for non lucrative visa with my wife and 1 child, does that mean i will need €7,200 x 2?

And for digital nomad, I should have €11,340 + €3,780 as an annual income?

Hi Ben. Check out our guides to the non-lucrative visa and digital nomad visa. Both have tables with financial requirements. All the best, Alastair

HiSir, Im married to a spanish but he doesn’t have work in spain yet since he will be moving back to spain, how much do we need as proof of financial capacity? Thanks so much

Hi Enses – you’ll need to show 100% x IPREm for your husband and 75% IPREM for you. So, in 2023, that is a minimum of €12,600. You’ll also need healthcare through EHIC or a qualifying Spanish private health insurance policy. Our article explains more about Spanish Residency for EU Citizens and Families. All the best, Alastair

Thank you for the response Mr Alastair.

For this “you’ll need to show 100% x IPREm for your husband and 75% IPREM for you. So, in 2023, that is a minimum of €12,600. ”

Will it be for a 5year residence permit or just 1year?

Hi Alastair! Could you please explain vividly how much precisely I would need to present as an international student for proof of travel insurance?

Hi Margaret – The amount and type of insurance will depend on the duration of your student visa. For a short-stay study course, a cover of €30,000 that includes any health-related incident and covers repatriation in case of death or severe health issues should suffice. All the best, Alastair.

Hello,

I’m applying for a 2 year university course. Would I need to show that I have 2 years worth of 100% of the IPREM orwould I just need to show I have enough for 1 year?

Thanks

Hi. You’ll need to show you can cover 2 years of expenses for a 2 year course. All the best, Alastair

Dear Alastair,

I have four questions about National Non-Working Residence Visa :

I am not a EU citizen, 28800 euro/ year is a deposit or an annual income?

After arrive to Spain, whether we can benefit the medicare insurance in the local system? Whether my kids can go to public school as the Spanish citizens?

How about the next year, how to renew the residence permit? We apply a new visa or go to local city hall?

Can we buy real estate instead of renting place to live?

Thanks!

Hi Joyce. 1) Annual Passive Income 2) You’ll need private health insurance, but your kids can attend public schools 3) You’ll renew your residency; you do not have to apply for a new visa 4) Yes, you can purchase a property. See here for more details: https://movingtospain.com/non-lucrative-visa-spain/. Regards, Alastair

Dear Alistair, my husband and I have been in Spain for a month, we currently have in a 3-6 mth rental. My retired husband has EU Hungarian citizenship and get the Australian pension €12,298 annual. He will support me. We also have savings and plan to buy a house here, Will that enough passive income to cover us annually for IPREM? Should my husband register now or wait until till we buy a house?

Hi Geri. The legislation for residency of an EU partner doesn’t give an exact amount, but 150% of IPREM should be sufficient with your savings. My best guess is that there is no upside to delaying the application, but you can confirm this with our Spanish immigration lawyer partner, who will handle the entire process for you. There’s more information in our article on Spanish residency for EU citizens and their families. All the best, Alastair.

Thanks Alastair the information is much appreciated

Dear Alastair, My monthly SS income is Euro 1,620 plus passive income of Euro 635 for a total of

Euro 2,255 per month or Euro 27,060 per year. I also have Euro 55,000 in my bank account consisting of securities and cash. Is there any way I can get a visa for myself and spouse using my income along with my savings. Thank you.

Hi Thomas. Your income is under the threshold for the non-lucrative visa, but your savings can be considered in the application. As your situation is not standard, I’d suggest meeting with our Spanish immigration lawyers to discuss the best way to structure your application. All the best, Alastair

Hi, I am non-EU. I was in Madrid for a master’s degree last year but had to leave. Now I am planning to return on a language course student visa and then look for work. Is it good enough to show that I can cover the entirety of my fees for my language course (including accommodation) which is roughly around 4,500 euros for 8 months? Or do I have to show more than that?

Hi Abhik. You must show you have at least 100% of the 2024 IPREM (€600 per month of study). Check out our Spain Student visa guide for more details. Regards, Alastair

Hi

I am a retired uk citizen, my son lives and works in Spain.

Is it possible for me to retire to Spain on my uk pension or do I need to get a job?

