New update: January 2025 >> We’ve updated our guide to the best banks in Spain for Expats in 2025 because we get constant feedback from clients and friends. We’ve lived in Spain since 2015 and have had our share of banking frustrations. Since 2023 we’ve polled the Spanish Expat community and done detailed research to create our index to make choosing a banking partner easy for people moving to Spain.

All recommendations result from our research and feedback from Expats clients and friends in Spain. Disclosure: We do get a small commission if you set up an account with Wise, Bunq, or N26 at no extra cost to yourself.

READ ALSO: Transfer Money to Spain – 5 Cheap, Fast & Secure Ways

The 8 Best Banks in Spain for Expats

Here is our updated list of the best Banks in Spain for Expats. Our rankings have changed considerably, with significant changes to the features offered. Head to the next section for detailed reviews of each bank, including its pros, cons, and services.

N26 is still our number 1 bank in Spain for Expats.

| Feature | N26 | Revolut | Sabadell | ING | Santander | Wise | BankInter | Bunq |

| English Capability | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ |

| BIZUM | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Spanish IBAN | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ |

| Debit Cards | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Credit Cards | ❌ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Mortgages | ❌ | ❌ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| ATMS | ❌ | ❌ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Low Fee Model | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ❌ | ✅ |

| Low-Cost International Transfers | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ❌ | ✅ |

| Google/Apple/Samsung Pay | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Positive Feedback | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Government Deposit Guarantee | ✅ | ❌ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ |

BIZUM Explained >> Send money to anyone in Spain with BIZUM enabled using just a phone number from your phone. We use this peer-to-peer payment daily – split restaurant bills, borrow €5, pay your share of a holiday – easy and instant – and so common that BIZUM is now a verb… “I’ll BIZUM you now.”

Also Read >> See our step-by-step guide to Opening a Bank Account in Spain to open your account with one of these institutions.

Pros and Cons of Our Best Spanish Banks for Expats

N26 (Rank Number 1)

N26 keeps its spot as the #1 bank for Expats in Spain in our latest 2025 update. You can get a Spanish IBAN, low fees, and a user-friendly app and use your Mastercard debit card for low-cost non-Euro purchases. There is also a range of account types (both free and paid) offering benefits like travel insurance, mobile phone insurance, and more. We believe N26 is still the best bank in Spain for Expats.

Pros

- You get a Spanish IBAN to pay your bills and taxes in Spain.

- They provide BIZUM capability to make person-to-person transfers super easy.

- N26 uses Wise for international transfers, so international forex transfer costs are low, and exchange rates are excellent.

- They offer excellent English language support.

- You can use the Cash26 process in some Spanish retail stores to deposit and withdraw cash (with some fees) from your N26 account.

- N26 is a licensed German bank with a €100,000 deposit guarantee.

“N26 is a “real” bank. You get a Spanish IBAN. It is insured by the German government, so if somehow it goes out of business, your money is protected. You can use BIZUM, which is a huge plus in Spain. N26 actually integrates with Wise to transfer money to/from foreign accounts, so it’s kinda of like having both anyways. N26 allows you take withdrawl money three times a month for free (at least on the free account), with “unlimited” amounts each time. I don’t use cash a lot, so it’s more than enough for me, I just take out 300 euros at a time.”

Anarchos – Reddit

Cons

- There are no branches or ATMs; everything is online.

- You can use any ATM in Spain to draw cash, but there are limits on the number and amount of your withdrawals. The limits vary by account type; if you exceed these limits, there are withdrawal fees.

- There is no mortgage facility.

- They do not have a credit card service (only a debit card).

- You cannot open an N26 account if you still live in the US. US residents must move to Spain before opening an N26 account).

Revolut (Rank Number 2)

Revolut offers a Spanish IBAN (account number) to pay taxes and utilities in Spain. This online bank offers a range of accounts, from a simple “Free” account to a paid “Ultra” account. The paid accounts have benefits and freebies (including some good insurance options). We use Revolut in Spain. Our favorite bit? Our 16-year-old son has an under-18 Revolut card. We transfer his pocket money automatically, and he uses the card to pay for everything. He can monitor and budget in a straightforward app, and we can see his spending.

We also use our debit card for travel in non-Euro countries as exchange rates and fees are excellent. Revolut recently added BIZUM capability, hence the promotion to number two in our ranking.

Note: The issues we’ve heard and seen reported with fraud against Revolut means we only use Revolut as a transactional debit card and never have significant balances in our Revolut.

- You open your Revolut account directly from the app by submitting documents online for verification.

- You can instantly access your account and card after opening the account.

- The website, app, and support are available in English.

- Apple Pay and Google Pay are also enabled.

- Many local Spanish people (and Expats) use Revolut for their day-to-day needs.

“I also like Revolut because the UI, fast top-up by Apple Pay w/o fees and instant free bank transfers with Euro Zone…”

Lukengatzte – Reddit

Cons

- There have been some reports of refund issues after fraud from Revolut accounts. See these reports in the Guardian, BBC, and the Telegraph.

- There are no branches or ATMs; everything is online. You can use any ATM in Spain to draw cash, but there are limits on the number and amount of your withdrawals. The limits vary by account type; if you exceed these limits, there are withdrawal fees.

