Retiring in Spain is attractive for retirees looking to relocate for their golden years. The magical Mediterranean climate, low cost of living compared to other Western nations, and affordable healthcare make it the ideal destination for retirees looking to maximize their savings.

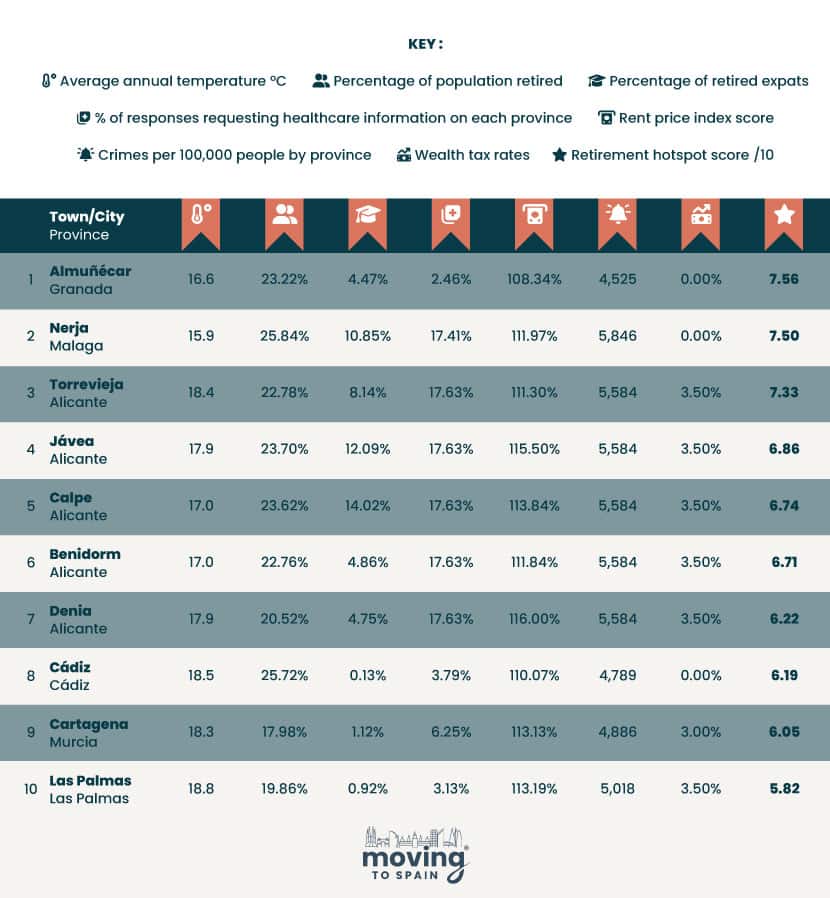

But which are the best places to retire in Spain? To find out, we created a list of 44 towns or cities that regularly feature in these discussions. We then picked 7 factors most important to Expat retirees, including the proportion of retirees and retired Expats, rent price index scores, crime rates, wealth tax rates, most popular destinations for retiree healthcare quotes, and average annual temperatures in each destination.

Almuñécar Is The Best Place To Retire In Spain, With A Score Of 7.56/10

Top 10 Places to Retire in Spain: Detailed Analysis

- Almuñécar Retirement Hotspot Score: 7.56/10

Almuñécar, on the southwest coast, takes the top spot and is our best place to retire in Spain. The town scores highly thanks to its low rent price index of 108.34% and its 0% wealth tax rates. It also ranks highly for its proportion of retired expats — at 4.47%, it’s just inside the top ten for the factor.

- Nerja Retirement Hotspot Score: 7.50/10

Up next is Nerja, a town on the country’s Mediterranean coast. The town ranks highly across the board. With its 0% wealth tax rate, it shares first place for the factor. Nerja also ranks third for both its 25.84% proportion of retirees and 10.85% of retired expats. This gives it a retirement hotspot score of 7.50 out of 10 and second place overall.

- Torrevieja Retirement Hotspot Score: 7.33/10

Rounding out the top three is Torrevieja, with a retirement hotspot score of 7.33 out of 10. The city on the southeast coast scores relatively well, placing in the top 10 for four of the seven factors we looked at. Torrevieja has the second-highest percentage of Moving to Spain respondents requesting healthcare information at 17.63% and ranks fourth for its proportion of retired expats at 8.14%.

What More Options? See our full list of 44 towns and cities to see where your picks rank on our long list at the end of the article.

The retirement hotspots with…

Destinations with a higher proportion of retirees are more likely to have services and amenities tailored to older populations. These can include everything from healthcare facilities to socializing opportunities. Salamanca has the largest retired population rate, at 28.44%.

Moving to a new country can be difficult, especially when you are away from family and friends. Luckily, Expat communities can help you transition, providing a support network and opportunities to make new friends. You’re also likely to find people who speak your language to help you get started. Calpe has the highest proportion of Expats over 65, 14.02% of the population.