Thank you

Hi Bree. There are two options for you. You can qualify for a Spanish retirement visa (as long as your annual pension is at least €28,800) or explore a family reunion visa, depending on your son’s immigration and financial status in Spain. All the best, Alastair

Good day

I am applying for a 3-year student visa how much do I have to show for the visa application?

Hi Wimbiso – You should have at least the minimum amount for the first year of your visa, but it is better to show an amount to cover the entire course of study. You can see more in our Spain Student visa guide. All the best, Alastair

Hello, no question at the moment. I am a subscriber to your newsletter and am starting the NLV application process. So I will have some.

I just want to thank both of you for your excellent information and research findings.

I am very appreciative

Hi! I am looking into the non-lucrative visa. If I don’t have €28,800 in savings, does that mean I can’t do this visa? I’m earning about 3,500 USD a month on a freelance remote job.

Hi Esther. The NLV requires either passive income (so income from not working) or significant savings. Please check out our Spain non-lucrative visa guide for all the details. Your income may entitle you to a Spain Digital Nomad Visa if that is of interest. Regards, Alastair

Hi Alastair,

My son is 18 and has been accepted to a university in Spain. We’re dual citizens of the US and Mexico (currently living in Mexico) and he’ll apply for the student visa as a Mexican citizen. We’ll be supporting him and I’ve been told that we will need to provide bank statements for the last 3 months showing we can cover his expenses but I’m unclear on which expenses need to be covered. Is it IPREM + monthly housing + monthly meals + monthly tuition if none of these have been paid yet? I’m just trying to figure out if IPREM covers housing.

For example, let’s say IPREM is €630, monthly tuition is €1560, residence and meals are €1760. Does this mean it will suffice if we show bank statements that have a minimum if €3950 balance at the end of each month? Also, I intend to apply for the digital nomad visa and bring my family. Is it best for my son to get his own separate student visa rather than come along on my digital nomad visa? Thank you!

Hi Lori. It is hard to comment on the easiest path for your family without more details on how you all plan to move. Given the options, I’d suggest meeting with our immigration lawyer partner, who’ll be able to look at the DNV vs Student visa options and the financial position needed for each to give you the easiest pathway to all moving to PSain. Regards, Alastair

Hi Alastair,

I am a university student from Canada and I am planning to attend a university in Madrid on an exchange program for four months from September – December. I understand that the current IPREM is €600 per month of stay (please correct me if I am wrong), so – €2400 for my entire stay.

Does this mean that at the time of my visa application, I just need to have at least this amount present in my bank account?

I work seasonal and part-time throughout the year in between classes, however, not consistently as most of my funding comes from my bank account.

Is that sufficient for the visa application? – just for having that amount of money on hand? – or do I have to show a steady income? – my parents are not in the country at the moment so difficult to do notarization.

Thank you so much for your help!

Hi Jacob. Yes, you need proof of funding of €600 per month of study, and a bank balance will be accepted in most cases where you can show that you have also covered the costs of the course. All the best, Alastair

Hi Alastair,

Thank you so much for your response.

Would it be helpful to provide my tax return forms?

Say, if I have $7,000 in my statements, would I be fine?

– I also have my mom’s tax forms/my birth certificate, however my notarized/apostilled/translated letter will unfortunately not come in time for my visa appointment.

Thank you so much again 🙂

If I have about 200.000 euro’s savings but only about 1,500 euro monthly income would I be able to obtain a visa to retire to Spain. We have additional savings which we will use to purchase a property.

Hi Gary The Spanish immigration department assess you total financial situation and so as long as you prepare your application correctly you should qualify for a Non-lucrative visa. Our immigration lawyer partner will help you to do this, and we recommend support in cases where your passive income does not meet the threshold. https://movingtospain.com/services/spain-immigration-lawyer/ All the best, Alastair

Hi Alaster! Could you please clarify how the required IPREM would get reduced with a proof of accomodation for the entirety of my stay? If region matters, I’m planning to stay near Barcelona since september and until middle of june.

Hi Angelina – the Spanish government is looking at your overall financial situation and your ability to support yourself while living in Spain. If you don’t meet the IPREM, then it can sometime help, in some circumstances, to show that you won’t need to pay for accommodation, but this is very case-specific. If you don’t clearly meet the requirements for your visa, I’d strongly suggest talking to a good immigration lawyer in Spain. All the best, Alastair