- There is no mortgage facility.

- You cannot deposit cash or cheques into your Revolut account.

“A man who had £165,000 stolen from his Revolut business account by fraudsters has told BBC Panorama he believes the company’s security measures failed to prevent the theft.” – Jack as per a BBC report 14 October 2024.

Banco Sabadell (Rank Number 3) – Best Traditional Bank

Sabadell is our first “bricks and mortar” traditional bank on the list. We’ve used Sabadell since 2015 as our primary Spanish bank, and it does the job for us. Our usage is simple: We use our Sabadell credit cards for most of our purchases in Spain. We’ve had recommendations for Sabadell from several Expats – they do have some focus on this market segment, so they understand and support Expats. We also use Sabadell for our Via-T automatic toll payments via a linked card.

- Their support, website, and app all have good English-language capabilities.

- A big plus is their mortgage capability; we know several Expats with Sabadell mortgages. This lending capability is a differentiator from our top 3.

- They also offer resident and non-resident accounts.

- BIZUM

- Servies like instant, pre-approved personal loans are simple to access through the app.

“We got our mortgage through Sabadell using a mortgage broker. The interest rates and fees were by far the best, and we’ve had no issue with unexpected expenses. The app and website plus English language support are all good.”

RW, Catalunya – from a WhatsApp

Cons

- Several people mention excess and surprise fees from Sabadell. Only some people have experienced this (we have not), but it does crop up enough for us to monitor our monthly bank fees closely. As I mentioned – we are relatively simple users, so that may be a factor.

- International bank transfers carry significant charges.

- You may have to visit a branch to sign documents, pick up cards, or open an account. Some branches don’t have English speakers avalible.

- Some people have been pressured to sign up for house insurance or life insurance policies, which may not offer the best value or service (See Christopher’s comment below). We’re marking Sabadell as a bank, not an insurance provider. If you want health, car, life, or home insurance, we suggest checking out our articles on insurance in Spain.

ING (Rank Number 4)

As a major European bank, they have a significant market share in Spain and many happy customers that we know personally. Accounts are relatively simple to open, and the app is easy to use. Fees are low for most users, and you can open some accounts online. There is a Spanish IBAN, and BIZUM is available. If you use your card or Apple/Google Pay for most transactions, then the lack of ATMs isn’t a big concern.

Pros

- Recently ranked highly in a Forbes global banking report.

- Easy to open accounts.

- It is a good app with an easy-to-use user interface.

“I work with ING and they are cheap (as in zero cost) and reliable. Downside is not many ATMs around.”

Pround_Friendship_533 – Reddit

Cons

- There are very few ING branches or ATMs compared to large Spanish banks.

- Support is only in Spanish for Spanish accounts.

- High costs for some ATM withdrawals. Look out for cheaper options like Euronet, Euro Automatic Cash, and Targobank.

- We’ve had occasional reports of people having issues using ING cards abroad.

“A friend tried to use ING card in Uzbekistan recently and it worked 1 in 10 times, while my Revolut was always accepted. We spent a lot of time trying ATMs. Same problem with ING in Oman, didn’t do well., and my husband is now in Chile and ING works half the time).” – From LP, a Moving to Spain client.

Banco Santander (Rank Number 5)

Santander is the biggest bank in Spain by asset volume, so you’ll see them everywhere. They offer English language support and a full range of banking and financial services, including BIZUM, mortgages, and investments. Santander provides both resident and non-resident accounts. Banco Santander also has an international presence in many other countries, including the USA.

“Banco Santander for the day to day bills, debit/creditcards etc. They are great (as banks go), good easy app, excellent telephone service, and our “personalised” account manager in the branch who does more complex stuff via direct email. Haven’t been in a branch for years and years.”

Lukengatzte – Reddit

Cons

- Once again, there is some mixed feedback on the service and support from Santander. Most people are positive, but a few are scathing.

- We have heard some reports of excess bank charges (as we did for all the “bricks and mortar” banks in Spain).

“We ended up with Santander, and happily so, as we don’t have to pay any monthly bank fees since we’re considered “autonomos” as independent business owners. Likewise, they do have Bizum and we’ve been using it quite a bit, and they also gave us our Spanish IBAN without having our NIE. Our neighborhood branch is the best. Their manager has helped us with a lot, we see and greet each other in the street often when she’s out smoking, and is super responsive when we’ve emailed her. We love Santander!” – Susanna Fránek, Moving to Spain client in Madrid.