Most people retiring to Spain need private health insurance for their residency or visa. We analyzed more than 750 recent Spanish private health insurance quote requests from Moving to Spain retiree clients. This data gives us up-to-date real-world information on the areas of highest interest to Expats who are actively looking to retire in Spain. From our analysis, Valencia has the highest percentage of requests, with 17.86%.

As potential retirement hotspots, it makes sense that rental costs in our 44 cities and towns will be above the Spanish average. We chose the 44 popular cities and towns based on our insider knowledge and a wide range of sources. We compared the average rental prices to the Spanish national average, and Almuñécar has the lowest rent index score on the list, at only 108.34% of the national average.

Many retirees prioritize peace of mind, and a low crime rate is a good indicator of this. A lower crime rate means peace of mind and a better quality of life if you don’t have to worry about your safety. You won’t have to worry too much if you plan to relocate to Ciutadella de Menorca. It has the lowest crime rate of our 44 destination short-list, at just 388 crimes per 100,000 people each year.

Warmer weather means milder winters, perfect if you plan to relocate for retirement. It can also have some physical and mental health benefits, keeping you outdoors for longer. But remember, this also means that mid-summer can get very warm. Two retirement destinations, Sevilla and Las Palmas, share the title of the warmest avergae tempreture on our list, with an annual average of 18.8ºC.

Budgeting enough for your retirement in Spain is a key part of retirement planning. The wealth tax in Spain can be a nasty surprise for Expat retirees as this tax is levied on global assets, including retirement savings. We only look at the headline tax rate here, but remember that there are also differences in deductions that you can claim in different autonomous regions in Spain.

Expert Tips on Retiring to Spain

Warm weather, welcoming locals, excellent food, and attractive living costs are just a few reasons around 8.7 million expats call Spain home. However, if you want to retire in Spain, there are a few things you’ll need to know. With this in mind, we’ve compiled a list of tips to help you through this process.

Choose The Right Visa

Spain offers two main types of visas for retirees emigrating from outside the EU. As our Spanish immigration lawyer partner explains:

The Spain non-lucrative visa, also known as the Spanish retirement visa, requires proof of passive income over €28,000 for the primary applicant. You can also include family members in your application. You’ll also need qualifying private health insurance, as you won’t be eligible for public healthcare.

Raquel Moreno (LLB) – Immigration Lawyer in Barcelona

The second option is the Golden Visa. This is best suited for retirees looking to buy property in Spain. It has requirements similar to those of a Spanish non-lucrative visa, with some exceptions. The Golden Visa requires an investment of at least €500,000 in real estate or €1,000,000 in other investments. The Spanish government has plans to amend or cancel this visa, so if buying a home in Spain is part of your plans, you should act as soon as you can.

These visas are a pathway to Spanish citizenship and an EU passport, making it ideal if you plan to travel outside the country during your retirement.

You must apply for either visa before you move to Spain, so make sure you apply well in advance and have all your proper documentation in order.

Apply for health insurance

Spain has a high-quality public healthcare system, but in most cases, you’ll need private healthcare as an Expat retiree. Luckily, private coverage is affordable, with monthly policies ranging from €100 to €200.

Look for policies with comprehensive coverage, including for pre-existing conditions and no co-payments to meet your visa requirements. You should also look for policies with a vast network of clinics and hospitals. If you initially need help with the language barrier, ensure your insurance company has a network of English-speaking healthcare providers.

Open a Spanish bank account

Opening a Spanish bank account will make managing your finances more manageable. You won’t have to worry about exchange rates or credit card fees, which can make paying bills and rent costlier.

The best banks in Spain for Expats offer a Spanish IBAN to allow you to work with the Spanish financial system. Look out for low-cost options, as some of the “bricks and motor” high-street Spanish banks have expensive fees. Access to BIZUM is a big plus, too. It’s a simple way to transfer money between people using the phone numbers of your contacts, and we use it almost daily.

Consider the Cost of Living

Spain has a relatively cheap cost of living compared to other European countries. However, it’s best to research a location you can comfortably afford.

Like many other countries, the cost of living in Spain can vary considerably from place to place. Coastal areas and larger cities tend to be more expensive in rent and property prices. Larger cities will also have higher living costs than rural areas, and areas popular with tourists and expats tend to be more expensive than those off the beaten track.

Embrace the local culture

Adapting to the slower pace of life and local customs in Spain can be difficult at first, but it’s essential if you’re committed to retiring to Spain. Start by engaging with your local expat communities to build a support network that can help you ease into your new life.

Join local groups and clubs to meet new people and integrate into the community. Participating in local events is also a great way to immerse yourself in the culture. While many Spanish people speak English, especially in tourist areas, it’s best to learn the basics of the language as soon as possible. Even speaking a little Spanish will make your retirement more enjoyable. Consider joining local Spanish classes to brush up on your Spanish and meet new people in the same situation.