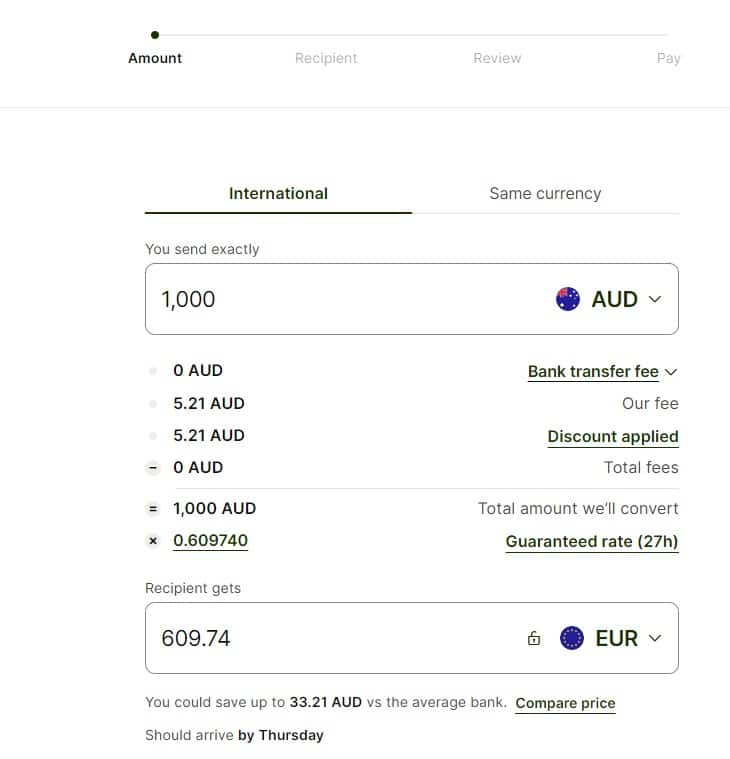

Wise (Rank Number 6)

Wise drops to #7 in this list as the lack of a Spanish IBAN and BIZUM makes it painful for day-to-day banking. The integration with other apps and banks (like N26) means you don’t need a dedicated Wise account as much. Having said that, we still use our Wise multi-currency account with a linked Mastercard debit card whenever we travel outside the Eurozone, and foreign shops and merchants almost always accept it).

Pros

- Paying for things in other countries is super simple, and the exchange rates on international money transfers are unbeatable.

- The app and website are super easy to use.

- The virtual card seamlessly integrates with Apple/Google/Samsung Pay.

“Super fast transfers, very user-friendly app, very transparent. but, i need to open a Spanish bank account for tax returns and to purchase a spanish mobile phone plan, and some other things. And i’m thinking which Spanish bank should i go to?”

Marramaxx – Reddit

Cons

- You don’t get a Spanish IBAN, so you can’t have this as your sole account.

- There are no credit card accounts (only debit cards), overdraft or loan options, and

- You cannot use BIZUM.

- Wise doesn’t offer mortgages.

- Wise doesn´t offer Credit Cards.

BankInter (Rank Number 7)

BankInter is a fast-growing Spanish bank that many Expats use. It offers similar services to Sabadell (#4) and Santander (#6) and strong digital/online functionality. Its branch and ATM network are growing.

Pros

- BankInter is trying to grab market share, so it is investing in infrastructure and customer service capabilities.

- Recognized for an excellent personal banker capability (but this service is not always available in languages other than Spanish (or local languages like Catalan).

Cons

- We’ve received feedback about a lack of branches in some areas of Spain and similar issues to Banco Sabadell and Banco Santander above.

“Bankinter is the one that has had the best in-person and over-the phone help, but you have to set the account up in person at the sucursal (branch), not online. I have a rep who I can call or email any time at my local branch. I like their online banking, too.”

Ultimomono – Reddit

Bunq (Rank Number 8)

Bunq is a niche bank recommened by many EU citizens living in Spain. Bunq is an online bank based in the Netherlands that operates all over Europe. In Spain, online banks offer a current account and a combination of debit cards. You get a Spanish IBAN, a debit master card, and virtual card capabilities. The big negative is the lack of BIZUM capability or credit or mortgage facilities.

“Yes, I recommend Bunq – very useful multi-currency account and simple to use.”

FV – Dutch Expat Friend in Sitges, Spain (From a WhatsApp.)

Pros

- Spanish IBAN.

- Excellent app and website with good customer service and support, including a live chat feature.

- Integration with Wise for cheap and easy FOREX transfers.

- Dutch and EU government-backed banking licenses with up to €100,000 deposits are guaranteed.

- People love the 25 sub-accounts that simplify budgeting, savings, and spending categorization.

- Apple/Google/Samsung pay and virtual cards.

- Reasonable interest rates on savings balances (and ethical investment options).

- Ethical and progressive – significant initiatives like automatic carbon offsets at no cost to you.

Cons

- No BIZUM.

- No credit card, mortgage, or overdraft facilities.

- There is no branch support; everything is virtual.

Top 3 Banks in Spain for International Students

International students in Spain often need services different from other Expats in Spain. While there are usually no salary deposits, international money transfers (to and from Spain) and cash withdrawals are more common.

For these reasons, we have three recommended banks for international students. All are easy to open, offer low fees, and have competitive international transfer fees and rates through Wise integration.

- N26 (BIZUM plus Cash26 capabilities are the differentiators)

- Revolut

- ING

Top 3 Spanish Banks for Non-Residents

Non-resident bank accounts in Spain are helpful for property owners, business owners, and other people with a financial interest in Spain who don’t live here. Many Spanish banks offer these, and there is a simple process to open a non-resident account.

- Banco Sabadell

- Banco Santander

- BankInter

What About the Rest of the Banks in Spain?

We surveyed Reddit, Facebook groups, and our network for feedback to pick the best banks in Spain for Expats. And people are passionate about the subject! Some people have had bad experiences with the banks in our top 8, and others are passionate about banks we don’t feature.

We’ve left off some of Spain’s most visible banks, including CaixaBank (Caixa had the worst feedback by some distance) and BBVA because there was enough negative feedback to outweigh the positive. And some Expat favorites like Deutsche Bank España didn’t hit as many vital indicators as our top 8.

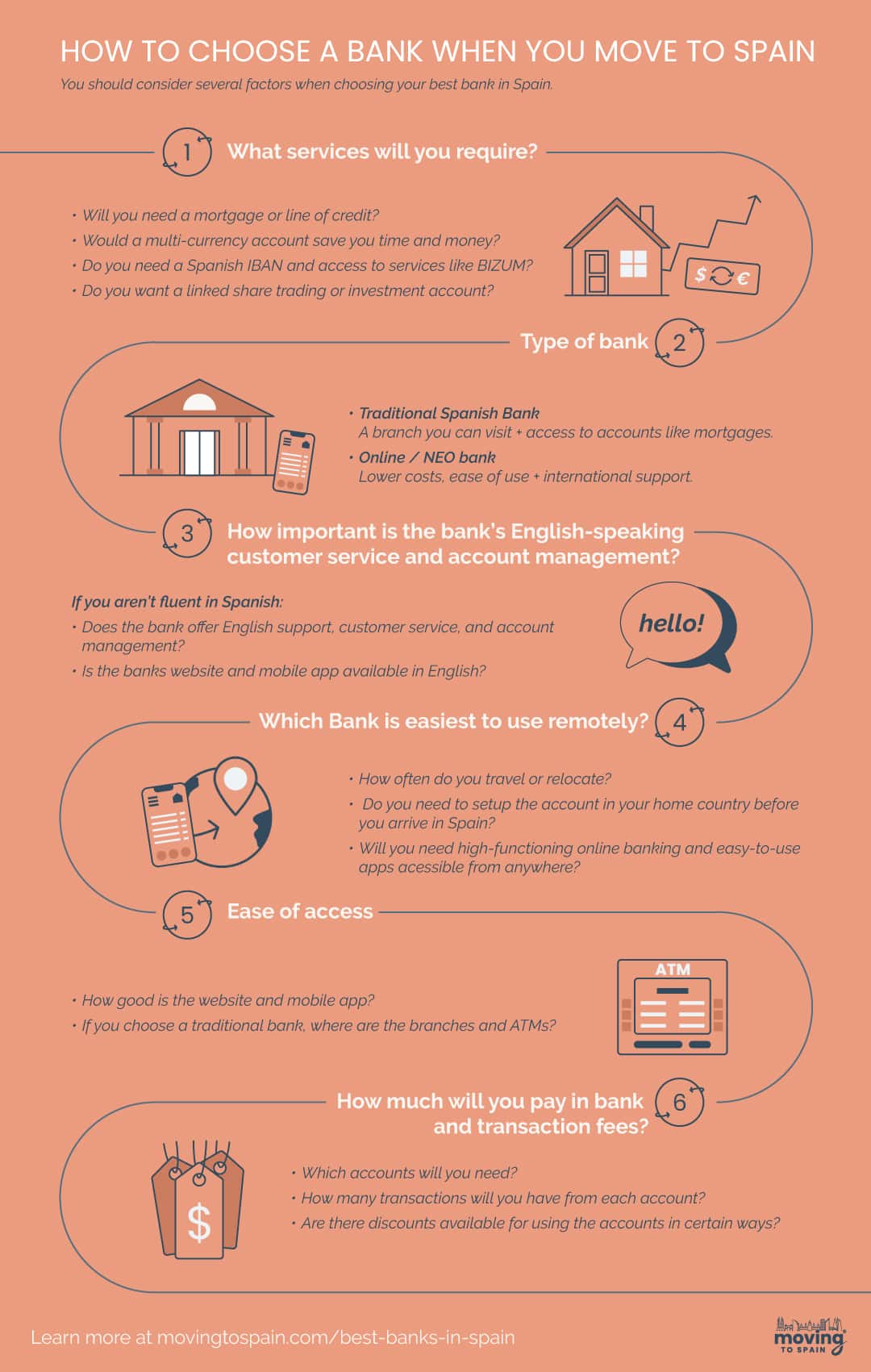

How to Choose a Bank When You Move to Spain

Selecting the right bank in Spain as an Expat can be tricky – we got lucky with a recommendation from Sabdell when we arrived. Given what I know now, there are six areas I’d use to assess my new bank if I decided to move. Like everything, getting first-hand feedback from people using the bank is always first prize.

1. Language Support

Communication can be a challenge, so finding a bank that provides support in your language can be a relief:

- English-Speaking Customer Service: Test out the bank’s English-language support, whether it’s in-branch, by phone, or through their app.

- English Digital Platforms and Documentation: Many larger banks have English versions of their websites and apps, but it’s always best to confirm.

- Multilingual Support: Banks accustomed to serving Expats often offer service in several languages, and I think this shows they are used to dealing with and helping people from abroad.