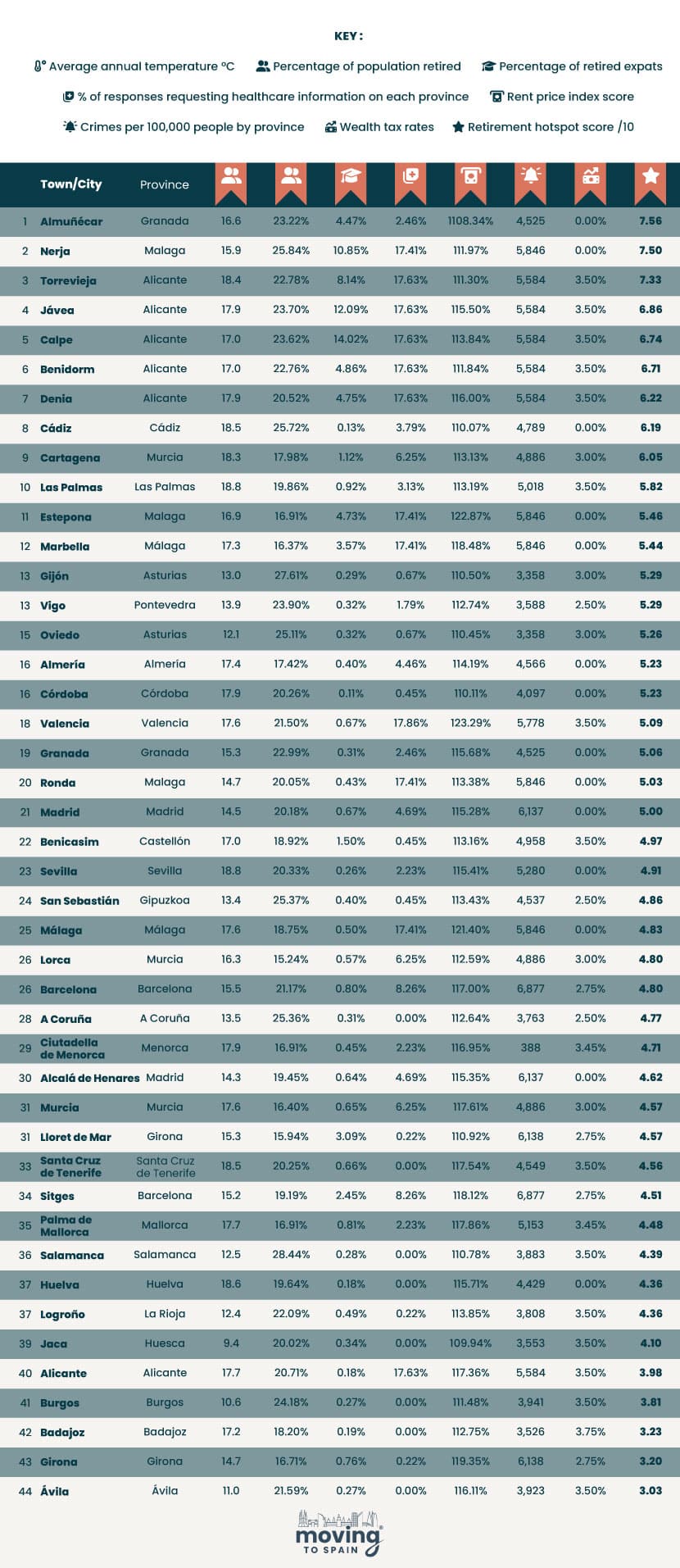

The Long List: The 44 Best Places To Retire in Spain Ranked

Methodology for the Best Places in Spain To Retire Index 2024

We built our long list of 44 Spanish retirement destinations based on client feedback, experience, and many articles and studies. We scored each destination on the factors listed below. We then gave each retirement destination a normalized score out of ten for each factor before taking an average across each of these scores to reach our final overall score out of ten.

- Average Annual Temperature: The average annual temperature in Celsius in each destination according to Climate Data.

- Percentage of Population Retired: The total population in 2021, divided by the number of residents over the age of 65, according to City Population.

- Percentage of Retired Expats: The total foreign population over the age of 65 in 2022 taken from Instituto Nacional de Estadistica divided by the population of each destination

- Percentage of responses Requesting Healthcare Information for Each Province: The proportion of people searching for healthcare information by province, according to our own internal data.

- Rent Price Index Score: The average rent price in 2022 in each destination, expressed as a percentage of the national average, according to Instituto Nacional de Estadistica.

- Crimes per 100,000 people by Province: The total number of crimes in each province in 2023, according to the Ministerio Del Interior, divided by the total population of each province in 2021 according to City Population.

- Wealth Tax Rates: The wealth tax rate in each region according to La Agencia Tributaria (Spanish Tax Agency).