2. Digital Banking Capabilities

Digital banking is convenient, but features and quality vary across banks. Here’s what to assess:

- Mobile App Functionality: Does the bank’s app have good reviews? A user-friendly app makes account management more accessible.

- Online Interface in English: An English interface can significantly help manage accounts and understand banking features, especially when issues arise.

- BIZUM Compatibility: If you plan on sending money to friends or paying local businesses, BIZUM Is part of our everyday life!

- Remote Setup and Digital Document Upload: Some banks enable you to open an account and upload necessary documents digitally, a particularly useful feature if you’re setting things up from abroad.

3. Physical Banking Needs

While digital services are convenient, in-person support can be essential for specific transactions or personal assistance:

- Branch Network and ATM Access: Check the bank’s branch and ATM locations relative to your home or work. Proximity can save on ATM fees, which vary widely across Spain.

- English-speaking Staff: Having an English-speaking branch nearby for those with limited Spanish can make banking infinitely easier.

4. Cost Considerations

Bank fees in Spain can add up quickly, so keep an eye on these standard charges (especially from Spanish “brick and motor” traditional banks.

- Monthly Maintenance Charges: Most traditional banks charge monthly fees. Compare these costs to avoid unnecessary expenses.

- ATM Withdrawal Fees (Domestic and International): Withdrawing cash from an ATM outside your bank’s network usually incurs fees. If you travel frequently, look for favorable international withdrawal options.

- International Transfer Fees and Exchange Rates: For Expats needing to transfer funds from abroad, a bank with competitive transfer rates and transparent fees can make a big difference. Please see our guide to international money transfers to Spain to save you time, money, and problems!

- Other Fees: Watch out for credit card, currency exchange, and card replacement fees. These often vary significantly among banks.

5. Additional Services

Today, you may just need to tap and pay for a coffee and BIZUM your share of a weekend away, but it is worth considering your plans in Spain when you choose the best bank for your future.

- Mortgage Options: Some banks offer specialized mortgage products for non-residents and expats, which can simplify property purchases if you decide to buy in Spain.

- Investment Products: If you’re interested in saving or investing, check if the bank offers savings accounts, investment funds, or even stock brokerage services.

- Insurance Services: Many Spanish banks bundle services like health, home, or travel insurance – beware, as there are reports of some pretty aggressive sales tactics from some banks. Check out our guide to insurance in Spain before you leap!

- International Banking Services: A bank experienced in serving international clients usually offers services that make cross-border transactions smoother and more affordable.

6. Security and Protection

Security is paramount when choosing where to place your finances. Here’s what to look for:

- EU Deposit Guarantee: Spanish banks, like those across Europe, offer deposit protection up to €100,000 per depositor per bank. This guarantee provides an essential safety net for expats.

- Two-Factor Authentication (2FA): Many banks in Spain use 2FA to add an extra layer of security to online transactions, which is especially important for secure online banking.

- Fraud Protection: Verify that your bank has policies to protect you against unauthorized transactions, particularly if you plan to use your account for frequent online purchases.

- Account Insurance: Some banks offer optional account insurance for additional peace of mind against fraud or misuse.

Some Things to Know About Banks in Spain

IBAN (International Bank Account Number)

An IBAN, or International Bank Account Number, is a standard international numbering system developed to identify bank accounts across countries. In Spain, as in many other European countries, an IBAN is crucial for two main reasons:

- Bank Transactions: You’ll need an IBAN for any bank transfer within Europe from your bank in Spain. This includes receiving your salary if you’re working, transferring rent to your landlord, paying taxes or fines, or sending money back home.

- Setting Up Utilities: Often, when setting up utility services like electricity, water, or internet in Spain, companies require the IBAN of your bank account for direct debit payment.

Example: An example IBAN in Spain would look like: ES12 1212 1212 1212 1212 1212

SWIFT / BIC

A SWIFT (Society for Worldwide Interbank Financial Telecommunications) or BIC (Business Identifier Code) code is an 8-11 character long, standard format code that only identifies banks and financial institutions, not clients or customers.

For example, a SWIFT/BIC in Spain would be REVOESM2.

BIZUM

If you live in Spain, you’ll want access to BIZUM. It is a simple way to transfer money between people in Spain (P2P) using the phone number of your contacts. Most major banking apps have BIZUM integrated with your bank account in Spain, or you can use the BIZUM app. The catch: the sender and receiver need a Spanish bank account with a Spanish IBAN. We use it constantly, and you’ll hear the word used as a verb: “I’ll BIZUM you my share now.” Here is a list of banks in Spain that use BIZUM.

“Not all of those banks have bizum, check which have it because that will be very useful for small payments to friends instead of transfers. Everyone in Spain uses it”

Lomerro – Reddit

Types of Banks in Spain

There are three main types of banks in Spain.

- Bancos (Private Banks) – These privately owned for-profit companies include all the central high street banks. If you are after a traditional “bricks and motor institution” with branches you can visit, this is where you’ll end up. Examples are Sabadell, Banco Sanatander, BVVA and CaixaBank.

- Online Banks, Neobanks, Digital-Only Banks, Challenger Banks, and Fintech Companies are the new disruptors. – They are online and compete without branch infrastructure. Examples include Revolut, Wise, and N26.

- Cajas de Ahorros (Savings Banks) – Since the 2008 financial crisis, you’ve seen far fewer of these not-for-profit depositor-owned institutions. However, they are still popular with some Spanish locals but seldom used by Expats.

Local Banks Vs. International Banks in Spain

There are three main areas where international banks differ from local banks in Spain.

- Regulatory Environment: Spanish and European Union authorities regulate local banks in Spain. International banks must comply with these regulations and those of their home countries. This can affect their operations and services.

- Service Offerings: Spanish local banks offer services tailored to the local market, like personal banking and mortgages. International banks provide a broader range, including services for expatriates and international transactions, often in multiple currencies.

- Language and Cultural Familiarity: Local banks operate primarily in Spanish and are well-versed in local customs and practices. International banks may offer services in multiple languages, which benefits non-Spanish speakers and international clients.

American Banks in Spain

Some American banks have a presence in Spain but generally focus on commercial, investment, and wealth management capabilities. Using an American bank as your primary financial institution as an Expat in Spain will be challenging. For example, Citibank, JP Morgan Chase, and Bank of America have Spanish operations. For Americans moving to Spain for the USA, we still recommend using one of our recommended banks.

UK / British Banks in Spain

HSBC has a dedicated Expat Global Money account but is still a UK-based bank account. Lloyds operated in Spain but sold its Spanish retail division to Banco Sabadell. The other major UK banks in Spain are commercial and investment service providers, not retail banking options for Expats in Spain.

FAQ – Best Spanish Banks for Expats

Are Spanish Banks Safe?

Spanish banks are considered safe and reliable. They are regulated by the Banco de España (Bank of Spain) and the European Central Bank (ECB), adhering to stringent European Union banking regulations. These regulations ensure a high level of financial stability and consumer protection. Additionally, deposits in Spanish banks are protected up to €100,000 per depositor, per bank, under the EU’s deposit guarantee scheme.

Can Foreigners Have a Spanish Bank Account?

Yes, foreigners can open a bank account in Spain. Even non-residents can open a specific type of Spanish bank account. For some accounts with Spanish banks, you must present your passport or another form of official ID to the bank. You can open a non-resident Spanish bank account online with some Spanish banks and online banks.

Can US Citizens Have a Bank Account in Spain?

Yes, US citizens can open a Spanish bank account. You can open an account with a traditional Spanish bank (resident or non-resident) or an online bank.

What Bank is Recommended in Spain?

The choice of bank in Spain largely depends on individual needs. N26, Bunq, and Revolut are popular choices for online-focused services and are known for their user-friendly online banking platforms. Banco Santander and Banco Sabadell are highly recommended for comprehensive services and extensive branch networks. They offer a wide range of products suitable for the personal and business banking needs of Expats in Spain.

Which Spanish Bank is Best for Non-Residents?

For non-residents, we recommend Banco Sabadell, Banco Santander, and BankInter. They have well-established non-resident banking services for American, British, and international customers.

What is the Number One (Largest) Bank in Spain?

Our number one bank in Spain for Expats is N26. However, Banco Santander (number six in our ranking) is the number one bank in Spain in terms of market capitalization and international presence. It is one of the largest banks in the Eurozone and offers a wide range of banking services, including personal, commercial, and corporate banking. The number one bank for you might not use size as the best criterion!

What Banks in Spain Speak English?

Most major Spanish banks offer services in English, especially in areas with a high concentration of Expats. We recommend banks like Banco Santander and Banco Sabadell, which have English-speaking staff who provide information, customer service, and online banking in English. This makes banking more accessible for English-speaking residents and Expats in Spain. Popular online banks in Spain, like N26, Bunq, Revolut, and Wise, all have excellent English support.

What Kinds of Fees do Spanish banks Charge Expats?

Bank fees vary between banks, depending on bank account type and usage. Look out for these and others.

– Maintenance fee – this could be charged monthly, quarterly, or annually.

– Credit/debit card fee – having one of these cards might be an additional charge.

– Cash withdrawal fee – You might be charged if you use an ATM that’s outside your bank’s ATM network or exceed your maximum monthly withdrawals.

– International transfer fees – fees and exchange rates can take a big chunk of the money you transfer internationally.

Low Transaction fees. Some accounts have a minimum monthly deposit or transaction limit, and you may be charged if you don’t meet these limits.

Thank you for your insight and wisdom-Cheers

Which banks is any accept direct deposit or untied states social security checks?

Hi David – the Social Security website confirms that direct deposits can be made to Spain (https://www.ssa.gov/international/countrylist6.htm). Based on this form, any Spanish bank account with an IBAN will be able to accept US social security payments. https://www.ssa.gov/forms/ssa1199sp.pdf All the best, Alastair

super helpful. thank you.

I used an ING ATM.

I “declined” their conversion.

They did not put their rate on the machine.

Regardless of declining the DCC, I had paid a €7 fee and 22% “exchange” rate(?).

I will never again use ING.

I looked at this article because we are not satisfied with Sabadell’s service. In our area of southern Costa Blanca among expats their reputation and service is bad. Can’t get cash after 11am, cancelled appointments, long queues, few staff available, and when we bought our villa, the transfer would have cost us 1000 euros unless we took out house insurance with them. So to see you promote Sabadell is a surprise and doesn’t match our experience.

Hi Ian. Thanks for the feedback on Sabadell in southern Costa Blanca. We agree that individual branch staff and management make a big difference in customer experience. We took the overall input from interviewees across Spain to develop our list. We are not promoting Sabadaell (we have no financial agreement with them), so we are just sharing our survey results. We’d love to know which bank you are now using and who has a good reputation in your area of Spain so others can choose wisely in your area. Cheers, Alastair

We are about to move again within the region and frankly are struggling with options. It seems to be heavily reliant on local experience with branch staff. We are considering app based bank like N26 but I notice they do not provide joint accounts and I am not clear how they deal with house sale/purchase funds as traditional banks make a large charge for bank drafts. Can you buy a house with funds from app banks? I haven’t seen any discussion on line regarding that type of transaction.

Fantastic web service you have. Congratulations! Could you possibly be in touch with me? I am with La Caixa bank, but favor Banco Santander, because I used it in the past and the person that was handling communications for me has left. Could you be in touch with me, or refer an attorney with at least 3 years practice, that will assist me. My account is a MM account in USD, and I am a resident of the USA. Reynaldo Salinas AKA Rey. … Blessings!

Hi Rey – you can book a consultation with our recommended immigration lawyer here or contact us at hello@movingtospain.com with more details about how we can assist you. All the best, Alastair

I am a married U.S. expat here on a non-lucrative residence Visa looking for a Santander bank Branch in Motril or Malaga that can help us with opening an joint account because our Spanish is still very weak. If not Santander, then maybe Sabadell. Does anyone know which branches offer this? Any help would be very appreciated as we are still working through our permanent residence 1st year renewal requirements. Thank you.

Hi very interesting information about Spanish Banks and Banking Systems. We live in the Netherlands and are non residents but do own an appartement in Arroyo de la Miel in the province of Malaga. That said some years ago ad is normal we had to choose and open.a Bank Account in Spain… In Arroyo de la Miel in one street The Avenida Federico Llorca were 3 Major Banks. Brink style as you put it…Banco Santander, Banco Sabatell and The BBVA. We chose the BBVA maybe we were wrong , they are not an easy bank to work with. Their systems change a lot and from time to time it can all go Pear Shaped. The Joke is they are all within 30 meters or each other but the laugh is aan ons …As they say in Dutch

Micheal – wij moeten glimlachen… it is ususal to see all the banks gathered togeather. We defintily see more support for Santader and Sabadell than BBVA, esecially when dealing with non-Spanish resident accounts. All the best, Alasatir

Hello,

We are about to open a non resident account. The purpose is to transfer the payment for our house purchase. Out lawyer recommend Banco Sabadell or Bankinter. They are not very clear to the fees involved. Can you please explain the fees for an incoming transfer in EUR from Wise and what is the fees for a outgoing bankers draft? is it a set fee or a percentage?

Many thanks, Jan

Hi, Jan. Our Sabadell account has zero charges for incoming amounts from our Wise account. However, I’d discuss your situation with a banker to ensure the account you open and quantities do not incur fees and to get the best deal for your outgoing banker’s draft. All the best, Alastair

Thank you for your information! I’m just getting my head around this … are you saying we should open a bank account with a local bank (In our case, in order to rent a place), and also use an “inbetween service” (like Wise) to transfer the money from my bank in the US to my Spain bank? If my bank/credit union here does not charge transfer fees internationally, would I still pay a fee from the local bank (like Santader)?

Hi Arnell. Yes, that is our recommendation. The local bank won’t charge you a deposit fee (as they receive the transfer in Euros). However, even if your local institution doesn’t charge a fee, we warn you to carefully check the FX rates, as they usually are worse than the FX exchanges we recommend. All the best, Alastair

Hola,

Soy español de nacimiento pero mi mujer, aunque tiene la nacionalidad española desde hace muchos años, no ha nacido en España.

El Banco de Sabadell bloqueó la cuenta bancaria de mi esposa sin previo aviso, dejándola sin acceso a sus ahorros durante casi dos meses, supuestamente por sospechas para prevención de blanqueo de capitales.

En realidad fue por recibir dinero de PayPal de su cuenta personal que yo le envié por envío de dinero de familiares que ofrece PayPal. Todo legal y con trazabilidad informática completa.

Todo fue justificado meticulosamente y a los dos días, sin previo aviso le bloquearon la cuenta.

Cuando fuimos a la oficina a reclamar me dijeron que el personal que habían contratado para la oficina online no sabía hacer su trabajo, y cuando pregunté porqué a mi no me habían bloqueado la cuenta cuando había hecho las mismas operaciones, nos dijeron “por el país de origen” de mi esposa. Son unos racistas.

Presentamos denuncia al defensor del cliente y resolvió a favor del banco.

Presentamos denuncia ante el Banco de España y en su informe afirman que el Banco se Sabadell no actuó conforme a las buenas prácticas esperables.

Actualmente hemos presentado una demanda porque no pagaron los intereses de dos meses de la cuenta de ahorro y por los daños y perjuicios del bloqueo injustificado e ilegal de la cuenta de un día para otro sin avisar, cuando por ley tienen que dar dos meses de plazo.

Me resulta muy incomprensible que por aquí se recomiende al Banco de Sabadell.

Espero que la OPA hostil del BBVA contra Banco de Sabadell funcione y Banc de Sabadell desaparezca de la faz de la tierra.

Un saludo y gracias por esta web tan útil.

Gracias Vincente – Gracias y lamento los problemas que habéis tenido usted y su mujer con Sabadell. Our research involved many people using these institutions, and we had people who had issues with almost all of the available options. However, the majority of people we spoke with who used Sabadaell as Expats had a positive review of their experiences. We´ll include your experience when we review and update the best banks in Spain for Expats. Regard, ALastair

We too have had terrible experiences with Sabadell. Threats to close account and blocked access, but customer support can’t or won’t resolve the issue. It’s been months and months. Definitely not recommended.

Hi there,

i made the most horrible experience with Banc Sabadell. They are intransparent, non-communicative, not reachable and act like a dictator. When I bought my house i needed a bank and Sabadell was recommended because they have some people speaking English. That was 2016. In the end there was one man in Barcelona who also made it quite clear, that if i want an account, i have to insure my house with them. I choose this option, as it felt comfy but now i know this is illegal. They are not allowed to sell one product bound to another.

I bought the house and started the renovation. Pandemia hit and postponed everything. We could not travel to the site as often as we wanted and in summer 2020 we got completely robbed by a gang. They took their time to take everything. Imagine, they opened all security doors, built out the new parquet and sinks, lights, fans – all installed and cleaned by us who just came for a shot inspection two weeks before. That time we also had an appointment with an alarm company but they didn’t hold on to the date so we had to postpone. Bummer!

As the house was insured with Banc Sabadell we got completely abandoned by them. No one wanted to help, they did not send anyone to close the house as all doors were taken. It took them 10 days to arrange to send some carpenter. For sake, we had other, private help coming in before. Then they send an assessor without telling us. We could exactly proof what was the status before and afterwards. We had so many photos. But they were not asking for it nor listen to us offering. We made lists of the damage and loss.

Until the end of the year there was nearly no communication with the bank. No one talked to us, no one was responsible, nor we received any info on the progress of the case. On Christmas Day they called and said they won’t pay as we were not in the house. It is a second residence and insured like that. So they acted against their own contract. We took a laywer and succeeded two years later as they became cold feet and wired an amount about half of the damage. There was no single communication, just a bank transfer. I am still out of words by this.

In the end they did not hold any promise they made. They even made the situation worse through that.

Now, as i still have my account there, i get mobbed out by them. They started deducting weird commissions in July which are not part of the contract and playing games with documents i need to bring to prove my tax liability as a foreigner. Well, i sent them three month ago. Today I found out, that they did not look at the docs as they want a Catalan translation. If they change the rules as they like it is dictatorship behaviour. Things can go on like this, but i will leave this Bank as soon as I can. I truly cannot recommend this entire entity. It is not about a branch. It is a “systemic collapsed shithole” (I quote my spanish laywer here). They are old-fashioned, greedy and not at all interested to serve people.

Great insights! I found the comparison of fees and services really helpful as I’m considering moving to Spain. Could you elaborate on any specific experiences you’ve had with these banks, especially regarding customer service for expats? Thanks!

Thanks, NA – yes, we use both Revolut and Sabadell. We will open an N26 account soon to gain personal knowledge, too. We’ve had no issues with customer service from either institution. We base all our recommendations on first-hand experience with expats in Spain. All the best, Alastair

What do you use Revolut for and for what do you use Sabadell?

Hi Nienk. We use Sabadell for day-to-day banking in Spain. Our son uses Revolut as his primary account (which we manage) and we use Revolut whenever we travel. All the best, Alastair

Feedback on the table. Wise has a green checkmark for “Spanish IBAN”. From what you write, it should be a red X instead.

Thanks Gerardo – that was my error when we updated the rankings. Apologies, I’ve corrected it now. All the best, Alastair

Great list! It’s helpful to see the best options for banking in Spain as an expat. I’m particularly interested in the customer service experiences with these banks—has anyone had positive or negative interactions?

Hi Xender – all of the feedanck we get for the index includes the customer service interactions with these banks in Spain. One thing to remember about banks in Spain is that your levels of service can vary depending on the staff in your local branch. All the best, Alastair

Hi, thanks for all the great information on your website! I am a resident on a NLV and use N26 (which has been great for paying utilities and rent) but my tax “accountant” here in Spain said that my N26 account cannot be direct debited for taxes and that I need to open an account with a traditional bank to set up my tax account. Any insights or thoughts on that? Gracias!

Hi Eric – we have confirmed with our Spansih tax expert “Yes, I confirm that you can use an N26 account to set up direct debit for Spanish tax payments.” All the best, Alastair